- Analýza

- Tržní údaje

- Online kotace komodit

- Ropa WTI Graf - Ropa WTI Dnešní cena

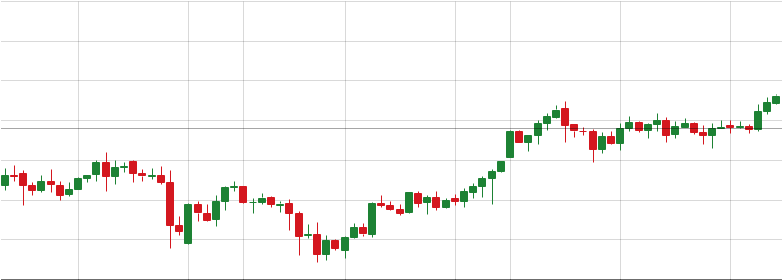

Vývoj ceny: Ropa WTI

This page includes full information about the Ropa WTI, including the Ropa WTI live chart and dynamics on the chart by choosing any of 8 available time frames.

By moving the start and end of the timeframe in the bottom panel you can see both the current and the historical price movements of the instrument. In addition, you have an opportunity to choose the type of display of the Ropa WTI live chart – Candles or Lines chart – through the buttons in the upper left corner of the chart. All clients that have not yet decided which instrument to trade are in the right place since reading the full characteristics of the OIL and watching its performance on the charts will help them to make their final decision.

Ropa WTI Graf - Ropa WTI Dnešní cena

- 1m

- 5m

- 15m

- 30m

- 1h

- 4h

- 1d

- 1t

FAQs

What is the current price of Oil?

As of Mar 11, the current price of oil is 85.3300.

Why Trade Oil?

Main reasons to trade oil, is price fluidity. Crude oil can be refined into a variety of forms such as petroleum naphtha, gasoline, diesel fuel, asphalt base, heating oil, kerosene, liquefied petroleum gas, jet fuel and fuel oils, which expand the market pool and increase demand. Trading can be done either by speculating on its market price, or exchanging the physical commodity.

How to Trade Oil?

Oil can be traded several ways:

- Long-term contracts between oil producer and consumer

- Through Futures

- On OTC market

Each method has specific goal. To learn which method is the right one for you, follow the link see the article “How to Trade Oil”.

What are the Biggest oil Companies?

1. China Petroleum & Chemical Corp. (SNP) - Revenue (TTM): $355.8 billion

2. PetroChina Co. Ltd. (PTR) - Revenue (TTM): $320.0 billion

3. Saudi Arabian Oil Co. (Saudi Aramco) (Tadawul: 2222) - Revenue (TTM): $286.9 billion

4. Royal Dutch Shell PLC (RDS.A) - Revenue (TTM): $263.1 billion

5. BP PLC (BP) - Revenue (TTM): $230.7 billion

6. Exxon Mobil Corp. (XOM) - Revenue (TTM): $213.9 billion

7. Total SE (TOT) - Revenue (TTM): $146.1 billion

8. Chevron Corp. (CVX) - Revenue (TTM): $115.0 billion

9. Marathon Petroleum Corp. (MPC) - Revenue (TTM): $102.4 billion

10. PJSC Lukoil (LUKOY) - Revenue $99.1 billion

What is Brent Oil?

Brent crude oil is one of the most popular oil benchmarks in the world, it’s recovered from the North Sea. Brent makes such a good benchmark because it is easy to refine into products such as diesel, gasoline, petrol, and other end products, which are in a great and consistent demand.

What is WTI Oil?

West Texas Intermediate (WTI) is a light, sweet crude oil (petroleum with less than 0.5% sulfur is called sweet) considered one of the main global oil benchmarks, along with Brent oil. WTI is a blend of several oils drilled and processed in the United States, primarily serves as a benchmark for the US oil market.

Technická analýza

Technická analýza je metoda pro studium a odhad dynamiky trhu na základě historie kotací. Jejím hlavním cílem je odhadnout dynamiku kotací finančního instrumentu v budoucnu pomocí indikátorů technické analýzy v budoucnu. Techničtí analytici používají tuto metodu analýzy trhu, aby bylo možné předvídat ceny různých měn a měnových párů. Tento typ analýzy Vám umožní správně odhadovat trh na základě prozkoumání historických cen obchodních instrumentů.

Viz rovněž poslední technické analýzy dynamiky kotací OIL: OIL odhad.

Ropa WTI News