- Education

- Introduction to Trading

- What is the Dow Jones Industrial Average

What is the Dow Jones Industrial Average

There are around 6.5 thousand stocks traded on leading US exchanges, and it is impossible to track the dynamics of each one on a daily basis. However, investors and financiers need to understand the general state of the market, and for this purpose, they came up with stock market indices.

They show how much the price of a certain set of stocks has changed on average, rather than all of them. Based on this sample, investors draw conclusions about general market trends.

This can be compared to a survey: to find out the mood of society, only a limited number of people are surveyed - often only a few thousand. However, the difference is that for the survey, random people are involved, while for the index, stocks are included based on certain criteria.

There are several key indicators in the US market: the S&P 500, NASDAQ, as well as the Dow Jones Industrial Average, which was the first to appear.

KEY TAKEAWAYS

- DJIA history started more than hundred years ago. The first stock market index in the world was developed in the United States in the late 19th century by two journalists - financial analysts Charles Dow and Davis Jones

- The index is not a comprehensive representation of the entire stock market, as it only includes 30 companies out of the thousands of publicly traded companies in the U.S

- To ensure the index is a fair representation of the US economy, the committee considers the relative value of the shares of each company.

- Dow Jones Industrial Average = Sum of the stock prices of the 30 Dow constituents / Dow Divisor.

What is Dow Jones Index

DJIA History

DJIA history started more than hundred years ago. The first stock market index in the world was developed in the United States in the late 19th century by two journalists - financial analysts Charles Dow and Davis Jones, founders of the Wall Street Financial News Bureau information agency.

The agency published a daily news bulletin (Customer's Afternoon Letter), which later grew into the globally renowned business publication Wall Street Journal.

In 1884, the bulletin featured a chart of the American market stock index for the first time. It included securities from 11 firms, mainly railroads, and was called the Dow Jones Railroad Average. This index is still traded today, although under a different name - the Dow Jones Transportation Average (ticker DJT).

But Charles Dow didn't stop there. Recognizing the growing importance of the industrial sector, he developed another indicator - in 1896, the first version of the modern Dow Jones Industrial Average (DJIA for short) was published.

It included 12 American industrial companies. Today, the index tracks issuers from the technology, pharmaceutical, and other sectors, but still retains the name "Dow Jones Industrial Average" in tradition.

The 30 companies that make up the Dow Jones Industrial Average are some of the largest and most well-known in the United States, including companies like Apple, Microsoft, Coca-Cola, and Goldman Sachs. The index is calculated using a price-weighted average, which means that companies with higher stock prices have a greater impact on the index's value.

The 30 companies that make up the Dow Jones Industrial Average are some of the largest and most well-known in the United States, including companies like Apple, Microsoft, Coca-Cola, and Goldman Sachs.

The index is calculated using a price-weighted average, which means that companies with higher stock prices have a greater impact on the index's value.

Important to know that the Dow Jones Industrial Average is often used as a barometer of the overall health of the U.S. stock market and the economy as a whole. Investors and analysts use the index as a benchmark to compare the performance of their portfolios or investments to the broader market.

However, it's important to note that the index is not a comprehensive representation of the entire stock market, as it only includes 30 companies out of the thousands of publicly traded companies in the U.S.

Dow Jones Index Stocks

The Dow index companies are not chosen randomly, and their selection criteria are complex. The index selection committee, comprising three representatives of the S&P Dow Jones and two representatives of the Wall Street Journal, is responsible for making these choices. The committee considers several factors, including the company's origin, reputation, and growth potential.

To ensure the index is a fair representation of the US economy, the committee considers the relative value of the shares of each company. Specifically, the company with the most expensive shares should not weigh more than ten times the company with the least expensive shares.

Meetings of the committee are held only when necessary to revise the index's composition, rather than on a regular basis. The committee replaces some companies with others to keep the index relevant and representative of the US economy.

Currently, there is not a single stock left from the original set in the Dow Jones. Some companies were acquired, others went bankrupt, and some reduced their turnover. General Electric was the last to stay for the longest time and was only removed from the Dow in 2018. In recent years, demand for GE's products had decreased, causing its stock price to fall.

Not only has the composition of the index changed, but also the number of stocks included. In 1928, there were 30 stocks, and that number remains the same today. The current Dow Jones Industrial Average index consists of the following companies.

