- Analytik

- Technische Analyse

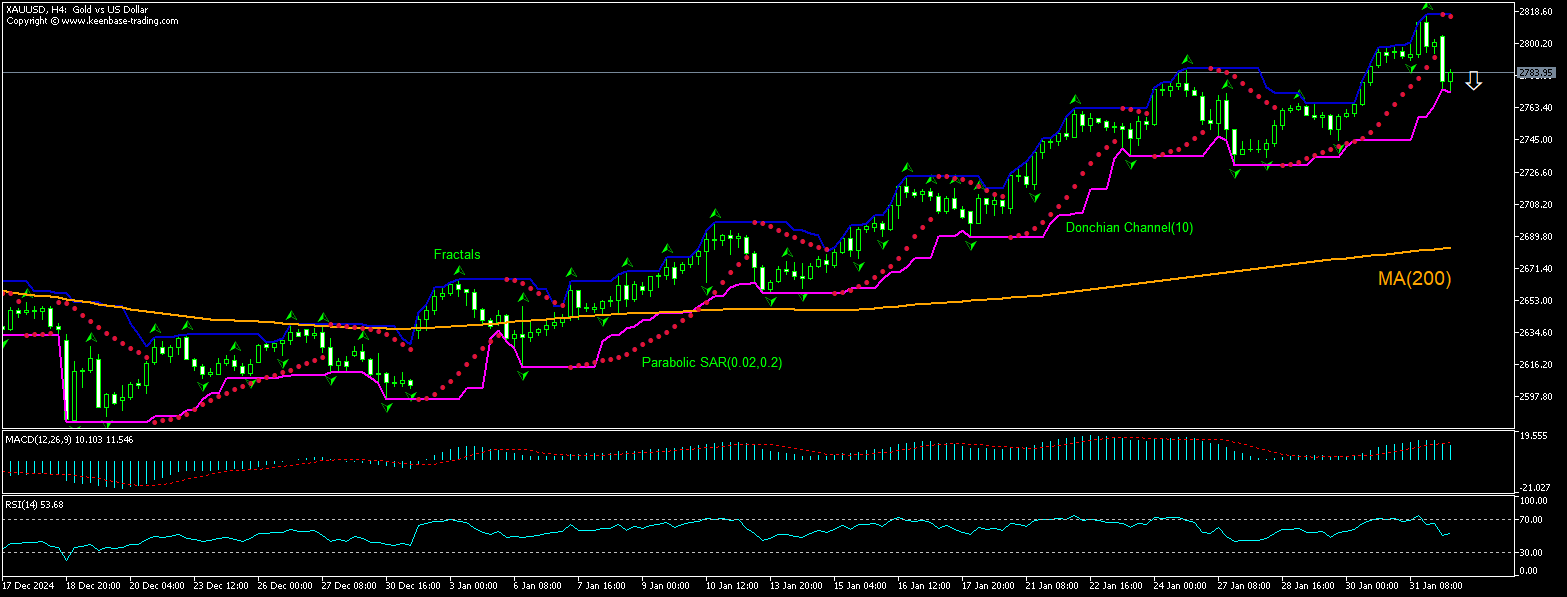

Gold Technische Analyse - Gold Handel: 2025-02-03

Gold Technical Analysis Summary

Below 2772.35

Sell Stop

Above 2816.12

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Gold Chart Analysis

Gold Technische Analyse

The XAUUSD technical analysis of the price chart in 4-hour timeframe shows the XAUUSD,H4 is retracing lower toward the 200-period moving average MA(200) after hitting all-time high last session. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 2772.35. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 2816.12. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (2816.12) without reaching the order (2772.35), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Edelmetalle - Gold

Gold is declining after president Trump on Saturday placed a 25% tariff on imports from Mexico and Canada and 10% tariffs on goods coming from China. Will the XAUUSD price declining persist?

Analysts point that gold price will be volatile in the near term as higher global uncertainty increases gold’s demand due its safe-haven nature while stronger US dollar and higher interest rates weigh on its price. High interest rates will keep supporting gold as majority of traders expect the Federal Reserve will keep interest rates unchanged through the first half of the year while some expect the Fed will not resume cutting interest this year at all. At the same time, tariff wars will have a negative impact on global economy, raising demand for gold as a safe haven asset. Thus, the Canadian government placed 25% tariffs on $30 billion worth of American goods coming into Canada as of Tuesday. It is also prepared to increase its tariffs to another $125 billion worth of American imports in three weeks' time. In retaliation, Mexico has said that it is preparing to place a 25% tariff on American imports and is expected to release its list today. China has said it is taking its case to the World Trade Organization.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.