- Analisi

- Analisi Tecnica

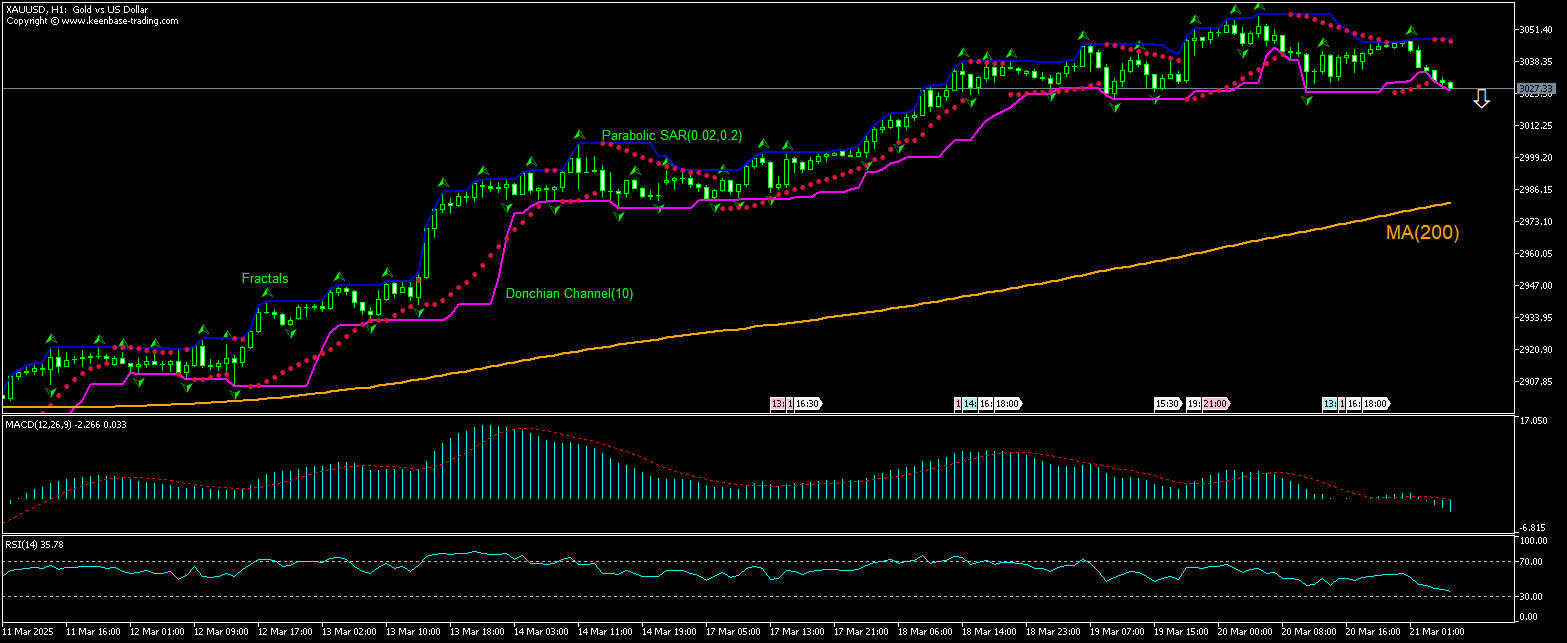

Oro Dollaro Analisi Tecnica - Oro Dollaro Trading: 2025-03-21

Oro Technical Analysis Summary

Sotto 3021.49

Sell Stop

Sopra 3044.72

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Neutro |

| Parabolic SAR | Sell |

Oro Chart Analysis

Oro Analisi Tecnica

The technical analysis of the XAUUSD price chart in 1-hour timeframe shows the XAUUSD, H1 is retracing lower above the 200-period moving average MA(200) after hitting all-time high yesterday. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 3021.49. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 3044.72. After placing the order, the stop loss is to be moved to the next fractal high, following Parabolic signals . Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (3044.72) without reaching the order (3021.49), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale PRECIOUS_METALS - Oro

Gold is retracing lower after renewed advance to new historical highs above $3000. Will the XAUUSD price retreat continue?

Analysts note that gold rally will likely continue as softer global economic data and heightening uncertainty amid escalating tariff wars support rising demand for safe haven assets. In January, net inflows into US gold ETFs amounted to $1.5 billion, whereas the number was just below $8 billion in February, the highest monthly total since March 2022, according to Bloomberg data. The Federal Reserve meeting this week signaled heightened likelihood of persistent inflation as the central bank cut its US economic growth forecast. At the same time, it signaled a shift in policy stance toward less restrictive monetary policy as it signaled a slowing of the pace at which the central bank will shrink the size of its balance sheet while planning still two rate cuts in 2025. Recent selloff in US stocks supports the view of reversal of bullish market sentiment that got a boost from president Trump’s victory in November 2024 elections. Rising uncertainty and expectations of persistent inflation are bullish for gold price. However, the current setup is bearish for XAUUSD.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.