Dow Jones Index Companies List

| # | Company | Symbol |

|---|---|---|

| 1 | 3M | MMM |

| 2 | American Express | AXP |

| 3 | Amgen | AMGN |

| 4 | Apple | AAPL |

| 5 | Boeing | BA |

| 6 | Caterpillar | CAT |

| 7 | Chevron | CVX |

| 8 | Cisco | CSCO |

| 9 | Coca-Cola | KO |

| 10 | Dow | DOW |

| 11 | Goldman Sachs | GS |

| 12 | Home Depot | HD |

| 13 | Honeywell | HON |

| 14 | IBM | IBM |

| 15 | Intel | INTC |

| 16 | Johnson & Johnson | JNJ |

| 17 | JPMorgan Chase | JP |

| 18 | McDonald's | MCD |

| 19 | Merck | MRK |

| 20 | Microsoft | MSFT |

| 21 | Nike | NKE |

| 22 | Procter & Gamble | PG |

| 23 | Salesforce | CRM |

| 24 | Travelers | TRV |

| 25 | UnitedHealth | UNH |

| 26 | Verizon | VZ |

| 27 | Visa | V |

| 28 | Walgreens Boots Alliance | WBA |

| 29 | Walmart | WMT |

| 30 | Walt Disney | DIS |

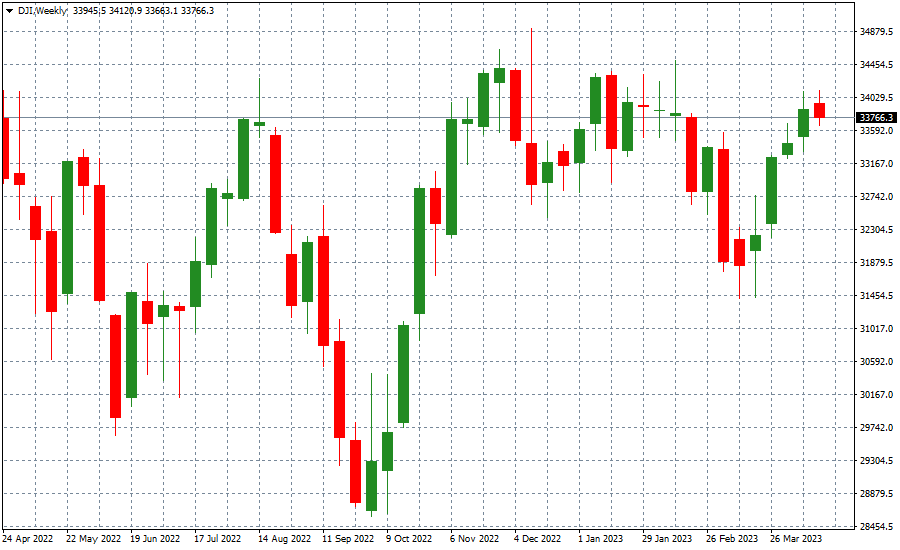

You can check out Dow Jones Index Historical Prices.

How the Dow Jones Index is Calculated

The Dow Jones index is price-weighted, meaning that each stock is assigned a weight based on its price. The higher the stock price, the greater the weight it receives. Initially, Charles Dow divided the total value of traded stocks by the number of index components, first by 12, and then by 30. However, due to stock splits or consolidations, the Dow divisor was introduced.

Now the index is calculated using the following formula:

The formula to calculate the Dow Jones Industrial Average is:

Dow Jones Industrial Average = Sum of the stock prices of the 30 Dow constituents / Dow Divisor

The Dow Divisor is a number that changes over time to account for events such as stock splits and mergers. It is used to ensure that changes in the prices of any individual stock do not affect the overall value of the index too much.

To calculate the Dow Jones Industrial Average, the current prices of the 30 stocks in the index are added together and then divided by the Dow Divisor. The resulting number is the value of the Dow Jones Industrial Average at that particular moment in time.

Dow Jones Trading Times

The Dow Jones index, a stock market index, is traded on several stock exchanges around the world, including the New York Stock Exchange (NYSE) and NASDAQ.

The Dow Jones index is open for trading during regular market hours, which typically run from Monday to Friday, 9:30 AM to 4:00 PM Eastern Time in the United States. In Central European time this equates to an opening time of 3.30 p.m. and a closing time of 10 p.m.

