- マーケット分析

- トレーディング・ニュース

- What is happening with Teck Resources

What is happening with Teck Resources

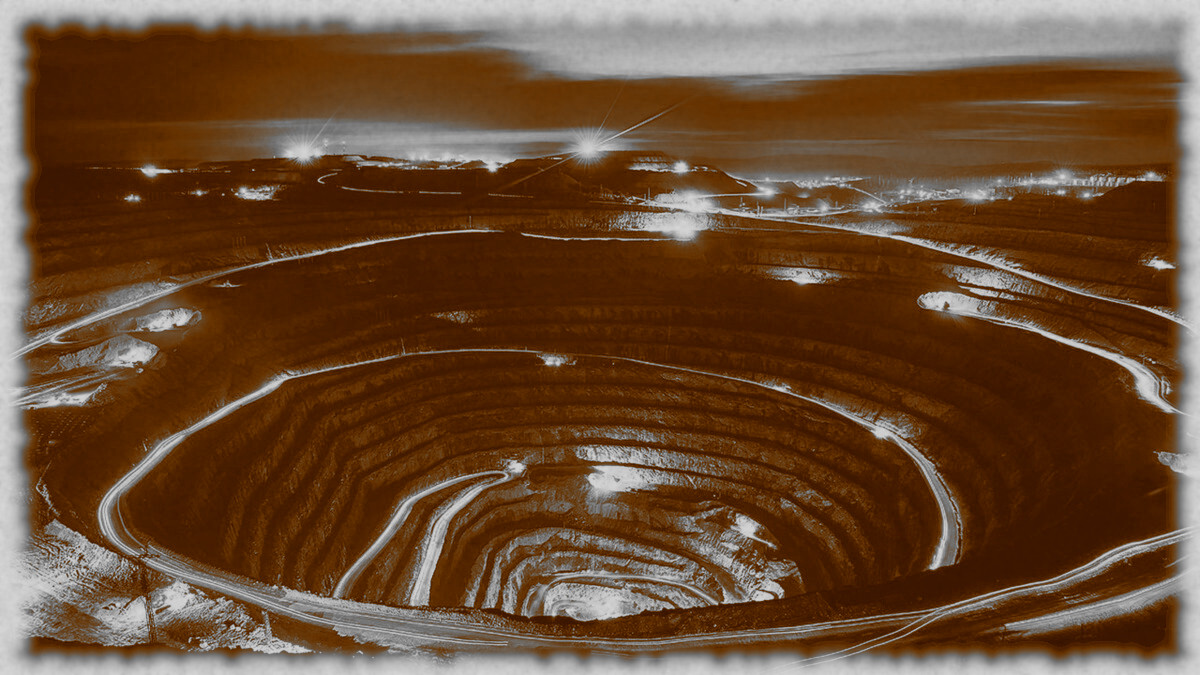

Teck Resources Ltd has recently restructured its operations to focus on becoming a pure-play energy transition metals company.

New Business Structure Overview

Teck Resources has established two regional business units:

1. North America: This unit encompasses operations such as Highland Valley Copper, Red Dog, and Trail, along with growth projects like Galore Creek and Schaft Creek.

2. Latin America: This unit includes operations like Carmen de Andacollo and Quebrada Blanca, as well as Teck's interest in Antamina, with additional growth projects such as Zafranal and San Nicolas.

This restructuring aims to streamline operations, enhance focus on copper growth, and ensure shareholder returns, supported by a new executive leadership team.

Strategic Rationale Behind the Transition

The transition is driven by the increasing demand for copper, particularly due to its critical role in EVs and renewable energy infrastructure. EVs use significantly more copper than traditional vehicles, positioning Teck to capitalize on this growing market.

JPMorgan analyst Patrick Jones notes that while discussions around substituting copper with cheaper materials exist, such substitutes are unlikely to fill the anticipated long-term supply deficits. The focus on copper is vital as the market expects a substantial deficit driven by rising demand from energy transition technologies.

