- 분석

- 기술적 분석

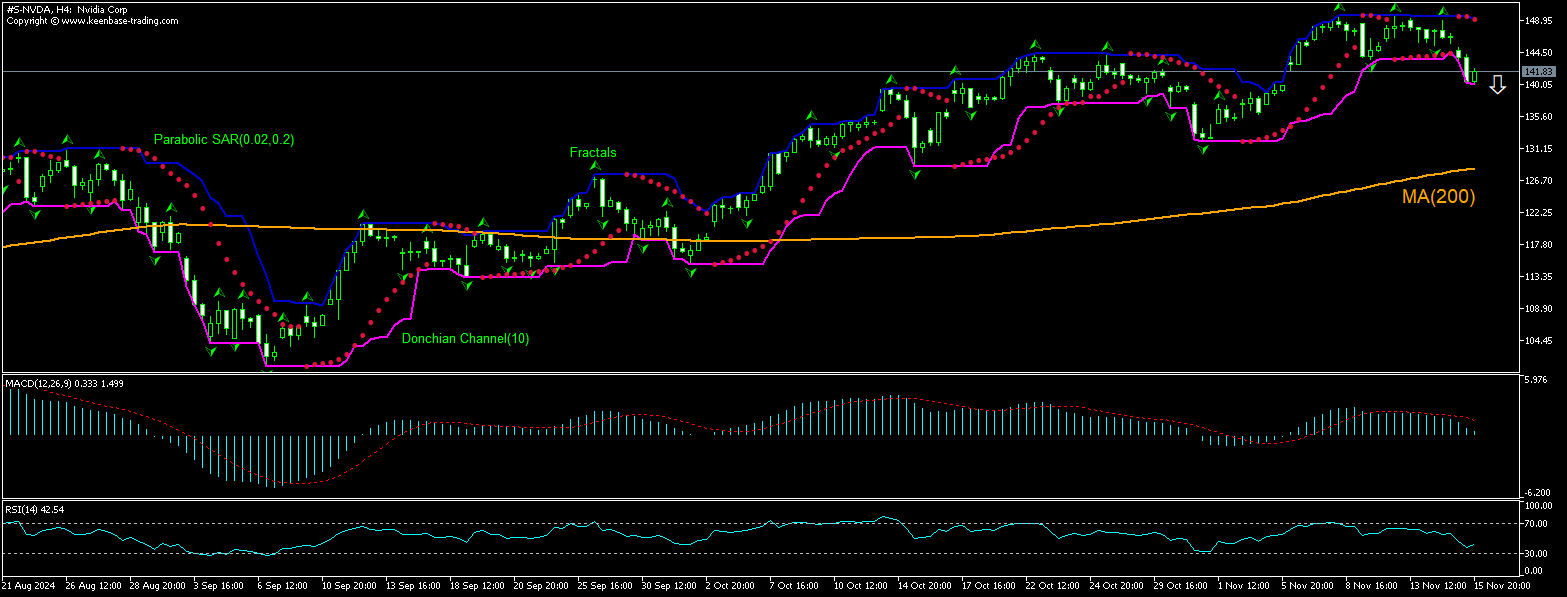

NVDA 기술적 분석 - NVDA 거래: 2024-11-18

Nvidia 기술적 분석 요약

아래에 139.99

Sell Stop

위에 149.66

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 판매 |

| Donchian Channel | 구매 |

| MA(200) | 구매 |

| Fractals | 판매 |

| Parabolic SAR | 판매 |

Nvidia 차트 분석

Nvidia 기술적 분석

The technical analysis of the Nvidia stock price chart on 4-hour timeframe shows #S-NVDA,H4 is retracing down toward the 200-period moving average MA(200) after hitting all-time high ten days ago. We believe the bearish momentum will persist after the price breaches below the lower boundary of Donchian channel at 139.99. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper boundary of Donchian channel at 149.66. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (149.66) without reaching the order (139.99), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

지수 - Nvidia 기본 분석

Nvidia's new Blackwell AI chips are overheating in servers, the Information reported on Sunday. Will the Nvidia stock price continue retracting lower?

The Blackwell graphics processing units overheat when connected together in server racks designed to hold up to 72 chips, according to reports. Some customers worry they will not have enough time to get new data centers up and running. Nvidia unveiled Blackwell chips in March after earlier announcement they would ship in the second quarter. The chip maker encountered delays potentially affecting customers such as Meta Platforms, Alphabet's Google and Microsoft. The company has asked its suppliers to change the design of the racks several times to resolve overheating problems, according to Nvidia employees. Blackwell chip takes two squares of silicon the size of the company's previous offering and binds them into a single component that is 30 times speedier at tasks like providing responses from chatbots. Delays in the launch of a new advanced product is bearish for a company stock. Nvidia is scheduled to release its quarterly earnings the day after tomorrow on Wednesday and a guidance with elevated demand for its Blackwell AI chips is an upside risk for the company’s stock price.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.