- Analytics

- Trading News

- Trump's Second Term and Market Rally

Trump's Second Term and Market Rally

The U.S. presidential election results have sent ripples through financial markets. Donald Trump’s return to the White House, combined with potential Republican control of Congress, has created both optimism and uncertainty. Here’s what traders need to know about the market impact and its implications.

Trump's Second Term: Policy and Market Impact

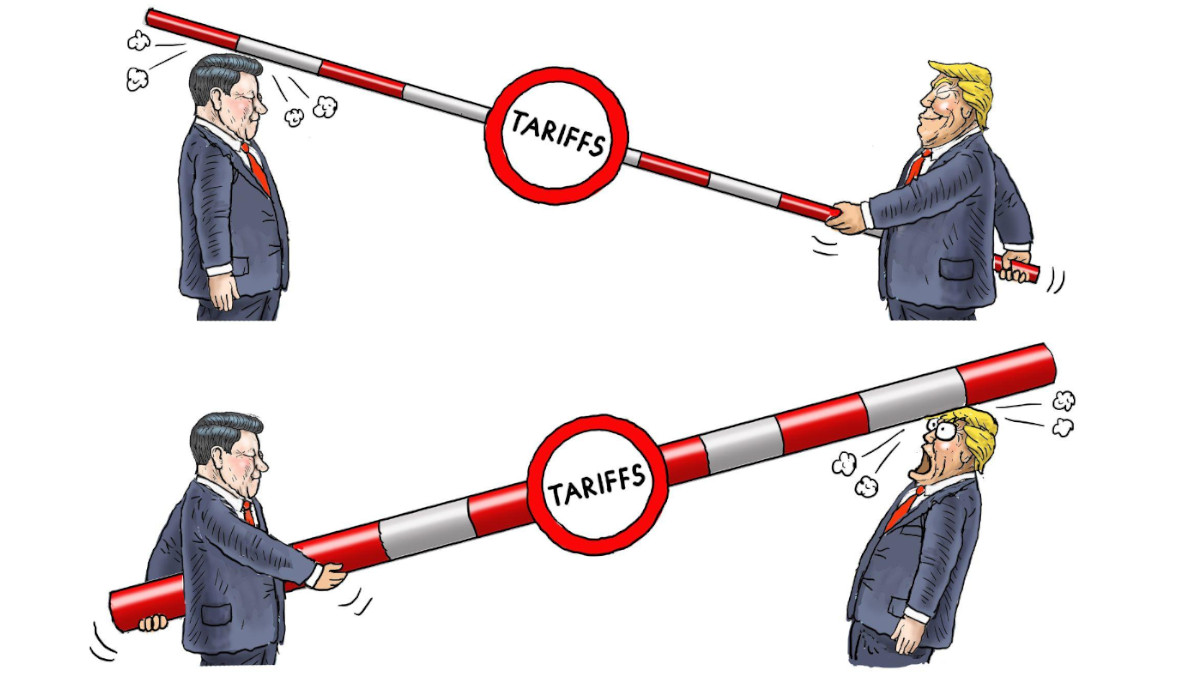

Donald Trump’s victory as the 47th president, supported by wins in key battleground states, paves the way for potential policy shifts, including tax reforms, tighter immigration measures, and protectionist trade practices. With a Republican-controlled Congress, these policies could be enacted more easily, signaling potential volatility for sectors like manufacturing and technology that are sensitive to trade and economic growth.

Stock Futures Reaction

U.S. stock futures increased following Trump’s win:

- Dow Jones futures rose 2.4% (1,012 points).

- S&P 500 futures climbed 2.0% (119 points).

- Nasdaq 100 futures increased 1.7% (341 points).

This rally reflects optimism about pro-business policies that could boost corporate profitability. Traders should watch industries that responded well to Trump's past policies, such as energy and financials.

The Return of "Trump Trades"

The election triggered notable movements in assets tied to Trump's policy prospects:

- U.S. Dollar: Recorded its largest single-day gain since March 2020, driven by expectations of increased inflation due to Trump’s spending plans and immigration policies.

- Mexican Peso: Declined due to potential trade and immigration policy changes.

- Bitcoin: Reached an all-time high of $75,060, buoyed by Trump’s support for cryptocurrency.

Traders should anticipate continued volatility as Trump's policies unfold and consider opportunities in the U.S. dollar and Bitcoin.

Slower Rate Cuts Ahead?

The Federal Reserve’s policy meeting comes at a pivotal time. While a quarter-point rate cut is expected, the outlook for further cuts in 2025 has moderated, with markets now anticipating two more reductions and stabilization at 3.75% to 4%. Trump's policies could spur growth and inflation, pushing the Fed to adopt a more gradual approach, potentially impacting long-term Treasury yields.

Oil Market Dynamics

Oil prices fell, with Brent crude down 1.8% to $74.20 per barrel and WTI crude down 1.7% to $70.75. This decline was driven by rising U.S. crude inventories and a stronger dollar, which makes oil more expensive for foreign buyers and may reduce demand.

Key Takeaways

Trump’s 2024 victory has sparked a rally in U.S. stock futures, a stronger dollar, and record-high Bitcoin, indicating market confidence in fiscal expansion. Key sectors like energy, financials, and technology could see significant impacts from policy changes. The global economic ripple effect is evident in currency and oil price movements.