The Copper Market Landscape

- Long-Term Supply Deficit

The global copper market is projected to face a significant supply deficit by 2030, with estimates suggesting a gap of approximately 4 million metric tons. This shortfall stems primarily from:

- EVs: EVs typically utilize two to four times more copper than internal combustion engine vehicles. The increasing complexity of vehicles is likely to sustain high copper demand, even as battery technologies improve.

- Renewable Energy Infrastructure: As the world shifts toward renewable energy, copper's role in solar and wind technologies continues to grow.

- Challenges in Substitution

Market analysts point out significant barriers to substituting copper with materials like aluminum:

- Technological Constraints: Aluminum has not proven to be a viable alternative to copper in many critical applications.

- Regulatory and Safety Concerns: These factors hinder broader adoption of substitutes in essential infrastructure.

Basic Financial Overview

- Profitability

Teck Resources reported profitability in the past year, maintaining positive operating cash flow. However, its net income results over the past five years have been mixed, with several years of negative income. Despite this volatility, the company has consistently generated positive operating cash flow.

- Key Financial Ratios

- ROA: 2.49%, outperforming 64.10% of industry peers, indicating effective asset utilization.

- ROE: 5.53%, placing Teck in the better half of its industry, outperforming 66.03% of peers.

- ROIC: 3.68%, which is in line with industry standards but below the average ROIC of 8.42% over the past three years.

- Margin Analysis

- Profit Margin: 9.41%, outperforming 79.49% of industry peers, although it has declined in recent years.

- Operating Margin: 21.04%, respectable but also showing a declining trend.

- Gross Margin: 29.02%, stable over the past couple of years and better than 72.44% of peers.

Financial Health

- Capital Structure

Teck’s ROIC is currently below its Cost of Capital (WACC), indicating potential value destruction. The number of shares outstanding has increased compared to the previous year, while the debt/assets ratio has risen.

- Solvency and Liquidity

- Altman-Z Score: 1.55, indicating distress and a risk of bankruptcy, ranking worse than 64.74% of industry peers.

- Debt/Equity Ratio: 0.41, suggesting Teck is not heavily reliant on debt financing, but still ranks lower than 71.15% of its peers.

- Current Ratio: 1.48, indicating sufficient ability to cover short-term obligations but worse than 75.00% of peers.

- Quick Ratio: 0.77, suggesting challenges in meeting short-term liabilities, performing worse than 81.41% of the industry.

Growth Prospects

- Historical Growth

Teck has experienced a strong negative growth in EPS, with a decline of -36.47% in the last year. However, EPS has grown by an average of 4.80% annually over the past several years. Revenue growth is at 12.80% for the past year, but historical growth is lower at 3.62% annually.

- Future Outlook

Forecasts predict a challenging growth environment, with expected declines in EPS of -11.79% per year and average revenue decreases of -8.03% over the coming years. This suggests a significant slowdown compared to historical growth rates.

- Evolution of Growth Rates

A comparison of past EPS growth rates to future expectations indicates a downward trend, with revenue growth rates also projected to decline, reflecting a less favorable outlook for the company.

- Valuation Assessment

Teck Resources appears relatively expensive with a P/E ratio of 17.25, although it is cheaper than 71.79% of its industry peers. Compared to the S&P 500 average P/E of 30.45, Teck’s valuation remains attractive. The Price/Forward Earnings ratio of 20.85 suggests that Teck is on the expensive side but aligns with industry averages.

The Bottom Line on Teck Resources

As Teck Resources transitions to focus on energy transition metals, traders should consider the broader implications for the copper market. With projected long-term supply deficits, the demand for copper is expected to rise, presenting opportunities in mining and electrification sectors.

However, concerns about financial health, declining growth prospects, and mixed historical performance warrant caution. Monitor Teck’s ongoing transformation and market dynamics closely, as potential increases in copper prices could offer upside despite current distress signals.

Stay informed on market trends, technological advancements, and regulatory developments.

Good Luck!