- Analisi

- Analisi Tecnica

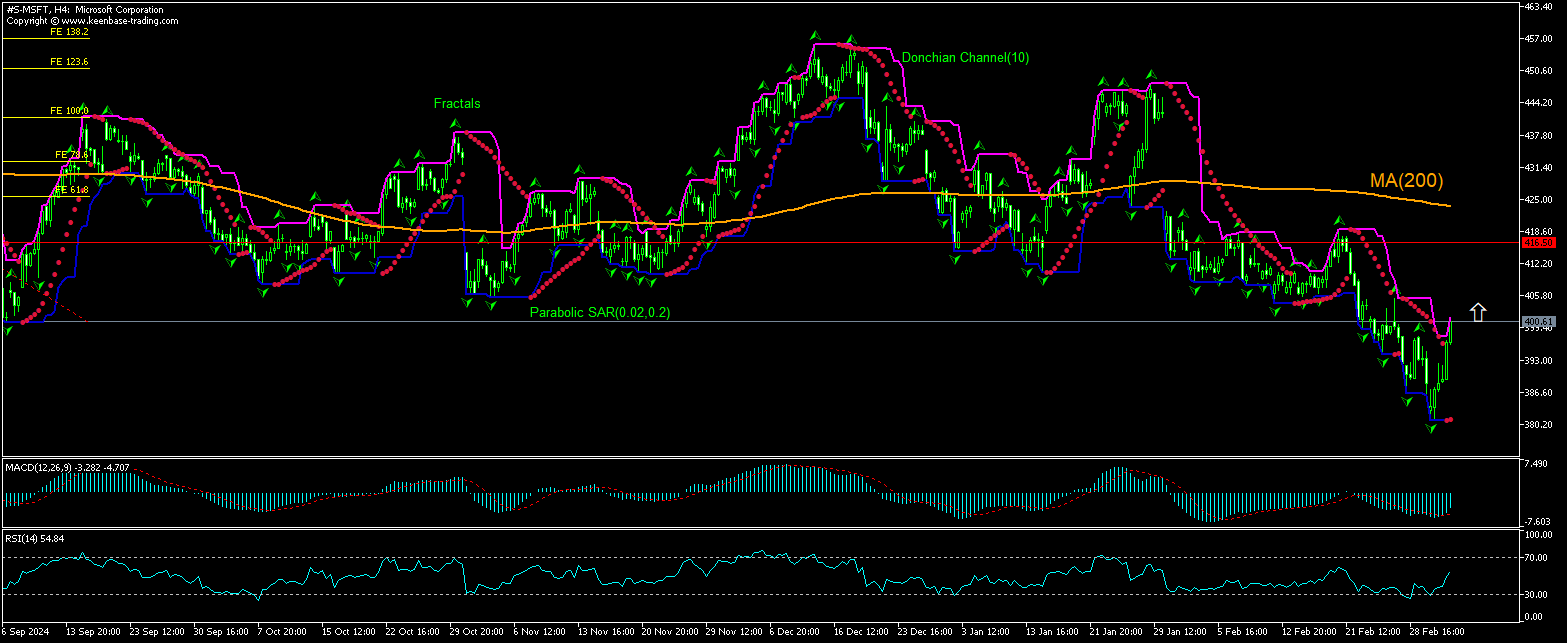

Microsoft Analisi Tecnica - Microsoft Trading: 2025-03-06

Microsoft Technical Analysis Summary

Sopra 401.4

Buy Stop

Sotto 386.3

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Sell |

| Fractals | Neutro |

| Parabolic SAR | Buy |

Microsoft Chart Analysis

Microsoft Analisi Tecnica

The technical analysis of the Microsoft stock price chart on 4-hour timeframe shows #S-MSFT,H4 is rebounding toward the 200-day moving average MA(200) after hitting 14-month low two days ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 401.4. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the fractal low at 386.3. After placing the order, the stop loss is to be moved every day to the next fractal low indicator , following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (386.3) without reaching the order (401.4), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Azioni - Microsoft

Microsoft stock rose after the software giant announced it withdraws some of its commitments to data center operator CoreWeave. Will the Microsoft stock price rebounding continue?

Microsoft revoked some of its agreements with Coreweave to provide cloud computing capacity due to delivery issues and missed deadlines, according to reports. Coerweave had earlier this week filed for an IPO and NYSE listing, aiming to raise $4 billion and valuing the firm at $35 billion in April. CoreWeave had seen strong demand from Microsoft as the tech giant had ramped up its artificial intelligence offerings over the past two years. The walking back of Microsoft’s commitments to CoreWeave comes after recent reports that the software giant was revising downward its demand projections for data centers and cloud computing services, which resulted in canceling of several data center leases in the US. Indications of lower expected Microsoft demand for data centers and cloud computing services are bearish for Microsoft stock price. However, the current setup is bullish for the stock.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.