- Education

- Introduction to Trading

- How to Trade Commodities in Canada

How to Trade Commodities in Canada

Commodities trading in Canada offers investors and traders a diverse range of opportunities to participate in the global market. With the fluctuating prices of various commodities, such as copper, Brent oil, WTI oil, natural gas, wheat, cotton, and corn, it is essential to understand how to navigate this dynamic sector. In this guide, we will explore why trading commodities can be beneficial, highlight the most traded commodities in Canada, and provide a step-by-step approach to help you get started.

KEY TAKEAWAYS

- Commodities prices are known for their volatility, presenting traders with opportunities to profit from price fluctuations.

- In the quest for financial stability and growth, diversification is an essential strategy. Commodities provide a unique asset class that can add depth and resilience to your investment portfolio.

- Commodities trading is a significant aspect of Canada's financial landscape, providing investors and traders with opportunities to participate in various markets.

- Novice traders should also consider practicing with virtual or simulated trading accounts before applying these methods in real market conditions.

Why Trade Commodities?

Commodities prices are known for their volatility, presenting traders with opportunities to profit from price fluctuations. Unlike stocks or bonds, commodities are physical goods that are constantly in demand across industries worldwide.

This demand is influenced by various factors such as supply and demand dynamics, geopolitical events, weather conditions, and global economic trends. By trading commodities, investors can diversify their portfolios and potentially earn significant returns.

Additionally, utilizing trading platforms like MetaTrader 4 allows traders to access real-time data, charts, and analysis tools, enabling them to make informed trading decisions based on market trends and indicators.

So why trade commodities?

Before we contine with commodity market, if you are more in stock trading, here is the Canadian stocks list, handpicked by us.

Now let's dive into the reasons why trading commodities can open up opportunities for you:

Profit from Price Volatility:

Commodities markets are renowned for their breathtaking price movements, presenting traders with a thrilling arena to capitalize on volatility. Whether it's the unexpected shifts in supply and demand, geopolitical tensions, or natural disasters, commodities are inherently influenced by a myriad of factors that can send prices soaring or plummeting.

These price fluctuations create a fertile ground for astute traders to enter and exit positions at opportune moments, harnessing the potential for substantial profits. Brace yourself for an adrenaline-fueled adventure as you navigate the highs and lows of the commodities market.

Diversify Your Portfolio:

In the quest for financial stability and growth, diversification is an essential strategy. Commodities provide a unique asset class that can add depth and resilience to your investment portfolio. Unlike traditional stocks and bonds, commodities possess distinct characteristics that make them less susceptible to market fluctuations.

By including commodities in your portfolio, you can mitigate risk and reduce the reliance on a single asset class. As the saying goes, don't put all your eggs in one basket – diversify with commodities and unlock a world of potential.

Tap into Global Demand:

Commodities lie at the heart of the global economy, fueling industries and driving progress. From the metals that construct our cities to the energy sources that power our lives, commodities are in constant demand worldwide.

By trading commodities, you position yourself at the forefront of this global appetite, allowing you to profit from the ebb and flow of demand across various sectors. Stay ahead of the curve and ride the waves of economic growth as you engage with the backbone of industry.

Hedge Against Inflation:

Inflation can erode the value of your hard-earned money, making it crucial to protect your wealth. Commodities offer a robust defense against the erosive effects of inflation. As prices rise, commodities often experience an upward surge, preserving their intrinsic value.

By investing in commodities, you can safeguard your purchasing power and shield your portfolio from the corrosive forces of inflation. Let commodities be your armor as you navigate the ever-changing tides of economic uncertainty.

Engage with a Vibrant Community:

Trading commodities is not a solitary endeavor. It is a gateway to a vibrant and diverse community of traders, where ideas are shared, insights are exchanged, and knowledge is built collectively. Engaging with fellow traders allows you to expand your perspective, learn from experienced professionals, and enhance your trading skills.

Join forums, attend conferences, and immerse yourself in the rich tapestry of expertise that exists within the commodities trading community. Together, you can navigate the complex terrain of the market and seize the boundless opportunities it presents.

