- Analisi

- Analisi Tecnica

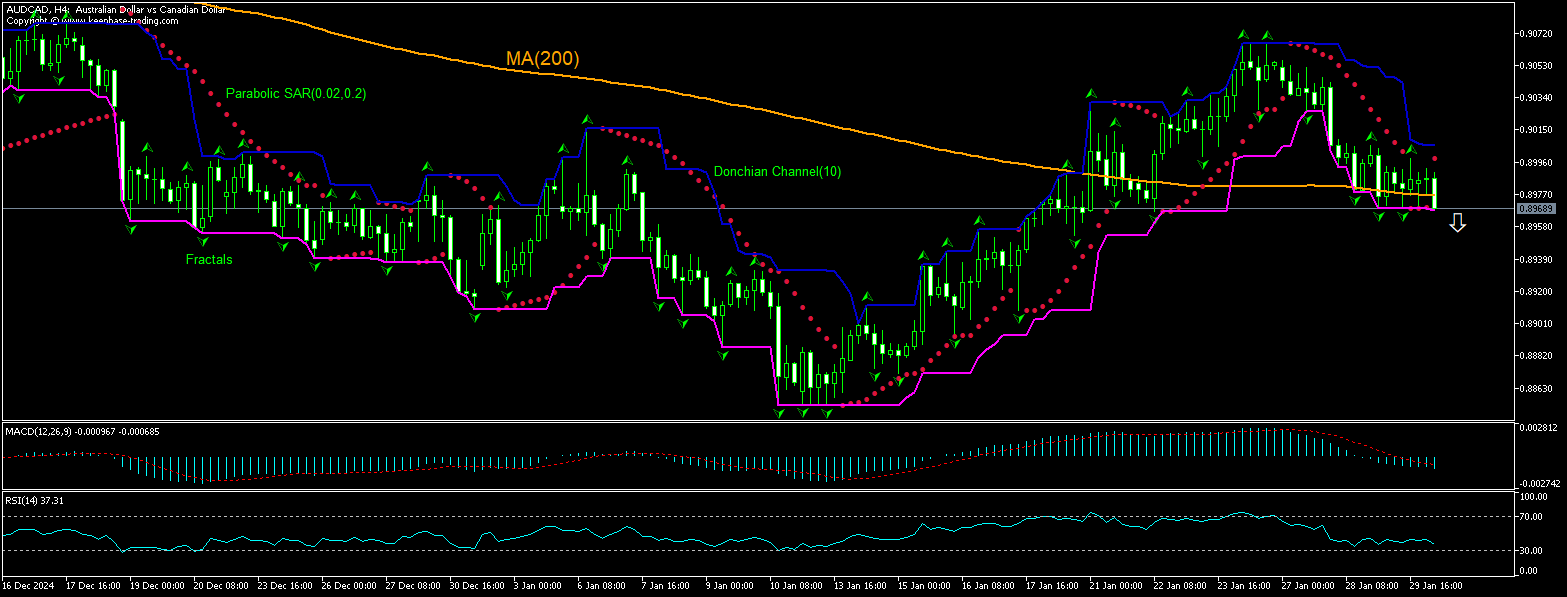

AUD/CAD Analisi Tecnica - AUD/CAD Trading: 2025-01-30

AUD/CAD Technical Analysis Summary

Sotto 0.89655

Sell Stop

Sopra 0.90058

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Sell |

| Parabolic SAR | Sell |

AUD/CAD Chart Analysis

AUD/CAD Analisi Tecnica

The technical analysis of the AUDCAD price chart on 4-hour timeframe shows AUDCAD,H4 has breached below the 200-period moving average MA(200) which is declining itself. We believe the bearish momentum will continue after the price breaches below the lower bound of the Donchian channel at 0.89655. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 0.90058. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Forex - AUD/CAD

Bank of Canada cut interest rates 25 basis points yesterday. Will the AUDCAD price retreating continue?

Bank of Canada cut interest rates 25 basis points to 3% yesterday. It was the sixth consecutive cut for a total reduction of 200 basis points. The easing was largely expected as Canada faces political and economic uncertainties in the form of provincial and federal elections and US President Donald Trump’s tariff threats. Interest rate cut by Canada’s central bank is bearish for the Canadian dollar and bullish for the AUDCAD dollar. And today the Australian Bureau of Statistics reported that the import prices index grew in the Q4 2024 0.2% over quarter after 1.4% growth in Q3 when 1.5% growth was expected. Lower than expected import prices inflation is bearish for a currency as it signals lower consequent inflation for businesses and consumers who rely heavily on imported goods. Therefore the slower growth of Australis’s import prices index is bearish for Australian dollar and bullish for AUDCAD pair. However, the current setup is bearish for AUDCAD.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.