- Education

- Introduction to Trading

- Canadian Stock Market Hours

Canadian Stock Market Hours

The Toronto Stock Exchange (TSX) is one of the top 9 global stock exchanges in terms of total capitalization of companies listed on the exchange. The TSX is the third-largest in North America after the New York Stock Exchange and the Nasdaq.

Is the Canadian Stock Market Open Today

The Canadian stock market opens from 9:30 am ET until 4:00 pm. ET. The market operates from Monday to Friday, except for official holidays, of course.

KEY TAKEAWAYS

- The Toronto Stock Exchange is often described as the "quiet" of the richest major stock exchanges in the world, with rare computer crashes, hacker attacks, "insider scandals" or high-profile "investigative journalism" and exposés of major hedge funds and banks.

- The Canadian stock market opens from 9:30 am ET until 4:00 pm. ET. The market operates from Monday to Friday, except for official holidays, of course.

- Toronto Stock Exchange offered computer access to its trading as early as 1977, well before the New York Stock Exchange.

- Canadian stock markets are very promising, especially the Toronto Stock Exchange.

Canadian Stocks Trading Hours

Traders need to know when the Canadian stock market is open for several reasons. Knowledge of the market operating schedule will allow you to trade during active trading sessions, when liquidity is usually higher.

- Additionally, understanding market hours helps traders avoid unnecessary risks associated with trading during periods of low liquidity or when markets are closed, thereby protecting their investments.

- Moreover, knowing the Canadian stock market hours allows traders to stay on top of any important announcements, economic events or corporate developments that could affect market sentiment and impact trading decisions.

Overall, staying informed about market hours is important to successfully navigate the Canadian stock market and make informed trading decisions.

| Trading Instruments | Trading hours (CET) | Local trading hours (Tuesday) |

|---|---|---|

| Stock CFDs: TSX stock exchange (Canada) / #CA-... | Monday — Friday (15:30 — 22:00) | 15:30 — 22:00 |

Toronto Stock Exchange Holidays

Below you can see a table with holidays in Canada and the USA*. The Toronto Stock Exchange will be closed these days. For US holidays, there is a separate approach;

* Note these holidays in the US with a special settlement for issues traded in US dollars

| Canadian Holidays | |

|---|---|

| Monday, January 1, 2024 | In Lieu of New Year's Day |

| Monday, February 19, 2024 | Family Day |

| Friday, March 29, 2024 | Good Friday |

| Monday, May 20, 2024 | Victoria Day |

| Monday, July 1, 2024 | Canada Day |

| Monday, August 5, 2024 | Civic Holiday |

| Monday, September 2, 2024 | Labour Day |

| Monday, October 14, 2024 | Thanksgiving Day |

| Wednesday, December 25, 2024 | Christmas Day |

| Thursday, December 26, 2024 | Boxing Day |

| U.S. Holidays* | |

| Monday, January 15, 2024 | Martin Luther King, Jr. Day |

| Monday, May 27, 2024 | Memorial Day |

| Wednesday, June 19, 2024 | Juneteenth National Independence Day |

| Thursday, July 4, 2024 | Independence Day |

| Thursday, November 28, 2024 | Thanksgiving Day |

Canadian Stock Market Hours

Traders can invest in shares on the Canadian stock exchange during opening hours. Below you can see when the Canadian stock exchange opens.

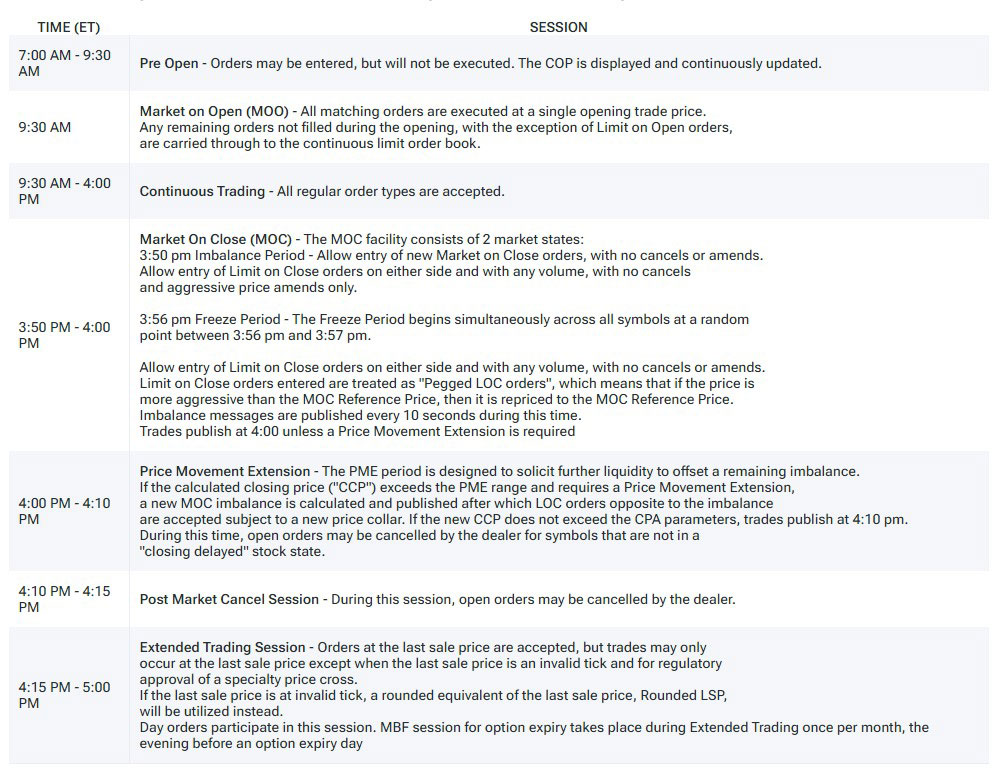

Here are the trading session hours for Toronto Stock Exchange and TSX Venture Exchange:

