- Education

- Introduction to Trading

- Pair Trading for Beginners

Pair Trading for Beginners: Everything You Need to Know to Get Started

If you are looking for a powerful investment strategy that can potentially reduce market risk and increase returns, Then you may want to consider pair trading!

This innovative strategy involves taking long and short positions in related assets with a strong positive correlation, aiming to capitalize on temporary divergences in their relative performance. However, as with any investment strategy, there are risks involved, and success depends on careful management and monitoring. To help you get started, in this article, we'll explore types of pairs trading and how it works as well as the advantages and limitations of pair trading, share examples of successful and unsuccessful strategies, and provide recommendations for using this strategy effectively.

KEY TAKEAWAYS

- Pairs trading strategy involves taking long and short positions in related assets with a strong positive correlation, aiming to capitalize on temporary divergences in their relative performance.

- With pairs trading traders can take advantage of market inefficiencies.

- Pairs trading is a good strategy because it offers traders the opportunity to profit from market inefficiencies while minimizing overall market risk and diversifying their portfolio.

- MetaTrader 4 is perfect for pair trading, with powerful charting tools and real-time data that can help you make smarter trades.

What is Pair Trading Strategy

You are a trader, and you want to make money regardless of which way the market is going. Sounds great, right, and with pairs trading, it is possible.

Here's how it works: first, you find two stocks that have similar characteristics and are strongly positively correlated. Then, you compare their current stock prices to their historical stock prices. If one security is trading higher than it should be based on its history, while the other is trading lower, you've hit the jackpot.

You short sell the overvalued security (meaning betting that their value will go down), and you go long (buy shares, hoping their value will go up) on the undervalued security.

What's the result? You've maintained neutrality in the market - it doesn't matter if the market goes up, down, or sideways, because your profits are based on the relative difference between the two securities you've chosen. So, if the overvalued security drops in price, and the undervalued security increases, you'll make a profit.

Overall, pairs trading is a clever strategy for traders who want to minimize their risk and maximize their profits. It's a bit like finding two peas in a pod, and then betting on their differences to make a profit!

Pairs trading is a popular and effective strategy for a few reasons.

- With pairs trading traders can take advantage of market inefficiencies. Let me explain, when two securities that are usually highly correlated start trading at different prices, it suggests that there may be an opportunity for profit. By identifying these discrepancies, pairs traders can capitalize on market imbalances and generate profits that wouldn't be possible through conventional trading strategies.

- Pairs trading helps to minimize market risk. Since the strategy involves taking both a long and short position on two correlated stocks, the trader is essentially betting on the relative difference between the two rather than the overall direction of the market. This means that the trader can potentially profit regardless of whether the market is going up or down.

- And finally, pairs trading can be an effective way to diversify a portfolio. By trading two stocks that are related to one another, the trader can potentially reduce overall portfolio risk while still generating returns.

Overall, pairs trading is a good strategy because it offers traders the opportunity to profit from market inefficiencies while minimizing overall market risk and diversifying their portfolio.

How Pairs Trading Strategy Works

Firstly, what is the Correlation of stocks?

Fundamentally, the correlation is just an alternative measure of the relationship between stocks.

Correlation of stocks refers to the statistical measure of the degree to which the prices of two stocks move in relation to each other. It is a measure of the strength and direction of the relationship between the two stocks.

If two stocks have a correlation coefficient of 1, it means that when the price of one stock goes up, the price of the other stock goes up too. If the correlation coefficient is -1, it means that when the price of one stock goes up, the price of the other stock goes down. And if the correlation coefficient is 0, it means that there is no relationship between the two stocks.

Understanding the spread is very important, let’s go

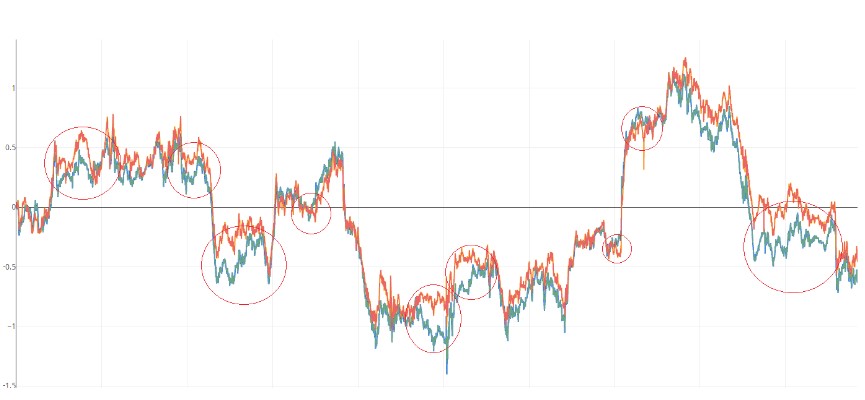

Pair trading is a strategy where traders look for two securities that have similar characteristics and are positively correlated. The goal is to identify a discrepancy in the prices of these two securities, and then profit from the difference in value between the two.

