- Analytik

- Technische Analyse

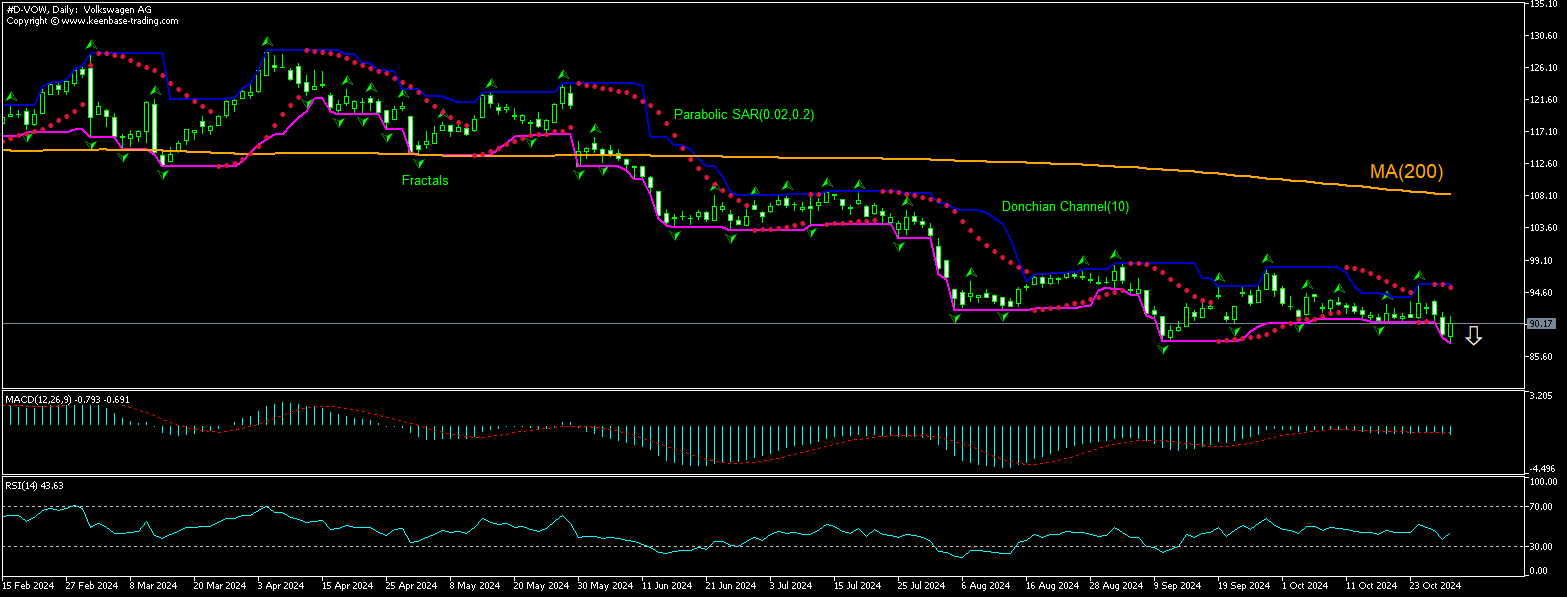

Volkswagen AG Technische Analyse - Volkswagen AG Handel: 2024-10-31

Volkswagen AG Technical Analysis Summary

Below 87.40

Sell Stop

Above 95.32

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Volkswagen AG Chart Analysis

Volkswagen AG Technische Analyse

The technical analysis of the Volkswagen stock price chart on daily timeframe shows #D-VOW,Daily is retreating under the 200-day moving average MA(200) after returning below the MA(200) four months ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 87.40. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper boundary of Donchian channel at 95.32. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (95.32) without reaching the order (87.40), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Aktien - Volkswagen AG

Volkswagen demanded 10% wage cuts from German workers union after it reported lower profits. Will the Volkswagen stock price reverse its retreating?

Volkswagen argued it was the only way that Europe's biggest carmaker could save jobs and remain competitive as profits plunged to a three-year low. Volkswagen on Wednesday reported a 42% drop in third-quarter profit to its lowest level in three years. Volkswagen's deliveries to China, the world's biggest car market, fell by 15% to 711,500 vehicles in the third quarter. This has resulted in Volkswagen’s global deliveries decline, which dropped to 2.176 million vehicles. The company is considering more than 10 billion euros ($10.8 billion) in cost cuts it sees as a solution to regaining competitiveness with Tesla and Chinese automakers. Labor representatives came into talks demanding a 7% pay rise and threatened strikes from December unless the company definitively ruled out plant closures. Two sides will meet again on November 21.Increased operational uncertainty with labor union threatening to go on strike is bearish for a company stock.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.