- Analytik

- Technische Analyse

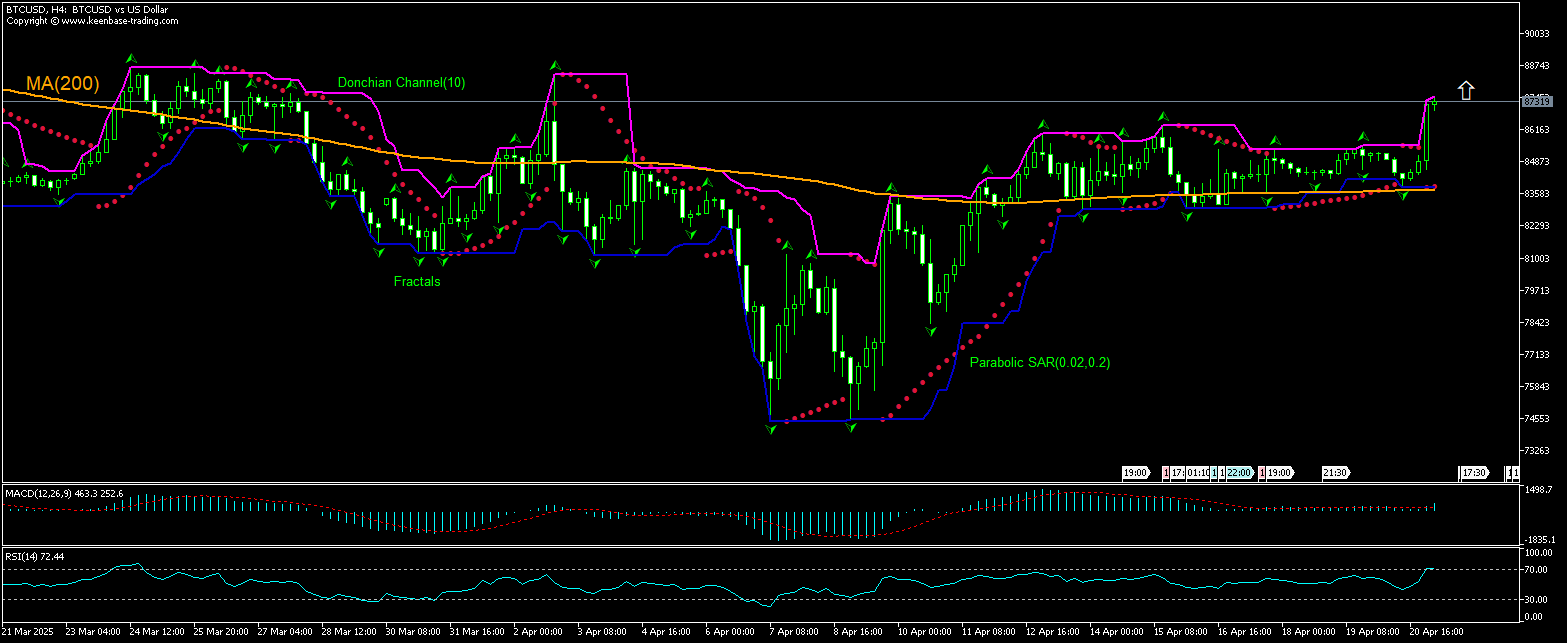

Bitcoin/USD Technische Analyse - Bitcoin/USD Handel: 2025-04-21

Bitcoin/USD Technical Analysis Summary

Above 87622

Buy Stop

Below 84047

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

Bitcoin/USD Chart Analysis

Bitcoin/USD Technische Analyse

The BTCUSD technical analysis of the price chart on 4-hour timeframe shows BTCUSD, H4 is rebounding after testing the 200-period moving average MA(200) yesterday. We believe the bullish momentum will continue after the price breaches above the upper bound of Donchian channel at 87622.0. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 84047.0. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Cryptovaluta - Bitcoin/USD

BTCUSD surged after news Metaplanet acquired an additional 330 Bitcoin. Will the BTCUSD price rebound continue?

Metaplanet reported it has acquired an additional 330 Bitcoin, spending approximately $28.2 million to expand its crypto reserves. The Japanese investment firm has cited an average price of around $85,561 per coin. The company has become one of the most aggressive corporate accumulators of the asset in Asia as it has more than doubled its Bitcoin position, increasing its total holdings to 4,855 Bitcoin. The Tokyo-based Bitcoin-stacking company has appointed Eric Trump, the second son of president Donald Trump, its first member of a Strategic Board of Advisors. The strategy of Metaplanet mirrors that of MicroStrategy in the US, aiming to convert fiat currencies into digital assets the company views as a long-term store of value. In early March Trump, a longtime crypto advocate, warned Wall Street that failure to adapt to the rapid growth of digital assets could make legacy institutions irrelevant. Continued purchases of Bitcoin by financial institutions is bullish for BTCUSD price.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.