- Analytik

- Technische Analyse

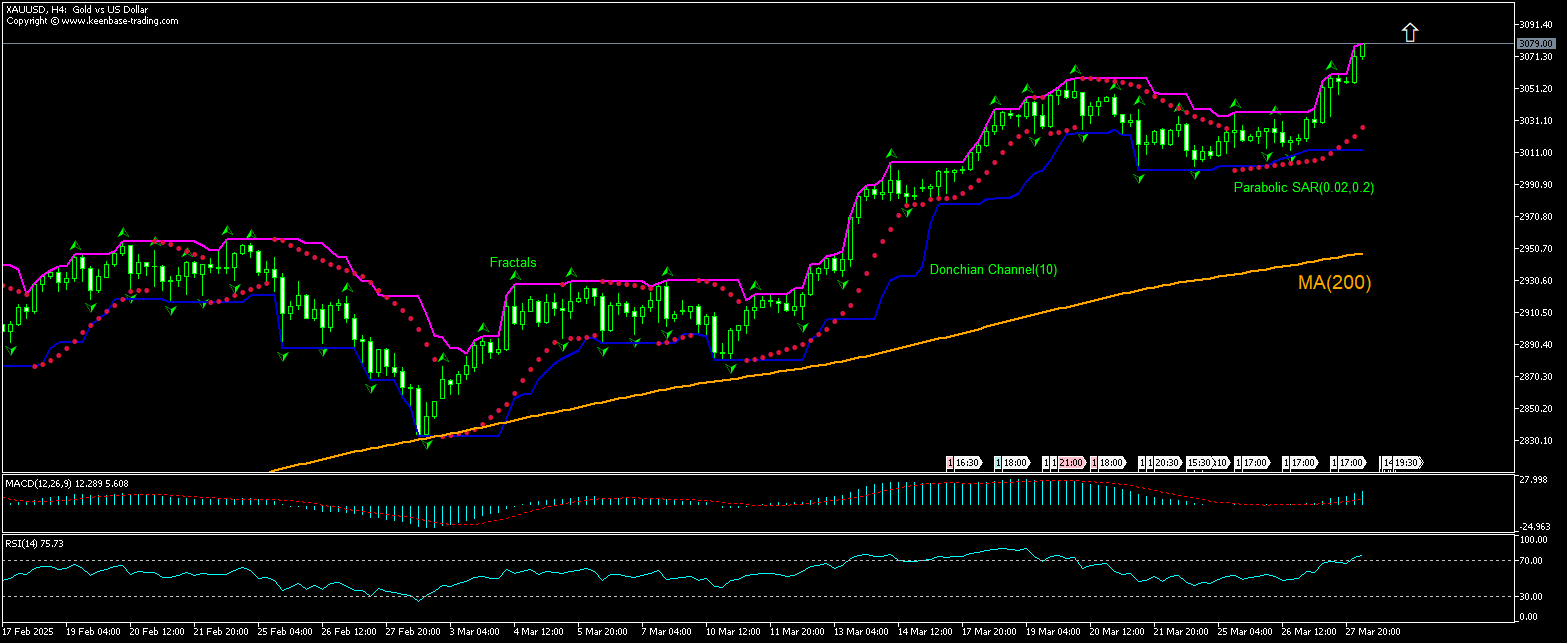

Gold Technische Analyse - Gold Handel: 2025-03-28

Gold Technical Analysis Summary

Above 3082.22

Buy Stop

Below 3033.34

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

Gold Chart Analysis

Gold Technische Analyse

The XAUUSD technical analysis of the price chart in 4-hour timeframe shows the XAUUSD,H4 is advancing to new all-time highs above the 200-period moving average MA(200) as it rebounds after hitting 10-day low a week ago. RSI indicator has moved into overbought zone. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 3082.22. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 3033.34. After placing the order, the stop loss is to be moved every day to the next fractal high , following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (3033.34) without reaching the order (3082.22), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Edelmetalle - Gold

Gold is advancing after president Trump confirmed auto tariffs on March 26. Will the XAUUSD price climbing persist?

Gold prices renewed their upward push after president Trump said 25% tariffs on imported cars and light trucks would begin on April 3. Analysts forecast that gold price benefits from president Trump’s import tariff policy as higher global uncertainty increases gold’s demand due to its safe-haven nature. Earlier this week, Bank of America upgraded its price target on gold to $3,500 per ounce over the coming 18 months from $3,000 previously. Analysts point that uncertainty around Trump administration trade policies could continue to push the USD lower, further supporting gold prices near-term. Before Bank of America upgrade the Macquarie Group predicted the precious metal will touch $3,500 in the third quarter of this year. And JPMorgan analysts asked in a client note “could the $4,000 mark be just around the corner?" The note stated "heading into 2025, gold remained our top bullish pick for a third consecutive year in a row." Rising global uncertainty as president Trump uses tariffs as a major policy tool is bullish for gold prices.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.