- Analytik

- Technische Analyse

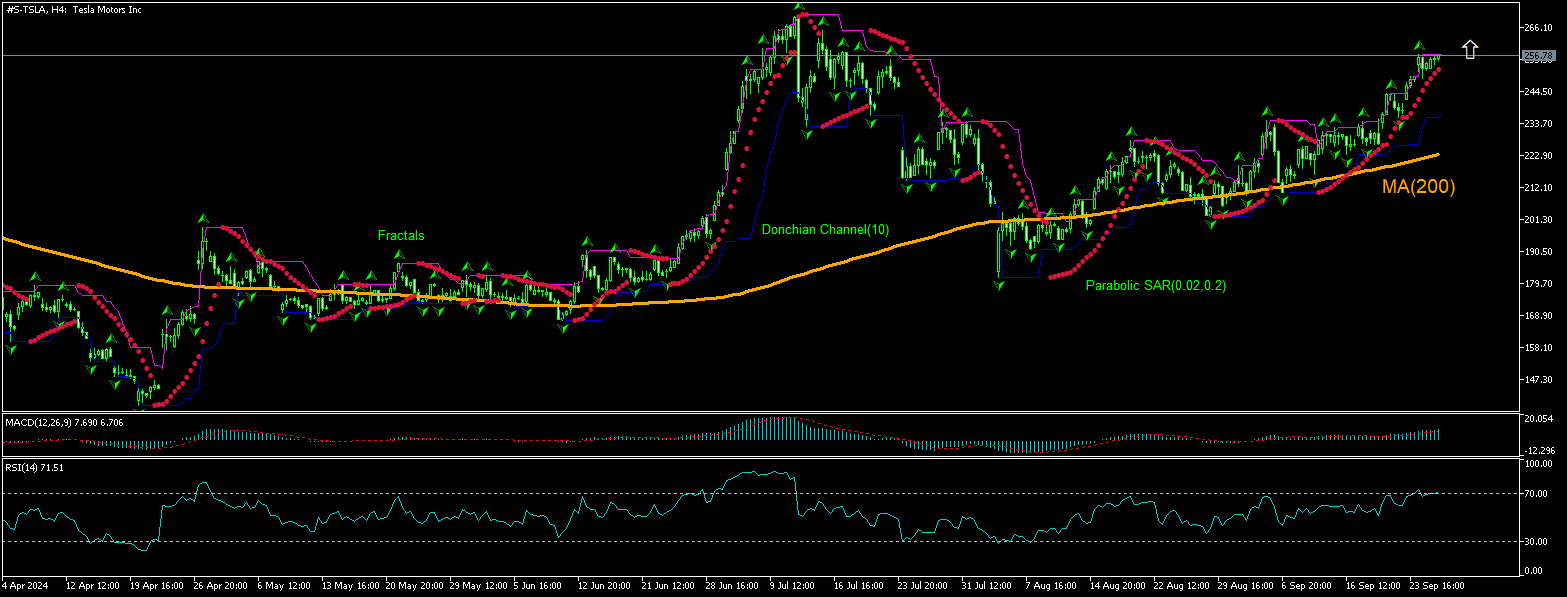

Tesla Motors Inc. Technische Analyse - Tesla Motors Inc. Handel: 2024-09-26

Tesla Motors Inc. Technical Analysis Summary

Above 256.91

Buy Stop

Below 237.24

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Tesla Motors Inc. Chart Analysis

Tesla Motors Inc. Technische Analyse

The technical analysis of the Tesla stock price chart on 4-hour timeframe shows #S-TSLA: H4 hit nine-week high above the 200-period moving average MA(200) yesterday after rebounding from three-months low it hit seven week ago. The RSI has entered into in the overbought zone. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 256.91. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 237.24. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (237.24) without reaching the order (256.91), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Aktien - Tesla Motors Inc.

Tesla stock closed higher despite filings showing Chief Financial Officer sold company stock worth over $2 million. Will the Tesla stock price continue rebounding?

Tesla SEC filings revealed that CFO Vaibhav Taneja executed transactions on September 23 that resulted in the sale of Tesla shares totaling over $2 million. The stock however closed over 1% higher over day after the news. Sales of substantial holdings of company stock by top executives are bearish for company stock price as stock transactions by company insiders are closely watched to help gauge company insider confidence in enterprise. At the same time, investment banks have maintained lately high Tesla ratings as they project high third-quarter deliveries. Thus, Piper Sandler has revised Tesla's price target from $300 to $310, citing an upward revision in vehicle delivery estimates for the third quarter and full year 2024. The firm predicts Tesla will reach nearly 459,000 deliveries in the third quarter, marking a quarter-over-quarter increase of 3.3% and a year-over-year growth of 5.4%. And Baird and RBC Capital have maintained their Outperform ratings on Tesla, projecting third-quarter deliveries at approximately 480,000 and 460,000 units, respectively.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.