Trading hours may vary depending on the stock exchange and your location.

| Week day | Trading hours (CET) | Local trading hours |

| Monday | 02:00 — 22:00 | 06:00 — 24:00 |

| Tuesday | 02:00 — 22:00 | 00:00 — 02:00, 06:00 — 24:00 |

| Wednesday | 02:00 — 22:00 | 00:00 — 02:00, 06:00 — 24:00 |

| Thursday | 02:00 — 22:00 | 00:00 — 02:00, 06:00 — 24:00 |

| Friday | 02:00 — 22:00 | 00:00 — 02:00, 06:00 — 24:00,

Saturday 00:00 — 02:00 |

| Stock Exchange | Trading Hours (GMT) | Trading Hours (CET) | Major stock Indices |

|---|---|---|---|

| New York Stock Exchange | 2.30pm - 9pm | 3.30pm - 10pm | Dow Jones, S&P 500 |

| TMX Group (Toronto Stock Exchange) | 2.30pm - 9pm | 3.30pm - 10pm | S&P/TSX Composite Index |

| London Stock Exchange | 8am - 4.30pm | 9am - 5.30pm | FTSE 100, FTSE 250 |

| Shanghai Stock Exchange | 1.30am - 7am (lunch from 3.30am - 5am) | 2.30am - 8am (lunch from 4.30am - 6am) | SSE Composite (SSE Index) |

| Japan Exchange Group | 12am - 6am (lunch from 2.30am - 3.30am) | 1am - 7am (lunch from 3.30am - 4.30am) | Nikkei 225 |

It is important to note that the Dow Jones index is also traded as a futures contract, which allows investors to speculate on the future price of the index. Futures trading hours are typically longer than regular market hours, and they can vary depending on the exchange and the contract.

It is recommended to check with your broker or the specific exchange for the exact trading hours of the Dow Jones index to ensure you have accurate information for your trading needs.

There are various ways to invest in the stocks that make up the Dow Jones index. One option is to buy shares directly with a securities account, which provides a regular income through dividends.

Alternatively, equity derivatives such as CFDs can be used to speculate on the rise or fall of these stocks without owning them. Due to their liquidity, it is easy to find a broker who offers these US stocks.

The Dow Jones index is a global benchmark, and it is possible to invest in its entire composition using ETFs. An ETF is an index fund listed on the stock exchange that replicates the index's composition and performance. Derivatives such as CFDs can also be used to trade on the Dow Jones index without an ETF. However, CFDs are only suitable for experienced investors due to the high risk involved, especially with leverage.

Dow Jones Index Composition

In order for a company to be included in the DJIA (US30) index, it must account for a significant portion of economic activity in the United States. The company must also be listed on the NASDAQ or NYSE exchanges and be one of the largest companies in the industrial sector.

The 30 companies that make up the index are distinguished by their high market capitalization and have the highest reliability ratings. Currently, the following companies are included in the Dow Jones Industrial Average index:

The Dow Jones index composition is as follows:

| Company Name | Sector | Weighting |

|---|---|---|

| 3M | Chemicals, Electronics, Maintenance | 2.53% |

| American Express | Financial Services | 3.11% |

| Amgen | Health | 5.15% |

| Apple | Technology | 3.21% |

| Boeing | Aeronautics and Aerospace | 8.83% |

| Caterpillar | Construction Equipment | 3.74% |

| Chevron | Oil | 3.27% |

| Cisco | Networking | 0.29% |

| Coca-Cola | Beverages and Food | 1.28% |

| Dow | Finance | 1.28% |

| Goldman Sachs | Finance | 6.68% |

| Home Depot | Home Improvement | 6.28% |

| Honeywell | Technology | 3.84% |

| IBM | IT | 2.74% |

| Intel | Microprocessor | 0.60% |

| Johnson & Johnson | Pharmaceutical | 3.71% |

| JPMorgan Chase | Financial Services | 2.39% |

| McDonald's | Fast Food | 5.29% |

| Merck | Pharmaceutical | 1.92% |

| Microsoft | Software | 5.36% |

| Nike | Sports Equipment | 2.15% |

| Procter & Gamble | Consumer Goods | 2.90% |

| Salesforce | Technology | 3.31% |

| Travelers | Insurance | 3.49% |

| UnitedHealth | Aerospace and Defense | 11.48% |

| Verizon | Telecommunications | 0.87% |

| Visa | Banking | 4.06% |

| Walgreens Boots Alliance | Pharmaceutical | 0.71% |

| Walmart | Retail | 2.89% |

| Walt Disney | Entertainment | 2.20% |

To see the price level in real time, you can go to this link - Dow Jones live chart

Bottom Line on What Is the Dow Jones Industrial Average

The Dow Jones Industrial Average, often simply referred to as the Dow, is a stock market index that tracks the performance of 30 large publicly traded companies in the United States.

The Dow is the oldest and most widely followed stock market indices in the world, and it is considered a barometer of the health and direction of the U.S. stock market and, to a certain extent, the broader economy. The Dow is calculated by taking the sum of the stock prices of its 30 component companies and dividing by a divisor that is adjusted for stock splits, dividends, and other corporate actions.

Notice, though the Dow can be a useful tool for investors and analysts, it is important to note that it represents only a small fraction of the overall U.S. stock market and may not be fully representative of the economy as a whole.