- Analisi

- Analisi Tecnica

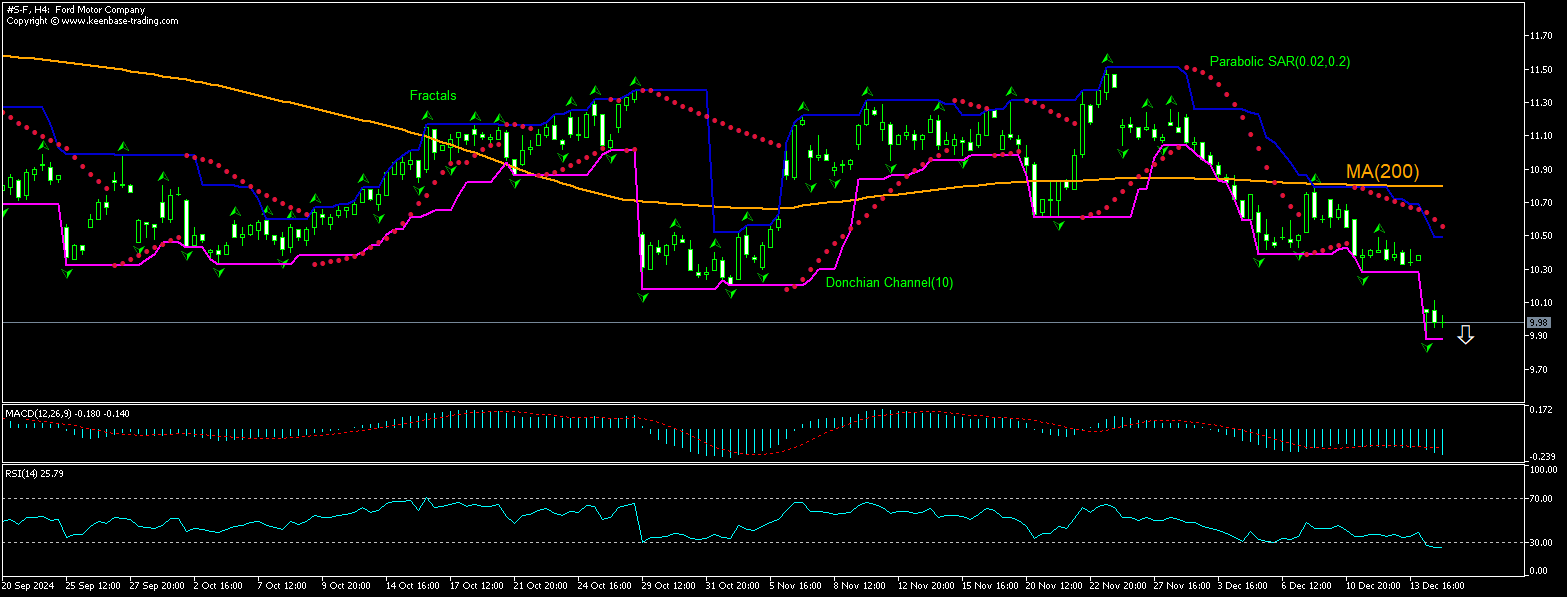

Ford Motor Analisi Tecnica - Ford Motor Trading: 2024-12-17

Ford Motor Technical Analysis Summary

Sotto 9.88

Sell Stop

Sopra 10.55

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Sell |

| Donchian Channel | Neutro |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Ford Motor Chart Analysis

Ford Motor Analisi Tecnica

The technical analysis of the Ford stock price chart on 4-hour timeframe shows #S-F,H4 is retreating under the 200-period moving average MA(200) after returning below MA(200) following a rebound to five-month high five weeks ago. RSI has entered the oversold zone. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 9.88. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 10.55. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (10.55) without reaching the order (9.88), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Azioni - Ford Motor

Ford Motor company stock fell after Jefferies downgraded the American carmaker to "underperform" from "hold". Will the Ford stock price continue retreating?

Ford Motor Company stock closed 3.85% lower on the day yesterday after Jefferies downgraded the carmaker to "underperform" from "hold" and cut its price target on Ford to $9 from $12. Jeffries noted it was concerned over inventory build-up, strategic uncertainty in Europe, and a widening gap between warranty provisions and cash outflows. Ford’s US inventory levels have risen to 96 days in November. Jeffries wrote while Ford’s balance sheet is "robust," the potential restructuring and warranty claims could constrain cash available for shareholders due to a cumulative $8.5 billion gap between warranty provisions and cash outflows since 2020. A downgrade by an investment banking company is bearish for a company stock price.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.