- Analytics

- Trading News

- 2025 Amazon Categories to Watch: Key Insights for Consumer Stock Traders

2025 Amazon Categories to Watch: Key Insights for Consumer Stock Traders

Amazon is a real-time indicator of consumer behavior, pricing power, and economic trends. If you want to track inflation, earnings, or market shifts, Amazon’s top-selling categories provide early signals, often before data or reports are released.

In 2025, five categories are standing out.

Beauty & Personal Care: Small, High-Margin Products

Beauty products are strong due to repeat purchases, brand loyalty, and low shipping costs. The category is resistant to inflation because people continue to buy despite price hikes, especially in premium segments.

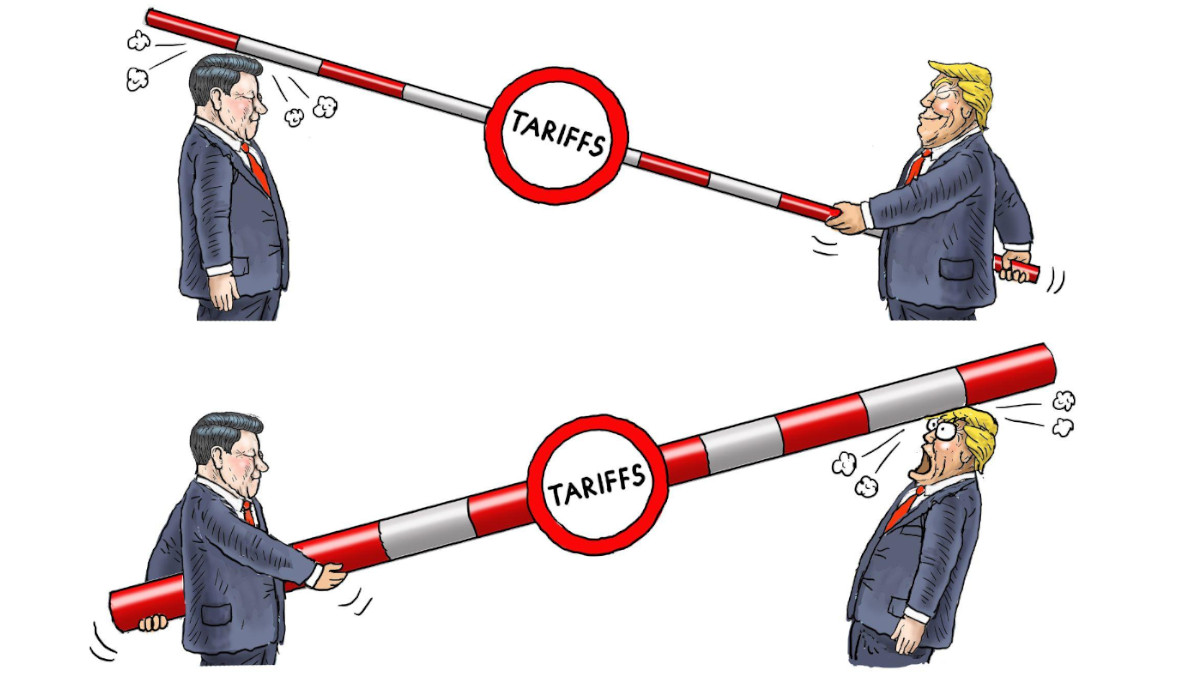

However, tariffs reinstated in April on Chinese-made cosmetic packaging components could increase costs for brands sourcing from China.

Beauty remains resilient in inflationary environments, especially in premium segments. Watch Estée Lauder, Ulta Beauty, and Amazon's own beauty offerings.

Health & Wellness: Preventative Spending Is Mainstream

Health products like supplements, wearables, and recovery tools are growing as part of an ongoing lifestyle shift. Subscription models for vitamins and wellness devices are gaining traction. However, new tariffs on electronic components for wearables could raise costs or slow restocks.

High-margin, repeat purchases dominate. Monitor companies like Herbalife, Newell Brands, and Apple (via wearables) for growth.

Home & Kitchen: Practical Purchases Reflect Consumer Behavior

Even in a cost-conscious environment, consumers are buying practical items like air fryers, storage solutions, and water filters. These items are seen as functional, not luxury. Tariffs on kitchen electronics could push prices higher, especially on goods sourced from China.

This category is a key economic indicator. Strong sales suggest consumer resilience, while weakness signals potential trouble in discretionary spending. Watch Whirlpool, Leggett & Platt, Lowe’s, and Amazon Basics.

Pet Products: Recession-Proof and Emotionally Driven

Pet spending remains strong during recessions because owners prioritize their pets’ needs. Premium pet food, smart tech, and subscription services are all growing. This category has low tariff sensitivity and continues to expand.

Pet products are a defensive sector with stable, recurring revenue. Keep an eye on Chewy, Freshpet, and Trupanion

Eco-Friendly Goods: Growing Fast, But Still Small

Sustainable goods are rising, especially among younger consumers. Demand for reusable products, biodegradable alternatives, and eco-friendly home goods is increasing. However, high prices and low volume limit short-term earnings.

This is a long-term growth play. Watch for potential M&A activity and brand scaling in the eco space, with companies like Planet Labs.

Final Takeaways

Amazon’s top-selling categories in 2025 show that consumers are still spending, but with more caution. Recurring models, emotional connections, and practical goods are what drive spending.

While tariffs are affecting some sectors, others like beauty and pet products are resilient. Tracking these trends gives you a real-time sense of consumer behavior, pricing power, and potential market shifts.