- Education

- Canadian Stocks List

- Barrick Gold Corp Stock Price & Overview

Barrick Gold Corp Stock Price & Overview

Gold has long held allure for investors seeking stability and potential for growth. And Barrick Gold Corp, one of the world's largest gold mining companies, stands as a prominent player in this arena.

But with a recent dip in share price and a complex market outlook, is Barrick a golden opportunity or a potential pitfall? Let's delve into the key takeaways and investment considerations surrounding Barrick Gold Corp shares.

KEY TAKEAWAYS

- Barrick has high-quality mines, potentially leading to improved efficiency and profitability. Their leading position in African gold production offers further expansion opportunities.

- The company aims to increase gold production, potentially boosting revenue.

- Despite a year-on-year decline, the share price has risen from its 52-week low. However, technical indicators suggest a potential downtrend, with some signs of a possible reversal.

About Barrick Gold Corp Share

Barrick Gold Corp is a big mining company from Canada that digs for gold and copper all over the world. They're actually the second-biggest gold getter out there, with mines in 13 countries and over 20,000 people working for them. Their mines are located in places like Nevada, Australia, and Africa.

Lately, Barrick has been making news for being more environmentally friendly at their biggest gold mine in Africa, and they're also continuing to invest in new projects like the Lumwana Super Pit in Zambia, which is set to start producing gold in 2028.

They're also working on keeping their existing mines in Tanzania going strong and even growing their output. On top of that, they built a new airport terminal in Tanzania to help their Buzwagi gold mine run smoothly.

Last but not least, Barrick Gold Corp reported producing more gold than expected in the last quarter of 2023.

Follow the link to explore ABX stock price history.

Barrick Gold Corp Share Current Situation

Barrick Gold's stock price hasn't grown as fast as the price of gold itself, likely due to increased costs and decreased gold production.

What you need to know about Barrick Gold Corp:

- High-quality mines: The company owns some of the world's best gold mines, which could improve efficiency and profitability.

- Leading African producer: Barrick holds the top spot for gold production in Africa, offering potential for expansion in a resource-rich continent.

- Production growth plans: The company aims to increase its gold production, potentially boosting revenue.

- Strong financial position: With no net debt, Barrick has a healthy balance sheet, providing financial flexibility.

- Attractive valuation: The stock trades at around 16 times next year's projected earnings, which could be considered a reasonable valuation compared to similar companies.

- Decent dividend: The stock offers a dividend yield of over 2.31%, providing investors with passive income.

While Barrick Gold boasts strengths and growth plans, its current stock quote reflects a cautious market, hovering around $15.55 on NYSE. Barrick Gold is in a position to improve its stock performance in the coming year.

The company has several strengths, including high-quality assets, production growth plans, and a strong financial position. However, there are always risks involved.

Barrick Gold Corp Share Price

Barrick Gold Corp shares are traded on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the symbol "GOLD" and "ABX", respectively.

Current Share Price on NYSE is $15.55 and on TSX is $20.58 as of February 2, 2024. If you want to start trading you can download MetaTrader 5 trading platform.

Barrick stock quote has declined by about 10% in the past year, however, it is up about 8% from its 52-week low of $14.39. The stock is currently trading below its 50-day and 200-day moving averages.

The majority of analysts have a "hold" rating on the stock, with an average price target of $18.00 (24.08 CAD), which represents a potential upside of 16%.

Here are some of the factors that could affect Barrick Gold's share price in the future:

- Gold is a precious metal that is often seen as a safe haven asset during times of economic uncertainty. If the price of gold goes up, it is likely that Barrick Gold's share price will also go up.

- Barrick Gold's production costs are a major factor in its profitability. If the company's costs go up, it could put downward pressure on its share price.

- Barrick Gold is constantly exploring for new gold deposits and developing new mines. If the company is successful in these endeavors, it could boost its share price.

- The overall health of the global economy can also affect Barrick Gold's share price. If the economy is doing well, it is more likely that people will have money to invest in gold, which could boost Barrick Gold's share price.

Barrick Gold Corp Share Trading

Where does Barrick Gold Corp stand technically?

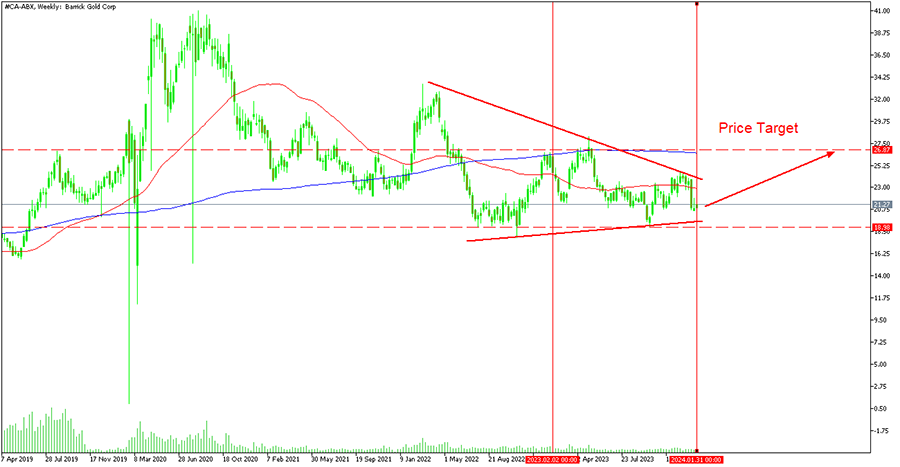

By analyzing key indicators such as moving averages, oscillators and momentum, we can paint a clearer picture and help you make investment decisions. Let's take a look at the technical analysis of ABX and find out both the sell signals indicating a potential downtrend and the positive signals indicating a possible reversal.

Form Barrick Gold Corp technical analysis chart above we can make a few important conclusions, let’s check it out:

Sell Signals

- Moving Averages: The 50 and 200-day simple moving averages (MAs) are all bothe above the current stock price, suggesting a downtrend. This is a classic sell signal.

- Price Rate of Change (ROC): A negative ROC indicates that the price momentum is downwards, supporting the sell signal from the moving averages.

Neutral Signals

- Relative Strength Index (RSI): An RSI rose from 30 indicates that the stock isn’t any more in an oversold area, but still could be a contrarian buy signal, as it stuck around it. However, in this case, the other indicators suggest a downtrend, so the neutral RSI reading might not be enough to trigger a buy.

Buy Signals

- Moving Average Convergence Divergence (MACD): A negative MACD value suggests a downtrend, but the fact that it's not very negative (-0.46) could indicate weakening selling pressure. This could be a sign of a potential reversal, but needs confirmation from other indicators.

- Trend Strength Indicator (ADX): A high ADX value indicates a strong trend, but it doesn't tell you the direction of the trend. In this case, the strong ADX combined with the negative MACD suggests a strong downtrend.

You should also consider fundamental factors such as the company's financial health, industry trends, and overall market conditions before making any investment decisions.

If you have already come to a certain conclusion about how you want to trade Barrick Gold Corp shares, you will need to know the Canadian stock market hours.

Bottom Line on Barrick Gold Corp Share

Barrick Gold Corp is a major gold miner with high-quality mines and ambitious growth plans. However, the company's share price has declined recently due to increased costs and decreased production.

While Barrick has the potential for future growth, there are also risks to consider, such as a potential downtrend in the stock price. Investors should carefully weigh the pros and cons before making any investment decisions.