- Analytik

- Grundstimmung des Marktes

Weekly Top Gainers/Losers: American dollar and South African rand

Top Gainers – The World Market

Top Gainers – The World Market

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened on the back of continued growth in US Treasury bond notes.

1.Tullow Oil PLC, 19,3% – a British oil and gas company

2. Alcoa Corp., 23,9% – an American aluminum producer

Top Losers – The World Market

Top Losers – The World Market

1. Orica Ltd. – an explosives manufacturer in Australia

2. Centerra Gold Inc – a Canadian gold mining company.

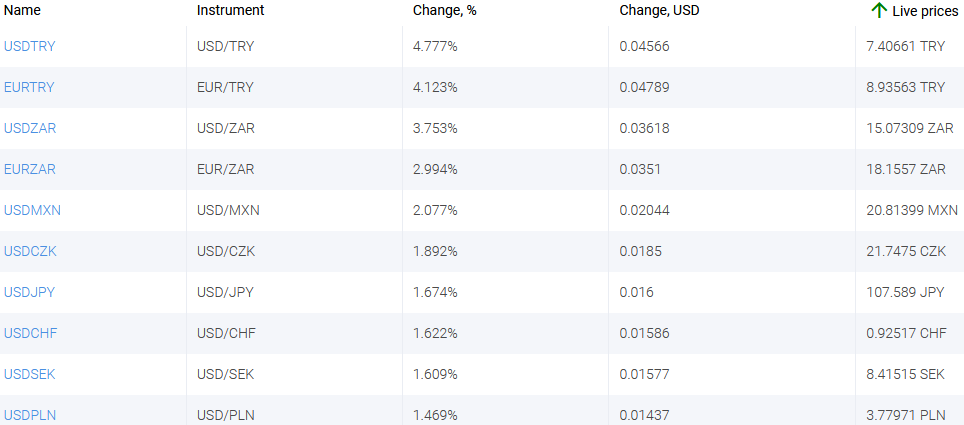

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. USDTRY, EURTRY - the growth of these charts means the strengthening of the US dollar and the euro against the Turkish lira.

2. USDZAR, EURZAR - the growth of these charts means the weakening of the South African rand against the US dollar and the euro.

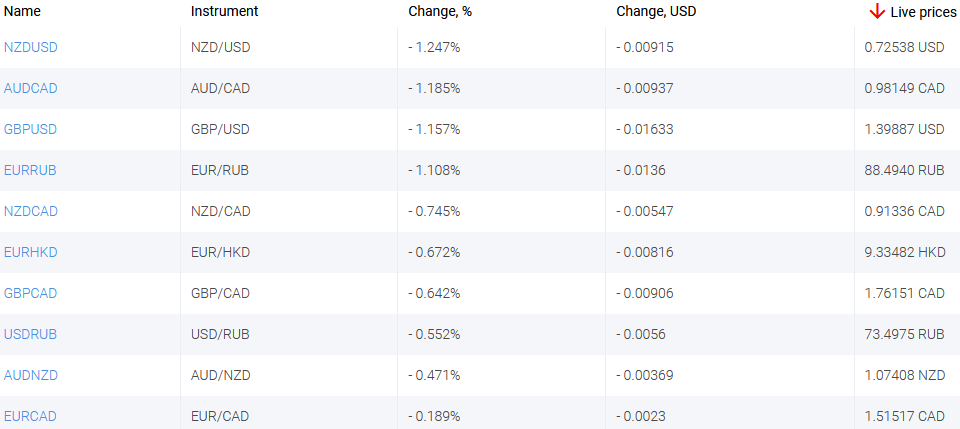

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. NZDUSD, AUDCAD - the decline in these charts means the weakening of the New Zealand and Australian dollars against the US and Canadian dollars.

2. GBPUSD, EURRUB - the drop in these charts means the weakening of the British pound against the US dollar and the euro against the Russian ruble.

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.

Letzte Stimmungen

- 18Mär2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10Mär2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 25Feb2021Weekly Top Gainers/Losers: New Zealand dollar and Swiss franc

Prices for various goods and raw materials continued to climb over the past 7 days. This led to the strengthening of the commodity currencies: Australia and New Zealand. The yield on US 10-year bonds has been actively growing since early 2021. Within this period it increased from 0.9% to 1.49% per annum,...