To do this, traders must understand the concept of the spread. The spread is the difference in price between the two securities that the trader has chosen. In pair trading, traders want to buy the underperforming stock (the one that is trading lower than its historical average) and simultaneously short sell the overperforming stock (the one that is trading higher than its historical average).

The goal is to profit from the convergence of the prices of two stocks. As the prices of the two securities move closer together, the trader profits from the spread.

For example, let's say you identify a pair of securities, A and B. And believe that A is undervalued and will increase in price, while B is overvalued and will decrease in price. The spread between the two stocks is currently $5. You then buy $10,000 worth of stock A and short sell $10,000 worth of stock B.

If your prediction is correct and the prices of the two stocks move closer together, the spread will decrease. If the spread decreases to $3, you would have made a profit of $2 per share. If the spread increases, then you will incur a loss.

Therefore, understanding the spread is crucial in pair trading. You must be able to identify the right pair of stocks, understand their historical correlation, and determine the optimal entry and exit points to maximize their profits.

Now Let’s talk about types of Pair Trading

There are several types of pair trading strategies that investors can use. Some of the most common types of pair trading include:

Statistical Arbitrage

This type of pair trading involves using statistical models to identify securities that are likely to move in the same direction. The idea is to identify securities that have historically exhibited a strong correlation and then take long and short positions in these securities in order to profit from the divergence of their prices.

Mean Reversion

Mean reversion pair trading involves identifying two securities that have a historically strong correlation but have recently diverged in price. The idea is that these securities will eventually revert to their mean, providing an opportunity to profit by taking a long position in the underperforming security and a short position in the overperforming security.

Sector-based Pair Trading

This type of pair trading involves identifying two securities within the same sector, such as two tech stocks or two energy stocks. The idea is to take a long position in one stock and a short position in the other, in order to profit from the relative performance of the two securities within the sector.

Cross-Asset Pair Trading

his type of pair trading involves identifying two stocks in different asset classes that are related, such as a stock and a bond. The idea is to take opposite positions in the two securities in order to profit from the divergence of their prices.

Looking to take your pair trading strategy to the next level? MetaTrader 4 is perfect for pair trading, with powerful charting tools and real-time data that can help you make smarter trades. Download MetaTrader 4 now and start improving your trading skills.

Advantages of Pair Trading

- Reduced Risk: Pair trading involves taking long and short positions in two related securities, which can help to reduce overall market risk. This is because the strategy is designed to profit from the relative performance of the two securities, rather than the overall market direction. If the overall market experiences a downturn, the investor may still profit if the long position outperforms the short position, or if the short position underperforms the long position.

- Increased Potential Returns: Pair trading provides an opportunity for increased potential returns by exploiting the relative performance of two related securities. Even if one security is underperforming, the investor may still profit if the other security is outperforming. By taking a long position in the security that is expected to outperform and a short position in the security that is expected to underperform, the investor can potentially earn higher returns than they would by simply holding a long position in a single security.

- Opportunity to Capitalize on Market Inefficiencies: Pair trading can also provide an opportunity to capitalize on market inefficiencies, such as mispricings or divergences in the prices of related securities. By identifying and exploiting these inefficiencies, the investor can potentially earn a profit. For example, if two stocks in the same industry have historically exhibited a strong correlation but are currently trading at significantly different prices, an investor could take a long position in the cheaper stock and a short position in the more expensive stock, betting that the prices will eventually converge.

- Flexibility: Pair trading is a flexible strategy that can be used in a variety of market conditions and with a variety of securities. This means that investors can tailor their pair trading strategy to their specific goals and risk tolerance. For example, an investor could use statistical models to identify two stocks that are likely to move in the same direction, or they could focus on two securities within the same sector or asset class. The flexibility of pair trading allows investors to adapt their strategy to changing market conditions and take advantage of different opportunities.

Limitations of Pair Trading

- Market Risk: While pair trading can help to reduce overall market risk, there is still a degree of market risk associated with the strategy. This is because the relative performance of the two securities being traded may be influenced by overall market conditions, such as economic trends or geopolitical events. As such, there is still a risk that both securities will underperform or that the overall market will experience a downturn that negatively impacts both positions.

- Execution Risk: Pair trading involves taking both long and short positions in two related securities, which can increase the risk of execution errors. For example, if the investor is unable to execute one leg of the trade, it could result in an imbalanced position and potential losses. Additionally, there is also the risk of slippage, where the execution price differs from the expected price due to market volatility or other factors.

- Model Risk: Pair trading often relies on statistical models or other quantitative techniques to identify related securities and predict their relative performance. However, these models are not infallible and may be subject to errors or biases. For example, the model may not adequately account for changing market conditions or unexpected events that impact the performance of the securities being traded. As such, there is a risk that the model will produce inaccurate or unreliable predictions.