How to Trade Commodities in Canada

If you are interested in trading commodities in Canada, here are a few key steps to consider:

1. Choose a Trading Platform

Select a reputable brokerage or trading platform that offers access to the commodities market. Ensure that the platform provides real-time data, charting tools, and order placement functionality for trading commodities futures, contracts for difference (CFDs), or exchange-traded funds (ETFs).

2. Conduct Market Analysis

Utilize technical analysis tools and fundamental research to analyze commodities market trends. Monitor supply and demand dynamics, economic indicators, and news related to commodity production, consumption, and geopolitical developments.

3. Develop a Trading Strategy

Define your trading strategy based on your risk appetite, time horizon, and market analysis. Consider factors such as entry and exit points, position sizing, and risk management techniques.

4. Monitor Price Movements

Keep a close eye on commodity prices and market news that can influence price fluctuations. Use charting tools to identify key support and resistance levels, trends, and patterns that can guide your trading decisions.

5. Risk Management

Implement risk management measures to protect your capital. Set stop-loss orders to limit potential losses and consider employing risk-reward ratios to assess the profitability of your trades.

6. Stay Informed

Continuously educate yourself about the commodity market. Stay updated on industry reports, economic indicators, and developments in major commodity-producing countries. Engage with industry experts, participate in forums or webinars, and leverage educational resources to enhance your understanding.

How to trade Commodities on Example (NatGas) in Canada

Learn about the Canadian natural gas market, including supply and demand dynamics, regulatory environment, and market participants.

The Canadian natural gas market is an important sector within the country's energy industry. Here's an overview of the Canadian natural gas market, including its supply and demand dynamics, regulatory environment, and key market participants:

Supply Dynamics:

- Natural Gas Reserves: Canada has substantial natural gas reserves, primarily located in Western Canada. The major natural gas-producing provinces are Alberta, British Columbia, and Saskatchewan.

- Shale Gas: The emergence of shale gas production, particularly in the Montney and Duvernay formations, has significantly boosted Canada's natural gas supply. Shale gas now constitutes a significant portion of the country's overall production.

- Infrastructure: Canada has an extensive network of pipelines and storage facilities that facilitate the transportation and distribution of natural gas across the country. Key infrastructure includes the TransCanada Pipeline (now called TC Energy), Alliance Pipeline, and Westcoast Energy's pipeline system.

Demand Dynamics:

- Domestic Consumption: Natural gas is a vital source of energy for residential, commercial, and industrial sectors in Canada. It is used for heating, electricity generation, industrial processes, and as a feedstock in various industries.

- Exports: Canada is a major exporter of natural gas, primarily to the United States. The country's proximity to the U.S. market allows for extensive cross-border pipeline exports, making it an essential supplier of natural gas to the U.S. Northeast, Midwest, and Pacific Northwest regions.

Market Participants:

- Producers: Numerous companies are engaged in natural gas exploration, development, and production in Canada. Key producers include companies such as Canadian Natural Resources Limited, Encana Corporation (now Ovintiv), Tourmaline Oil Corp, and ARC Resources Ltd.

- Pipeline Operators: TC Energy, Enbridge Inc., and Pembina Pipeline Corporation are major pipeline operators responsible for transporting natural gas from production areas to end-use markets across Canada and the United States.

- Local Distribution Companies (LDCs): LDCs are responsible for distributing natural gas to residential, commercial, and industrial customers within specific regions or cities. Examples of LDCs include Enbridge Gas Inc., FortisBC, and ATCO Gas.

- Natural Gas Traders: Various trading companies, energy marketers, and financial institutions actively participate in the trading of natural gas contracts, including futures and options, within Canadian and international markets.

- Government Agencies: Alongside the CER, other governmental bodies, such as Natural Resources Canada and provincial regulatory authorities, play a role in overseeing and regulating the natural gas sector.

The Canadian natural gas market is influenced by global energy trends, market prices, infrastructure development, and environmental considerations. Understanding the supply-demand dynamics, regulatory framework, and key market participants is crucial for anyone involved or interested in the Canadian natural gas industry.

Choose a reputable online brokerage or trading platform that offers commodity trading in Canada.

