Disney Board Wins Shareholder Vote, Peltz's Trian Fund Management Loses Bid for Control

The Walt Disney Company (Disney) shareholders voted to retain the current board members, rejecting attempts by activist investor Nelson Peltz and his hedge fund Trian Fund Management to gain control. This news could have implications for Disney's stock price and overall strategy.

This development is most relevant to the entertainment sector and investors holding Disney stock (DIS).

Disney News Analysis

Disney shareholders voted down proposals from Trian Fund Management and Blackwells Capital to place their own board member candidates. This indicates a show of confidence in the current board's leadership, led by CEO Bob Iger.

While Trian's attempt to gain board control failed, the hedge fund might still see financial gains. Disney's stock price has risen significantly since Trian began its campaign, potentially benefiting their existing holdings.

Disney has been implementing changes to appease investors. These include investments in video game companies and launching new streaming services. Additionally, they have added new members to the board.

Trian and Blackwells argued for a shift in Disney's leadership, claiming the current strategy is outdated and requires fresh ideas. They believe Disney has made missteps in planning the company's future, particularly regarding its streaming service and sports channels.

Bob Iger, Disney's current CEO, is focusing on improving creative content, achieving profitability for the streaming service, and finding digital partners for ESPN.

For Traders

You should consider how this news might impact their Disney stock holdings

- Short-term volatility: The news might cause short-term fluctuations in Disney's stock price. Investors with a short-term horizon should be cautious.

- Long-term strategy:This vote signifies support for the current board's direction. Investors who believe in the board's long-term vision can hold or consider adding to their positions.

- While Trian lost this battle,it doesn't necessarily mean they'll abandon Disney entirely. Investors should stay informed about potential future activist campaigns.

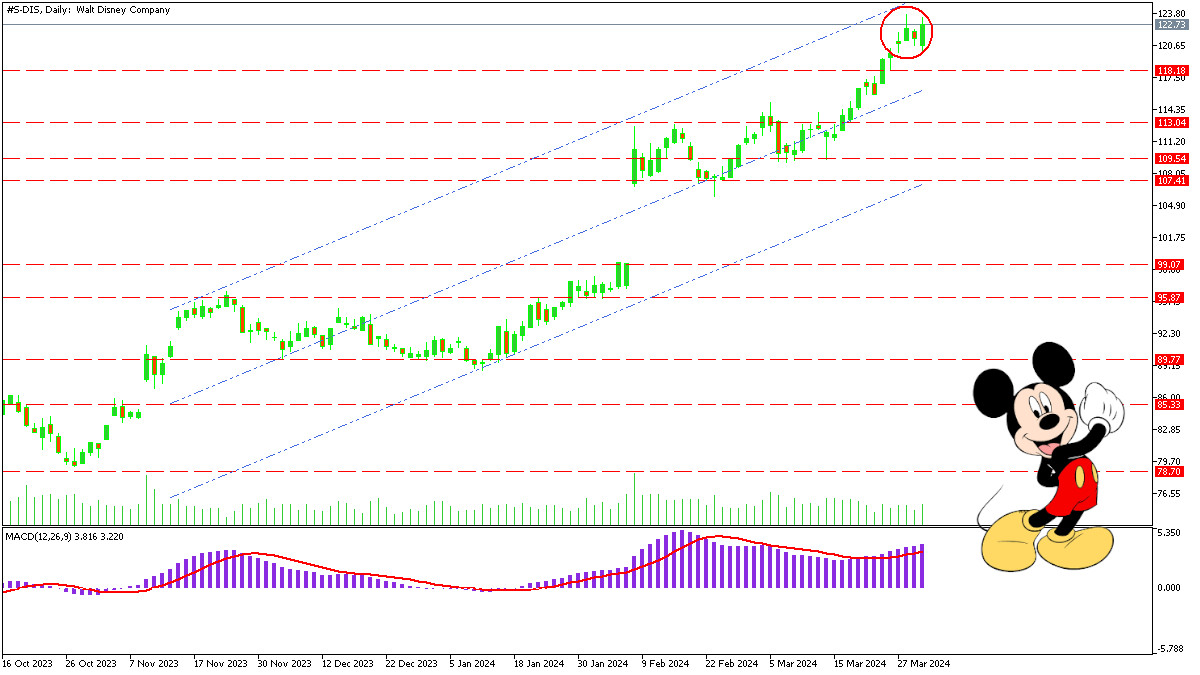

The technical analysis for Disney stock showing several buy signals through various indicators like:

- Moving Averages: shorter-term moving average 20-dayMA is above the 50-day MA, longer-term average, which indicates an upward trend.

- MACD: A crossover of the MACD line above the signal line could be a bullish signal.

- RSI: If the RSI is above 70, it suggests the stock might be overbought.

- Bollinger Bands: A breakout above the upper Bollinger Band could signal a potential price increase.

Conclusion

Disney shareholders have maintained the current board, potentially providing stability for the company's leadership. However, the pressure from activist investors highlights ongoing concerns about Disney's future strategy.

It remains to be seen how Disney's stock price will react and how the company will address investor concerns moving forward.