- Analisi

- Analisi Tecnica

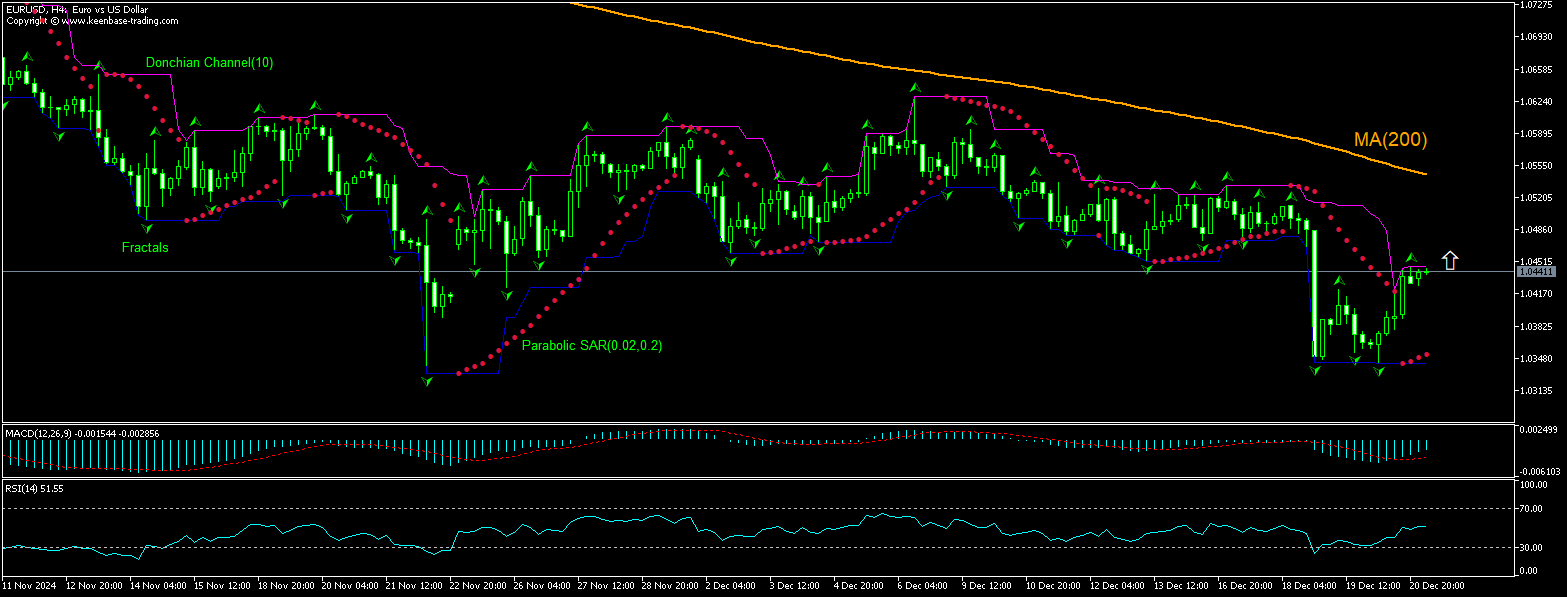

EUR USD Analisi Tecnica - EUR USD Trading: 2024-12-23

Euro Dollaro Technical Analysis Summary

Sopra 1.04469

Buy Stop

Sotto 1.03524

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Buy |

| Donchian Channel | Neutro |

| MA(200) | Sell |

| Fractals | Neutro |

| Parabolic SAR | Buy |

Euro Dollaro Chart Analysis

Euro Dollaro Analisi Tecnica

The technical analysis of the EURUSD price chart on 4-hour timeframe shows EURUSD,H4 is retracing up after hitting one-month low three days ago. The 200-period moving average MA(200) is declining. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 1.04469. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 1.03524. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Forex - Euro Dollaro

German producer prices rose in November. Will the EURUSD price rebounding persist?

German wholesale prices rose in November. The federal statistics office Destatis reported German Producer Prices Index (PPI) rose 0.5% over month after 0.2% increase in October when an increase to 0.3% was forecast. The PPI rose also in annual terms: the producer prices of industrial products were 0.1% higher in November than in November 2023. Higher capital goods prices were the main contributor to year-on-year increase in producer prices together with non-durable consumer goods, durable consumer goods and intermediate goods. This was the first over-year increase recorded since June 2023 after 1.1% decline over year in October. Higher producer prices in the largest economy in euro area are bullish for EURUSD.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.