While personal experience can be valuable in assessing the quality of a broker, it's also important to consider several factors beyond personal experience alone. Here are some key aspects to evaluate when determining if a broker is good:

- Regulation and Reputation: Research the regulatory body overseeing the broker and ensure they are properly licensed and compliant with relevant regulations. Look for reviews, testimonials, and feedback from other traders to gauge the broker's reputation and reliability.

- Security and Safety: Assess the broker's security measures to protect your funds and personal information. Look for brokers who offer robust encryption, segregated client accounts, and adherence to industry best practices.

- Trading Platform: Evaluate the broker's trading platform for its user-friendliness, stability, and the availability of tools and features that suit your trading needs. A good trading platform should provide real-time market data, order execution capabilities, and risk management tools.

- Range of Tradable Instruments: Consider the variety of commodities and financial instruments offered by the broker. Ensure they provide access to the specific commodities you are interested in trading, such as Natural Gas (NatGas) in your case.

- Trading Costs: Compare the broker's fee structure, including commissions, spreads, and any other charges associated with trading commodities. Lower trading costs can contribute to higher profitability.

- Customer Support: Assess the broker's customer support services, including their availability, responsiveness, and the quality of assistance provided. A good broker should offer multiple channels of communication and timely support.

- Educational Resources: Consider whether the broker offers educational materials, webinars, or research tools to help traders enhance their knowledge and skills. These resources can be valuable, especially for beginner traders.

- Account Types and Funding Options: Evaluate the different account types offered by the broker and check if they align with your trading preferences. Additionally, review the funding options available and ensure they are convenient and secure.

- Order Execution: Look for a broker with efficient order execution and minimal slippage. Speed and reliability of trade execution are crucial, especially in fast-moving markets like commodities.

- Transparency: Assess the broker's transparency in terms of pricing, fees, and policies. They should provide clear information about costs, terms and conditions, and any potential conflicts of interest.

Combining personal experience with thorough research and evaluation of these factors can help you make an informed decision about the quality and suitability of a broker for your commodity trading needs.

1. Open an Account & Fund it (I think you don’t need help with this)

2. Conduct thorough research on NatGas market trends, news, and relevant fundamental and technical factors.

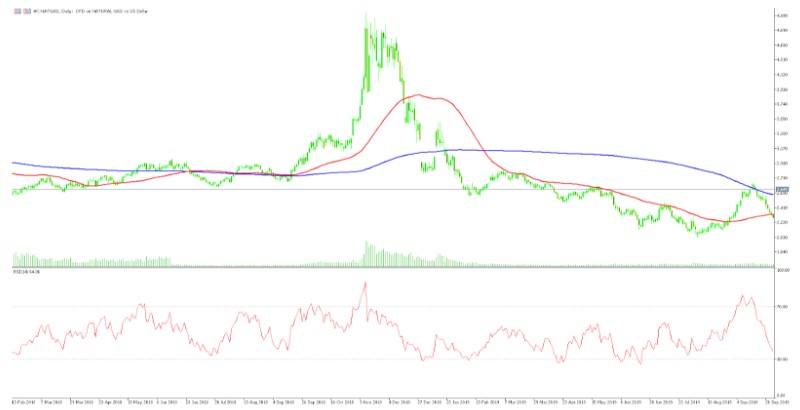

Based on historical data, the price of Natural Gas has reached a support level of around 2.00, which has only been tested six times since September 1996. Typically, when Natural Gas reaches this bottom level, it tends to occur in the January-February period, while the recovery tends to happen in March and beyond.

Currently, in May, Natural Gas has experienced a corrective bullish rally by surpassing the additional resistance level at 2.500. This suggests a delay in the downward pressure and indicates some potential gains as it moves towards the target of 2.650. The positive momentum signals from the stochastic indicator further support the expectation of continued corrective bullish attempts.

The next target for the upward move would be around 2.900, followed by the main resistance level within the bearish channel at 3.200. In simpler terms, the price of Natural Gas has reached a historically significant support level near 2.00.

Despite being in May, which is not the usual period for recovery, the price has shown a temporary upward movement by surpassing the resistance level at 2.500. This indicates a possible extension of the upward move towards 2.650. Positive momentum signals from the stochastic indicator support the expectation of further upward attempts. The next targets for the upward movement are around 2.900 and 3.200.

