- Analytik

- Technische Analyse

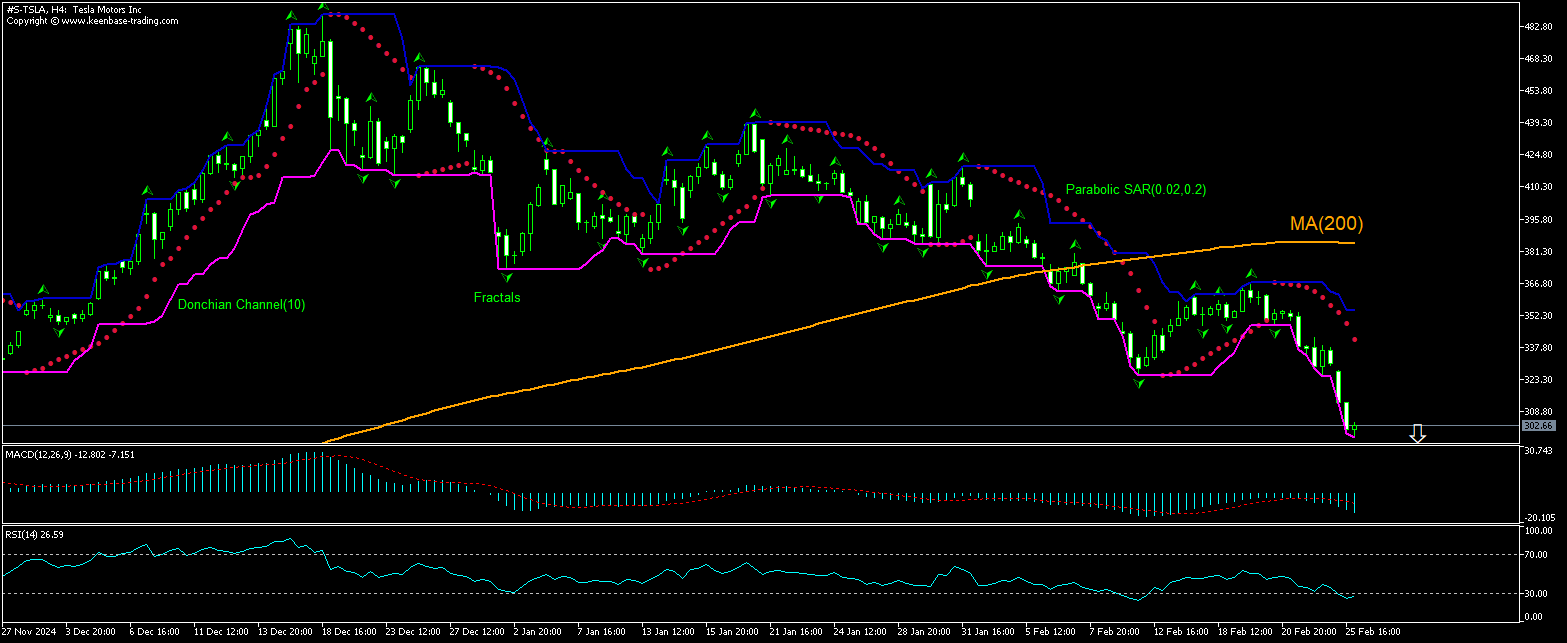

Tesla Motors Inc. Technische Analyse - Tesla Motors Inc. Handel: 2025-02-26

Tesla Motors Inc. Technical Analysis Summary

Below 298.76

Sell Stop

Above 341.51

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Tesla Motors Inc. Chart Analysis

Tesla Motors Inc. Technische Analyse

The technical analysis of the Tesla stock price chart on 4-hour timeframe shows #S-TSLA,H4 is retracing down under the 200-day moving average MA(200) after rebounding from six-week low it hit two weeks ago. RSI is in oversold zone. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 298.76. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed at 341.51. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (341.51) without reaching the order (298.76), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Aktien - Tesla Motors Inc.

Tesla stock slumped as sales in Europe plunged in January. Will the Tesla stock price continue retreating?

Tesla stock slumped as sales in Europe plunged in January. Tesla’s new car registrations in the European union, the European Free Trade Association and the UK fell 45.2% over year to 9,945 registrations. And the company’s market share slid to 1% from 1.8% a year earlier, data from the European Automobile Manufacturers' Association showed yesterday. The sales drop came against the backdrop of a 2.1% over year fall in new car registrations in January, with declines in France, Italy, and Germany. However, battery EVs were seen gaining market share in the region with new BEV sales growing by 34% to 124,341 units while petrol car registrations slid 18.9% to 290,301 units. The market share of BEVs rose to 15% from 10.9% a year ago. The decline in Tesla’s sales in Europe came amid increased competition from Chinese rivals and a greater push into the sector from European manufacturers. Decline in vehicle sales is bearish for a carmaker’s stock price. Tesla's stock closed down 8.4% yesterday.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.