- Analisi

- Analisi Tecnica

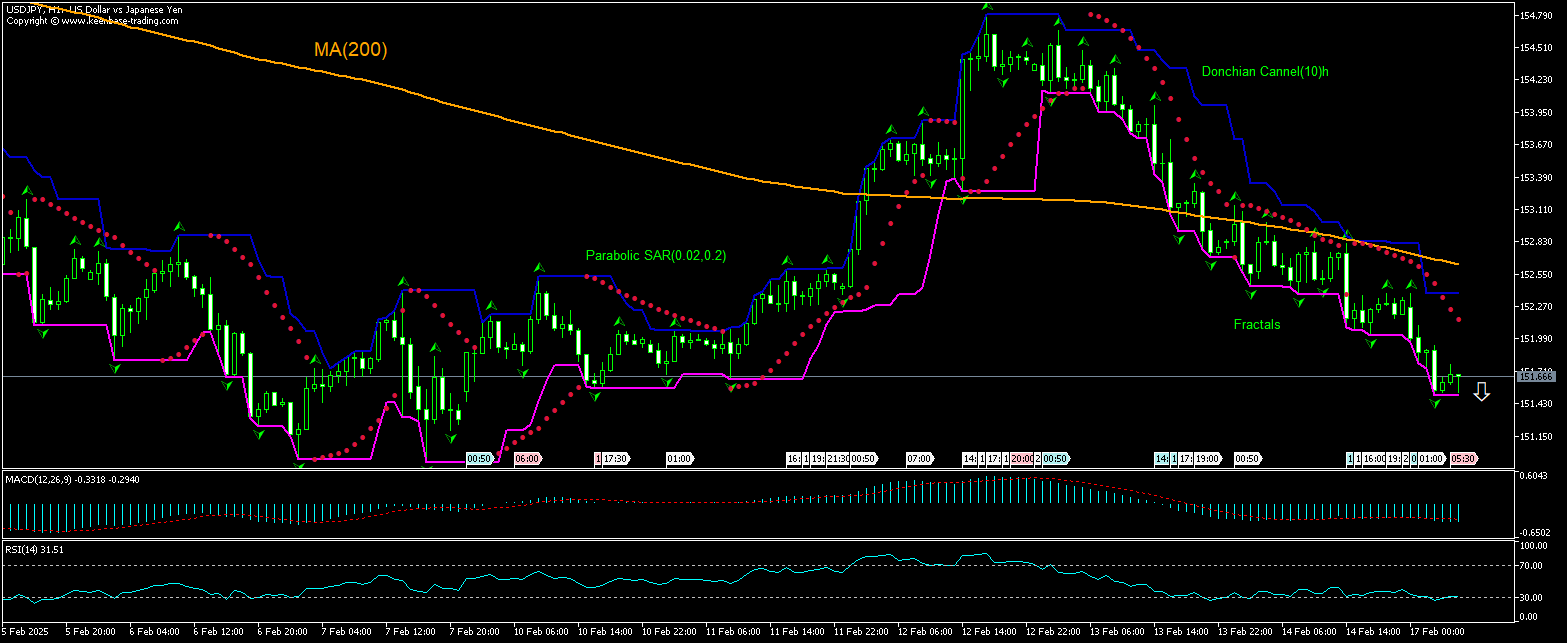

USD JPY Analisi Tecnica - USD JPY Trading: 2025-02-17

Dollaro Yen Technical Analysis Summary

Sotto 151.467

Sell Stop

Sopra 152.062

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Neutro |

| Donchian Channel | Neutro |

| Fractals | Sell |

| Parabolic SAR | Sell |

| MA(200) | Sell |

Dollaro Yen Chart Analysis

Dollaro Yen Analisi Tecnica

The technical analysis of the USDJPY price chart on 1-hour timeframe shows USDJPY, H1 is retreating under the 200-period moving average MA(200) after breaching below it in the last session. RSI indicator is at the lower bound of the neutral band. We believe the bearish movement will continue after the price breaches below the lower bound of the Donchian channel at 151.467. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 152.062. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Forex - Dollaro Yen

Japan’s economy grew more than expected in the fourth quarter. Will the USDJPY price retreating continue?

Japan’s economy grew more than expected in the fourth quarter: the Cabinet Office reported the Q4 gross domestic product (GDP) grew 0.7% over quarter following 0.3% increase in Q3 when steady growth was forecast. On an annualized basis, Japan’s GDP grew 2.8% in Q4, in line with expectations and up from 1.7% growth in Q3. There were a few positive developments that drove GDP’s growth: government spending quickened, up for the fourth straight quarter, and net trade made a positive contribution for the first time in five quarters - exports continued to increase even as US President Donald Trump’s tariff risks fuel concerns about the shipment outlook, while imports declined after two consecutive periods of growth. And while consumption’s growth slowed significantly amid elevated costs and higher interest rates, it still rose for the third quarter in a row. Rising GDP is positive for Japanese yen and bearish for USDJPY currency pair.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.