3. Determine your trading strategy, (implementing risk management strategies, such as setting stop-loss and take-profit orders, to protect your investment).

Novice traders often find comfort in using trend lines, chart patterns, and support/resistance levels as they begin their trading journey. For instance, when the current price of Natural Gas approaches a previous high (resistance), it is often seen as a potential target to aim for. Similarly, previous lows can serve as reference points for traders.

Trend lines play a crucial role in identifying and confirming the prevailing direction of a market. By connecting higher highs in an uptrend or lower lows in a downtrend, traders can establish trend lines that also act as dynamic support or resistance levels.

One commonly used technical indicator is the Relative Strength Index (RSI), which not only helps identify overbought or oversold conditions but also enables traders to spot divergences. Divergence occurs when the RSI shows a different trend compared to the underlying instrument's price movement. For example, in a bearish market, if the RSI indicates higher lows while the price exhibits lower lows, this divergence could suggest a potential reversal of the underlying instrument's trend.

Experienced traders employ advanced techniques such as Elliot Wave Theory, Fibonacci retracement, and Ichimoku to fine-tune their market entries. These methods, combined with a solid understanding of the fundamental factors influencing Natural Gas prices, allow traders to strategically time their entry into the market. Accurately timing the entry is crucial for maximizing trade success, making it essential to explore these techniques.

For instance, let's consider a historical scenario where, on August 25th, 2018, reports emerged about dangerously low inventories of Natural Gas. This scarcity was a consequence of increased demand during the summer season, depleting stock levels from the previous winter.

This fundamental analysis provides valuable insight for traders crafting their Natural Gas trading strategy. In this case, the expectation of higher prices can be supported by incorporating technical analysis.

By utilizing the Relative Strength Index (RSI), traders can observe a situation of positive divergence evident in the chart between September and October. This divergence indicates a discrepancy between the RSI trend and the price movement. The positive divergence further bolsters the expectation of higher Natural Gas prices.

It's worth noting that while these techniques offer valuable insights, they should be complemented with comprehensive analysis and risk management strategies. Experienced traders understand the importance of integrating both fundamental and technical analyses to enhance their trading decisions.

It's important to note that while these techniques can be useful, they should be combined with comprehensive analysis and risk management strategies. Novice traders should also consider practicing with virtual or simulated trading accounts before applying these methods in real market conditions.

4. Understand and comply with the regulations governing commodity trading in Canada, including any tax obligations associated with your trading activities.

In Canada, commodity trading is regulated by several bodies, and there are specific tax obligations associated with trading activities. Here's an overview of the regulations and tax considerations related to commodity trading in Canada:

Regulations:

- Canadian Securities Administrators (CSA): The CSA is an umbrella organization composed of provincial and territorial securities regulators in Canada. They regulate securities and derivatives, including commodity futures contracts.

- Investment Industry Regulatory Organization of Canada (IIROC): IIROC is the national self-regulatory organization that oversees investment dealers and trading activity in Canada. They establish rules and regulations for commodity futures trading.

- Futures Commodity Act (FCA): The FCA is the federal legislation that governs commodity futures trading in Canada. It outlines the regulatory framework for commodity futures exchanges, intermediaries, and participants.

Tax Obligations:

- Capital Gains Tax: Profits made from commodity trading may be subject to capital gains tax. The tax rate depends on various factors, including the holding period and the taxpayer's income tax bracket.

- Reporting Requirements: Canadian residents who engage in commodity trading must report their trading activities and capital gains or losses in their annual tax returns. This includes reporting any income earned from commodity trading as business income or capital gains.

- Tax Treatment of Different Instruments: Different instruments used for commodity trading may have different tax treatments. For example, gains or losses from trading commodity futures contracts are typically treated as 50% taxable capital gains or losses, while gains or losses from options trading may be treated differently.

Registered Accounts: Canadians can also trade commodities within registered accounts such as Tax-Free Savings Accounts (TFSA) or Registered Retirement Savings Plans (RRSP). These accounts provide certain tax advantages, such as tax-free growth or tax deferral, depending on the account type.

