- Analisi

- Analisi Tecnica

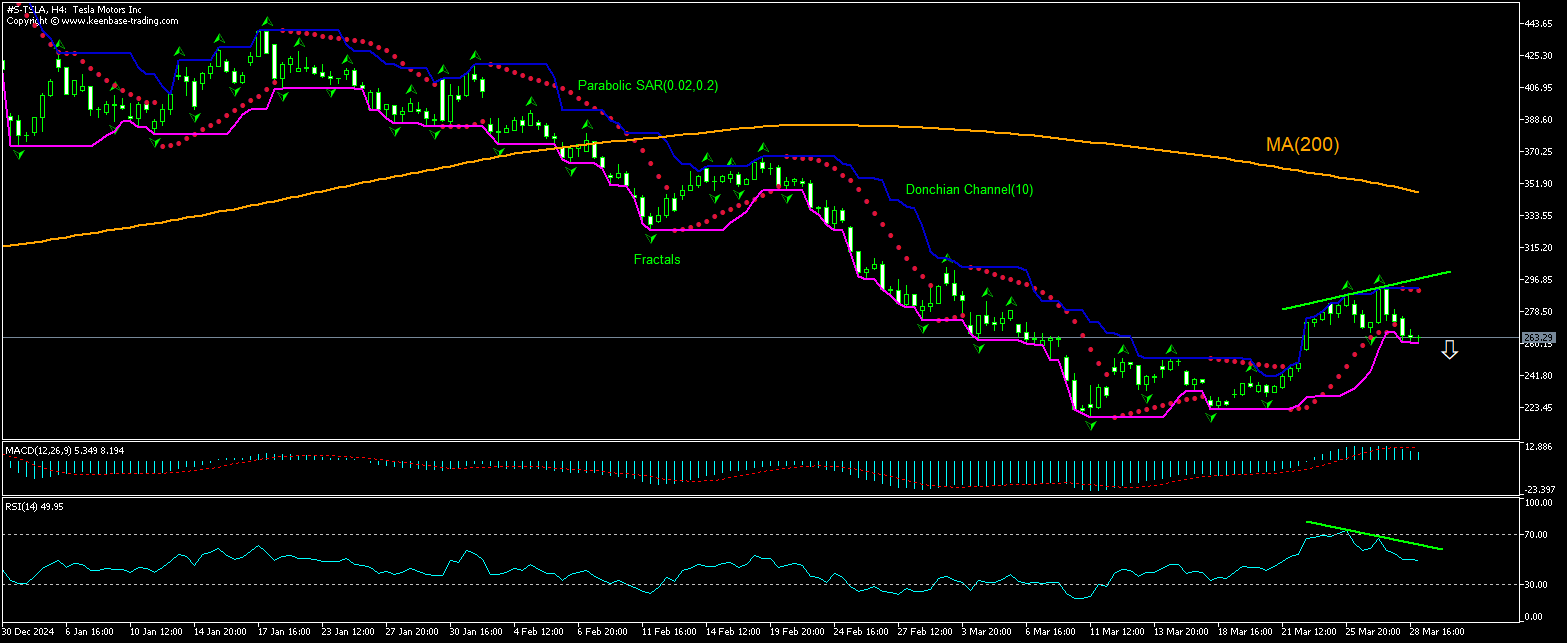

Tesla Motors Inc. Analisi Tecnica - Tesla Motors Inc. Trading: 2025-03-31

Tesla Technical Analysis Summary

Sotto 267.30

Sell Stop

Sopra 290.36

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Neutro |

| Parabolic SAR | Sell |

Tesla Chart Analysis

Tesla Analisi Tecnica

The technical analysis of the Tesla stock price chart on 4-hour timeframe shows #S-TSLA,H4 is retracing under the 200-day moving average MA(200) after rebounding to over 3-week high four days ago. The RSI indicator has formed a bearish divergence pattern. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 267.30. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 290.36. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (290.36) without reaching the order (267.30), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Azioni - Tesla

Tesla stock price is retreating after declining European sales report. Will the Tesla stock price reverse its retreating?

Tesla shares fell almost 6% on Wednesday as data from Europe showed slowing sales last month. The European Automobile Manufacturers’ Association (ACEA) data revealed that Tesla recorded a 40% over year drop in new vehicle registrations in Europe in February, while overall battery electric vehicle sales were up 26%. And the White House said on Wednesday that President Trump would announce new tariffs on auto imports. The next day General Motor plunged over 7% and Ford fell nearly 4% while Tela closed higher. Analysts note that tariffs on auto imports will likely not impact Tesla as much as other carmakers since Tesla's US-sold vehicles are made exclusively at the company's Fremont, California location or at Giga Austin in Texas. The company operates gigafactories in China and Germany but none of the EVs built there are sold in the US. Tesla had warned the previous week that tariffs could lead to retaliation from US export partners and higher prices for parts that can only be sourced internationally. Tariffs on US auto imports yield in higher car prices in US which will likely lead to lower car sales hence have bearish impact on automakers’ stock prices. At the same time, analysts note that Tesla may not be as much susceptible to negative impact from car import tariffs in the long run as others since the car maker is expected to benefit from easing of regulation on deploying robotaxis and self-driving technology at scale.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.