- マーケット分析

- テクニカル分析

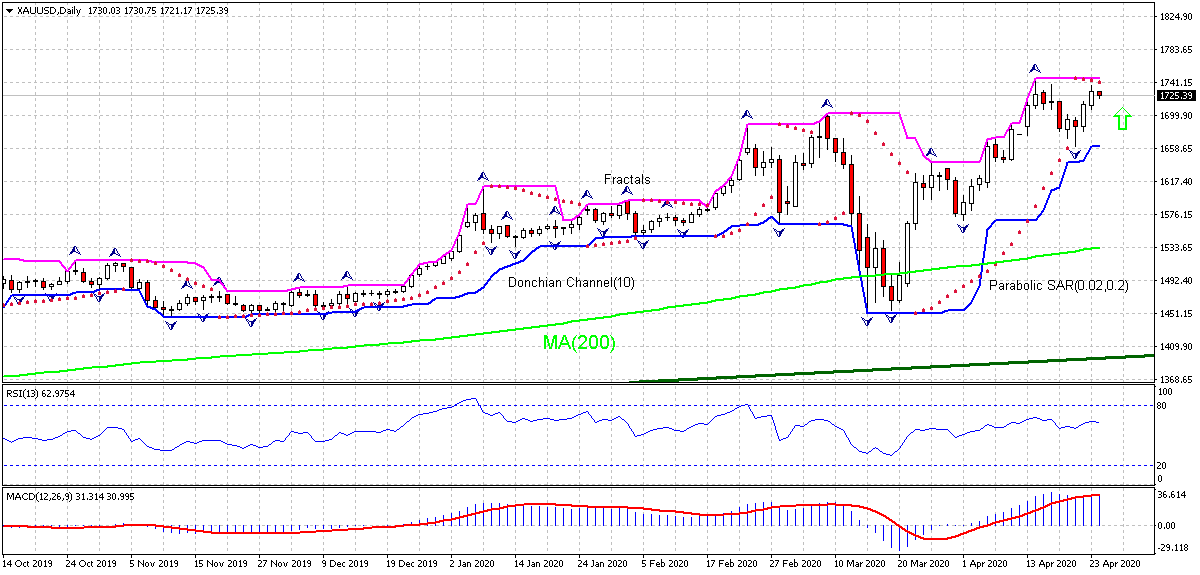

金 テクニカル分析 - 金 取引:2020-04-24

金 テクニカル分析のサマリー

Above 1746.98

Buy Stop

Below 1661.20

Stop Loss

| インジケーター | シグナル |

| RSI | 横ばい |

| MACD | 買い |

| Donchian Channel | 横ばい |

| MA(200) | 買い |

| Fractals | 買い |

| Parabolic SAR | 買い |

金 チャート分析

金 テクニカル分析

On the daily timeframe XAUUSD: D1 is rising above the 200-day moving average MA(200), which is rising itself. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 1746.98. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 1661.20. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (1661.20) without reaching the order (1746.98), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

分析 貴金属 - 金

Uncertainty that followed the coronavirus outbreak boosted safe haven demand. Will the XAUUSD climbing continue?

Recent US economic data were dismal. The Labor Department report implied more than 25 million Americans sought unemployment benefits over the last five weeks. And Markit’s report indicated US manufacturing sector continued contracting in April. As businesses around the globe struggle to keep afloat under conditions of shutdowns, major industrial economies’ governments adopted monetary and fiscal stimulus programs to prop flailing economies. Thus, the Federal Reserve added $1.5 trillion of liquidity to the financial system on March 12 to stabilize money markets. It restarted the Quantitative Easing program on March 15 with the purchase of $500 billion in treasuries and $200 billion in mortgage-backed securities. The Federal Reserve expanded its asset purchases of both treasuries and mortgage-backed securities by an additional $625 billion on March 23. On April 9, The central bank announced new loan program totaling $2.3 trillion. On the fiscal side US administration launched a $2 trillion Phase Three stimulus bill On March 25 including direct cash payments to population , loan program to companies impacted by the outbreak, federally guaranteed small business loans , expansion of unemployment insurance, business tax cuts, funding to state governments and public programs. This Tuesday Senate passed another coronavirus relief package worth nearly $500 billion to replenish funds for small businesses. The European Central Bank announced on March 19 it will purchase roughly $800 billion of additional bonds throughout 2020 in excess of $128 billion announced on March 12. The Bank of Japan announced on March 16 a doubling of the rate at which it was purchasing Exchange Traded Funds from $56 billion a year to $112 billion. The uncertainty that followed the coronavirus outbreak and massive monetary stimulus programs have boosted safe haven demand which is bullish for XAUUSD.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。