Note: while some stock markets in Asia (including the Shanghai Stock Exchange (SSE) and the Tokyo Stock Exchange (TSE/TYO)) close for lunch (30 minutes to 1 hour), the Toronto Stock Exchange and other major global markets do not.

What is TSX (Toronto Stock Exchange)

Features of the Toronto Stock Exchange

The Toronto Stock Exchange is often described as the "quiet" of the richest major stock exchanges in the world, with rare computer crashes, hacker attacks, "insider scandals" or high-profile "investigative journalism" and exposés of major hedge funds and banks. A major difference between the Toronto Stock Exchange and the NYSE and NASDAQ is a significantly smaller share of "stock speculators" in relation to institutional investors, which is why there is less volatility in the stock market and stock indices, with a more logical bull market.

Also, the Toronto Stock Exchange (TSX) is considered one of the most conservative and ultra-reliable in the world. There are even jokes around Canadian conservatism as if they were less impulsive, “thinking for a long time” than US citizens, they say, they are used to reacting to everything “in a slow” and measured way in “cold Canada”.

Interestingly, the Toronto Stock Exchange offered computer access to its trading as early as 1977, well before the New York Stock Exchange.

An interesting fact is that the name of the exchange looks like this - TSX, and abbreviation is opened as Toronto Stock Exchange. The fact is that the abbreviation TSE was already occupied by the Tokyo Stock Exchange (Tokyo Stock Exchange). To avoid confusion, we decided to replace the first letter in the word Exchange with the second.

The main participants of the Toronto Stock Exchange are:

- Issuers of shares traded on the TSX;

- Market makers responsible for ensuring full liquidity of any order from the broker;

- Brokers who receive buy/sell orders from exchange traders; Traders, who are representing hedge funds,

- Investment banks,

- Investment funds,

- etc.

The operator of the Toronto Stock Exchange - TMX Group - is a large investment company founded in 2010. (assets: $10.16 billion for 2014, 1.4 thousand employees).

The largest and the most famous companies whose shares are traded on the Toronto Stock Exchange are.

- Bank of Montreal (capitalization $103.7 billion, March 2019);

- Canadian National Railway Company ($116.88 billion).

- Royal Bank of Canada ($103.54 billion) - the largest Canadian bank, with a capital of 63.944 billion Canadian dollars (2015);

- Bank of Nova Scotia ($73.9 billion). Third largest bank in Canada by deposits and net worth of $49.085 billion (2015);

- Metro supermarket chain ($48.39);

- BlackBerry Limited ($12.6 billion). Telecommunications company, manufacturer of smartphones of the same brand. Revenue $1.3 billion (2017);

- Magna International ($65.28) is one of the largest manufacturers of auto parts for the assembly of Mercedes-Benz, Volkswagen, General Motors, Porsche, Toyota, Ford, Honda, Mitsubishi, Hyundai, headquartered in Aurora (Canada);

- Canadian Imperial Commercial Bank ($53.7 billion);

- Agnico Eagle Mines Limited ($13.7 billion). Engaged in gold mining. Revenue $2.8 billion (2016);

- Bombardier Inc. ($28.6 billion). The world's fourth largest aircraft manufacturer after Boeing, Airbus and Embraer., as well as trains and trams.

If you are interested in investing and trading Canadian stocks but don’t know how, we are inviting you to read in more detail “how to trade stocks in Canada” article.

Bottom Line on Canadian Stock Market Hours

The Toronto Stock Exchange is the first stock exchange in Canada, the third after the NYSE Euronext and Nasdaq in the Americas. It ranks ninth in the world in terms of market capitalization. This stock market materializes the satisfaction of capital requests from companies seeking funding with investors who own the capital.

The Toronto Stock Exchange is reliable, the political and business atmosphere in the country is calm, and this is transmitted to the stock exchanges. Investors love it for its simplicity, reliability, and predictability.

Worth mentioning, that since the beginning of the year, the TSX has started an upward trend of more than 4% against the backdrop of a fall in the US stock market, which fell by 4%. Despite the global health crisis, TSX continues to operate. In fact, unlike other major indices that have experienced sharp price corrections, the TSX has not experienced the same turmoil. This opportunity provides positive feedback on the Canadian stock market. The more TSX works, the more it becomes visible, and therefore the shares listed will only increase.

Canadian stock markets are very promising, especially the Toronto Stock Exchange. The latter is one of the world leaders, and its flagship S&P/TSX index has been extremely successful since the beginning of the year. Changing global conditions will support companies listed on Canadian stock exchanges. Therefore, we advise you to invest in the Canadian financial market because, given the latest developments, 2023 is the right year to invest.