- Analýza

- Technická analýza

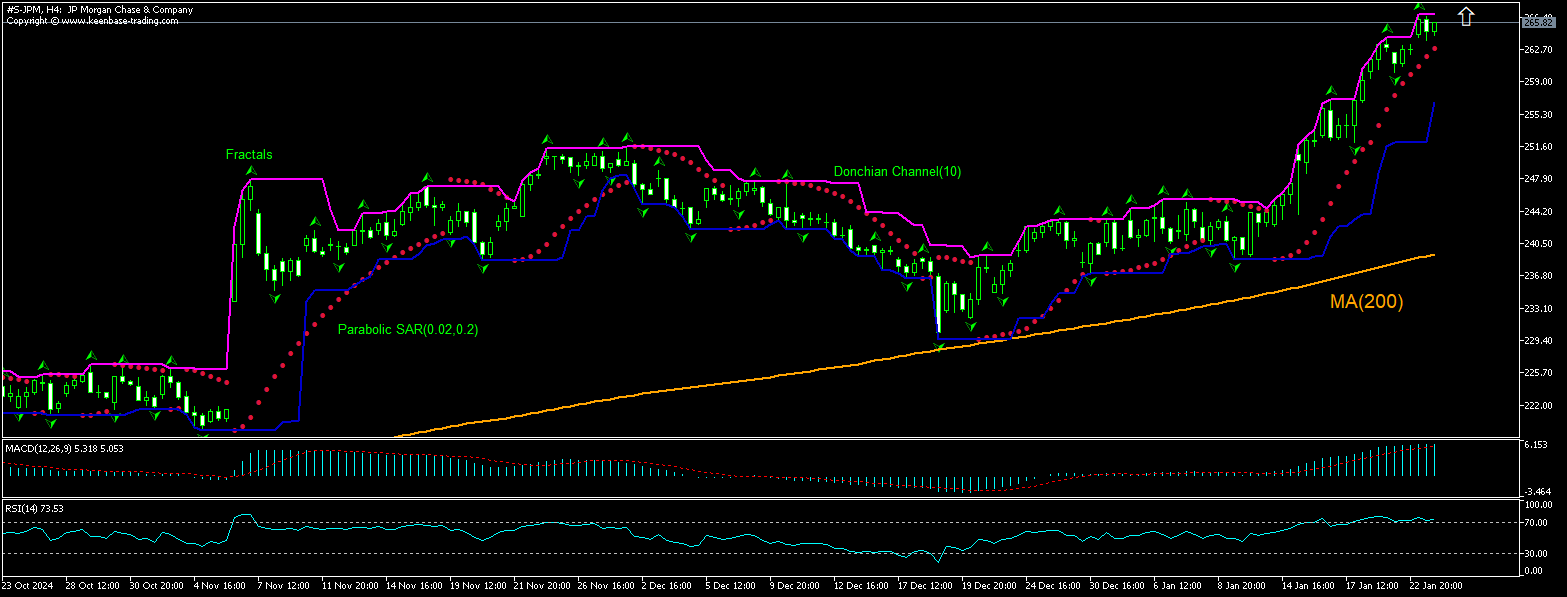

JP Morgan Technická analýza - JP Morgan Obchodování: 2025-01-24

JP Morgan Technical Analysis Summary

výše 266.71

Buy Stop

níže 260.12

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

JP Morgan Chart Analysis

JP Morgan Technická analýza

The technical analysis of the JPMorgan stock price chart on 4-hour timeframe shows #S-JPM,H4 is rebounding above the 200-day moving average MA(200) after testing it five weeks ago. RSI is in overbought zone though. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 266.71. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 260.12. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (260.12) without reaching the order (266.71), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentální analýza Akcie - JP Morgan

JPMorgan stock price closed up despite president Trump airing conservative complaints that JP Morgan, Bank of America deny services. Will the JPMorgan stock price continue advancing?

In an address at the World Economic Forum in Davos, Switzerland, via a video link President Donald Trump accused the Bank of America and JPMorgan Chase of not providing banking services to conservatives. There had been earlier complaints by many conservatives aired by congressional Republicans that “the banks are not allowing them to do business within the bank.” Bank of America spokesperson emailed that “we never close accounts for political reasons and don't have a political litmus test." JPMorgan said it has never and would never close an account for political reasons. The spokesperson of biggest US lender wrote "we welcome the opportunity to work with the new Administration and Congress on ways to remove regulatory ambiguity while maintaining our country's ability to address financial crime." Banking industry insiders expect that the criticism could lead to some changes. Expectations of regulation changes that may enable banks to provide more services to more customers is bullish for bank stocks.

Poznámka:

Tento přehled má informativně poznávací charakter a publikuje se zdarma. Všechny údaje, uvedené v přehledu, jsou získány z otevřených zdrojů, jsou uznávány více méně spolehlivé. Přitom, neexistují žádné garance, že uvedená informace je úplná a přesná. Přehledy se v budoucnu neobnovují. Veškerá informace v každém přehledu, včetně názorů, ukazatelů, grafů, je pouze poskytována a není finančním poradenstvím nebo doporučením. Celý text nebo jeho jakákoliv část a také grafy nelze považovat za nabídku provádět nějaké transakce s jakýmikoliv aktivy. Společnost IFC Markets a její zaměstnanci za žádných okolností nemají žádnou odpovědnost za jakékoli kroky učiněné kýmkoliv po nebo v průběhu seznámení s přehledem.