It's important to note that tax laws and regulations can be complex and subject to change. It is recommended to consult with a qualified tax professional or financial advisor who can provide personalized guidance based on your specific circumstances and trading activities. They can help ensure compliance with regulations and optimize your tax strategy related to commodity trading in Canada.

Remember, trading commodities involves risk, and it's essential to develop a solid understanding of the market and have a well-thought-out trading plan before getting started. Consider seeking professional advice or utilizing educational resources to enhance your knowledge and skills in commodity trading.

Most Traded Commodities in Canada

Commodities trading is a significant aspect of Canada's financial landscape, providing investors and traders with opportunities to participate in various markets. The country's rich natural resources and thriving agricultural sector contribute to the vibrant trading environment, with several commodities standing out as the most actively traded. From metals to energy sources and agricultural products, these commodities attract attention due to their economic importance and potential for profit.

From the industrial metal copper, to energy sources such as Brent oil, WTI oil, and natural gas (NATGAS), to agricultural staples like wheat, cotton, and corn, we will delve into each commodity's characteristics, demand drivers, and factors affecting their prices. By gaining a comprehensive understanding of these commodities, you can better navigate the Canadian market and make informed trading decisions.

Furthermore, we will discuss the fundamentals of trading commodities in Canada, including the use of trading platforms such as MetaTrader 4, which provide real-time data, analysis tools, and order execution capabilities.

With a step-by-step approach, we will guide you through the process of trading commodities, from educating yourself about the market to choosing a reliable brokerage, developing a trading plan, and executing trades.

Trading commodities in Canada offers both opportunities and challenges. Volatility, supply and demand dynamics, global economic trends, and geopolitical events all play a role in shaping commodity prices. By staying informed and adapting to market conditions, you can capitalize on trading opportunities and potentially achieve financial success.

Let's explore the diverse world of commodities trading and discover the potential it holds for your investment journey.

| Commodity | Description | Importance |

|---|---|---|

| Copper | Vital industrial metal used in construction and electrical equipment manufacturing. | Crucial role in multiple sectors. |

| Brent Oil | Global benchmark for oil prices, significant in Canada's energy sector. | Influences global oil prices. |

| WTI Oil | Commonly traded commodities in Canada, influenced by supply disruptions, geopolitical tensions, and global oil demand. | Significant in Canadian energy markets. |

| Natural Gas | Clean-burning fossil fuel used for heating, power generation, and industrial processes. | Essential energy source in multiple sectors. |

| Wheat | One of the world's largest wheat exporters, important in Canada's agricultural sector. | Significant commodity in agricultural markets. |

| Cotton | Versatile commodity used in the textile industry. | Important commodities traded globally. |

| Corn | Staple crop used in food, animal feed, and biofuels. | Valuable commodity across multiple industries. |

Factors Influencing Commodity Prices:

Several factors can impact the prices of commodities, including:

- Supply and Demand Dynamics: Changes in supply and demand can have a substantial impact on prices. Factors such as mine production, exploration activities, and global economic conditions influence the balance between supply and demand.

- Economic Indicators:Copper prices are sensitive to economic indicators such as GDP growth, industrial production, and manufacturing activity. Increased economic activity generally leads to higher demand.

- Global Trade and Geopolitical Factors: Trade policies, tariffs, and geopolitical events can affect commodities prices. Disruptions in international trade or political instability in major commodities-producing regions can impact supply and lead to price volatility.

- Currency Movements: commodities prices are influenced by currency fluctuations, particularly the value of the U.S. dollar. As commodities are priced in dollars, changes in currency exchange rates can impact its affordability and demand.

Bottom Line on How to Trade Commodities in Canada

Trading commodities in Canada can be an exciting and potentially profitable venture. By understanding the reasons to trade commodities, identifying the most traded commodities in Canada, and following a systematic approach, you can increase your chances of success.

Remember to educate yourself, choose a reliable brokerage, develop a trading plan, analyze the market, execute trades wisely, and practice effective risk management. By staying informed and adaptable, you can navigate the commodities market with confidence and optimize your trading outcomes.