- Limited Upside Potential: While pair trading can potentially provide increased returns, there is also a limit to the potential upside. This is because the investor is essentially betting on the outperformance of one security relative to the other, rather than on the absolute performance of either security. As such, there is a cap on the potential returns that can be earned through pair trading, which may not be sufficient for some investors.

Examples of Pair Trading

Here are a few examples of successful and unsuccessful pair trading strategies

Successful Pair Trading Strategies

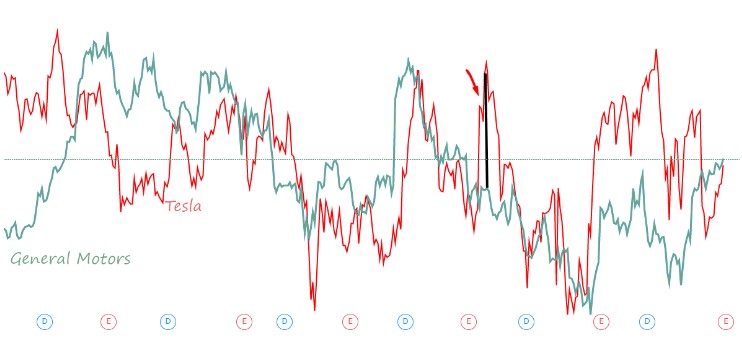

- Coca-Cola and PepsiCo: A classic example of pair trading is the long-short position in Coca-Cola and PepsiCo. These two companies are direct competitors in the soft drink industry and have historically exhibited a strong positive correlation. However, there are times when one stock may outperform the other due to various factors such as earnings reports or news events. Pair trading in this case could involve taking a long position in one stock and a short position in the other, depending on the expected relative performance. If executed successfully, this strategy can generate returns through the relative outperformance of one stock over the other.

- Gold and Silver: Another popular pair trading strategy is to trade gold and silver, as these two precious metals tend to exhibit a strong positive correlation. However, there may be times when one metal outperforms the other due to market conditions such as changes in inflation or interest rates. Pair trading in this case could involve taking a long position in one metal and a short position in the other, depending on the expected relative performance.

Unsuccessful Pair Trading Strategies

- Blackberry and Apple: In 2011, many investors attempted to pair trade Blackberry and Apple, as the two companies were seen as direct competitors in the smartphone market. However, this pair trading strategy was largely unsuccessful, as the correlation between the two stocks was weak and volatile. This led to significant losses for many investors who were unable to accurately predict the relative performance of the two stocks.

- Volkswagen and Porsche: In 2008, many investors attempted to pair trade Volkswagen and Porsche, as the two companies were in the process of merging. However, this pair trading strategy was also largely unsuccessful, as the merger negotiations were complicated and unpredictable, leading to significant volatility and losses for many investors.

It's important to note that pair trading can be a complex and risky strategy, and success or failure depends on various factors such as market conditions, the accuracy of the statistical models used, and the timing of the trades. Therefore, it is crucial to conduct thorough research and analysis before implementing a pair trading strategy.

Successful pair trading strategies often involve trading in related assets that exhibit a strong positive correlation, but with occasional periods of divergence in their relative performance. These periods of divergence may be caused by company-specific news, changes in market conditions or macroeconomic factors. Pair trading strategies that have been successful in the past include trading in stocks, commodities, and currencies.

Unsuccessful pair trading strategies often involve trading in assets that are not closely related, have weak correlations, or are subject to significant volatility or uncertainty. In some cases, investors may overestimate the degree of correlation between two assets or fail to consider important market factors that can affect their relative performance.

Bottom Line of Pair Trading Strategy

Pair trading is a popular investment strategy that involves taking long and short positions in related assets with a strong positive correlation. This strategy aims to capitalize on the temporary divergences in the relative performance of the two assets. Pair trading can be used to reduce market risk and increase potential returns. However, it is important to be aware of the limitations and risks involved, such as execution risk, model risk, and market risk.

Pair trading is a market-neutral trading strategy that involves taking long and short positions in related assets with a strong positive correlation. The goal is to profit from the temporary divergences in the relative performance of the two assets. This strategy is designed to reduce market risk and increase potential returns, but it is important to be aware of the risks involved.

Successful pair trading strategies involve trading in related assets that exhibit a strong positive correlation, but with occasional periods of divergence in their relative performance. Unsuccessful pair trading strategies often involve trading in assets that are not closely related, have weak correlations, or are subject to significant volatility or uncertainty.

Here are a few recommendations for using pair trading as an investment strategy:

- Conduct thorough research: It is important to research the assets you plan to trade and use reliable statistical models to identify suitable pairs for trading.

- Manage risk: It is important to manage risk by setting stop-loss orders and monitoring the trades carefully.

- Diversify: Diversify your portfolio by trading in different asset classes and using different pairs to reduce concentration risk.

- Stay updated: Stay updated on market conditions and events that can affect the relative performance of the assets you are trading.

- Be patient: Pair trading is a long-term strategy and requires patience and discipline. It is important to avoid making impulsive trades and to stick to your trading plan.