- Analytik

- Technische Analyse

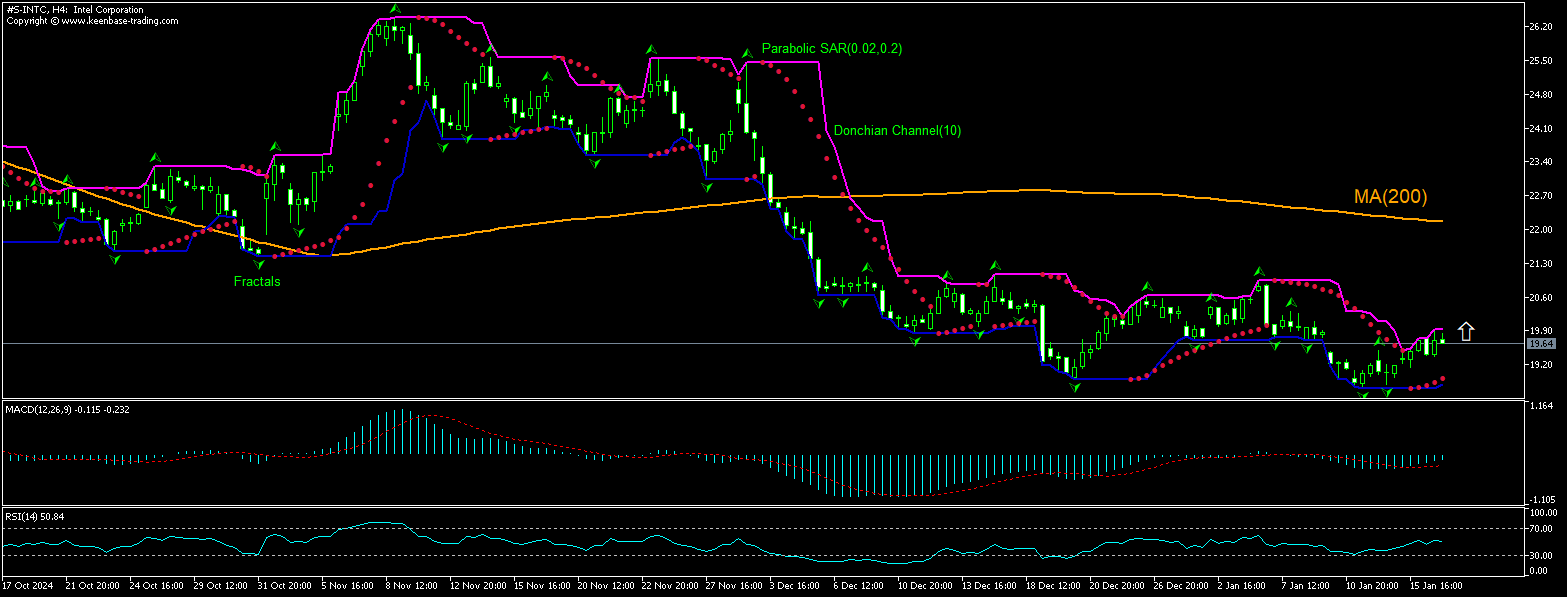

Intel Technische Analyse - Intel Handel: 2025-01-17

Intel Technical Analysis Summary

Above 19.92

Buy Stop

Below 18.91

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Sell |

| Fractals | Buy |

| Parabolic SAR | Buy |

Intel Chart Analysis

Intel Technische Analyse

The technical analysis of the Intel stock price chart on 4-hour timeframe shows #S-INTC,H4 is rebounding toward the 200-period moving average MA(200) after retreating to 4-month low four days ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 19.92. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 18.91. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (18.91) without reaching the order (19.92), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Aktien - Intel

Intel announced plans to turn its venture capital arm into a separate fund with a new name. Will the Intel stock price continue rebounding?

Intel Corporation announced plans two days go for separating Intel Capital, its global venture capital arm, into a standalone investment fund. The chip making giant, which will remain an anchor investor, said the standalone operations are expected to begin in the second half of 2025 and will have a new name. While Intel cited the “access to new sources of capital” for the fund as motivation for the decision, analysts point out that the move is an integral part of the company’s plan to prioritize investments in core chipmaking business by suspending its stock dividend, simplifying its portfolio and reducing capital and other costs. Intel plans to achieve $10 billion in cost savings by 2025 by reducing 15% of its workforce and implementing other cost-cutting measures such as the spin-off of Intel Capital. Expectations of improved long-term competitiveness via increased efficiency across the business are bullish for a company stock price. Intel stock ended virtually unchanged over the day after the news.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.