- マーケット分析

- テクニカル分析

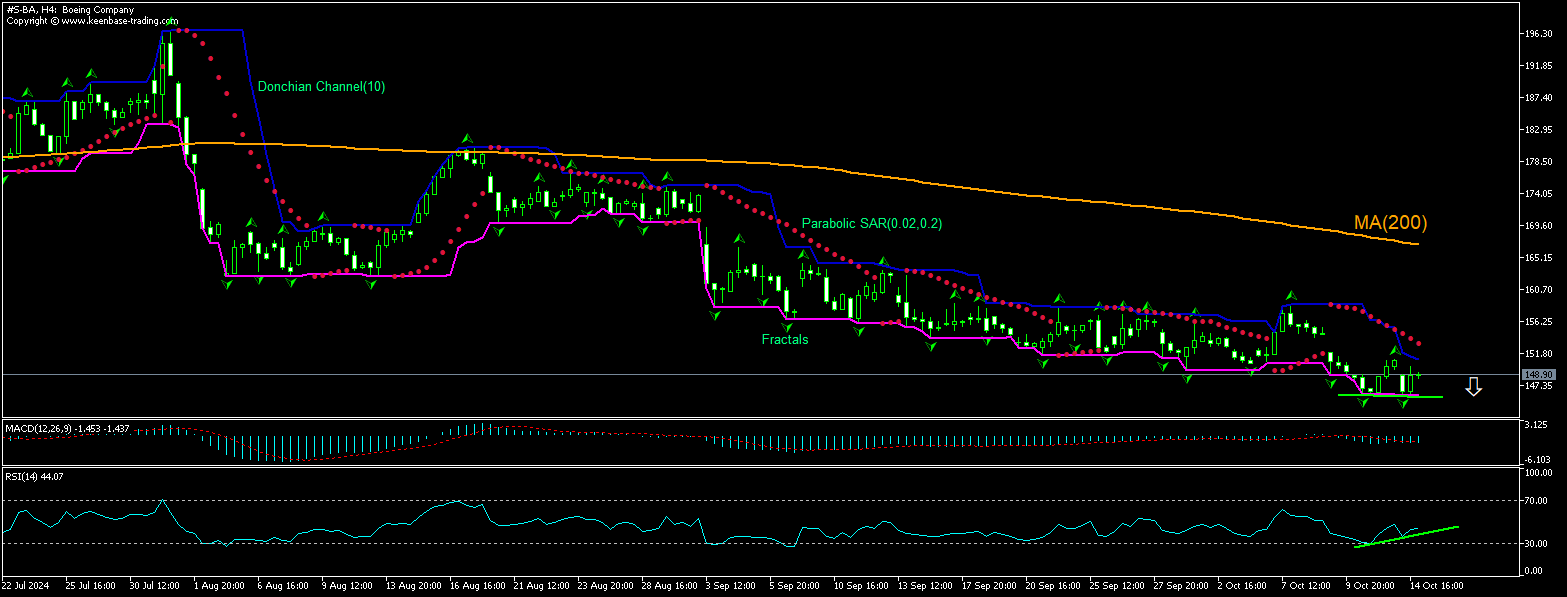

Boeing テクニカル分析 - Boeing 取引:2024-10-15

Boeing テクニカル分析のサマリー

Below 145.90

Sell Stop

Above 150.94

Stop Loss

| インジケーター | シグナル |

| RSI | 買い |

| MACD | 買い |

| Donchian Channel | 売り |

| MA(200) | 売り |

| Fractals | 売り |

| Parabolic SAR | 売り |

Boeing チャート分析

Boeing テクニカル分析

The technical analysis of the Boeing stock price chart on 4-hour timeframe shows #S-BA,H4 is retracing down under the 200-period moving average MA(200) after testing the MA(200) six weeks ago. The RSI indicator has formed a bullish divergence. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 145.90. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 150.94. After placing the order, the stop loss is to be moved every day to the next fractal high indicator following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (150.94) without reaching the order (145.90), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

分析 証券 - Boeing

Boeing stock closed down yesterday after reports thousands of Boeing staff will get layoff notices within weeks. Will the Boeing stock price retreating persist?

Roughly 33,000 Boeing workers have been on strike since September 13, seeking a 40% wage increase over four years. The plane maker plans for 10% reductions at its commercial unit involving both union and non-union workers. Boeing will send out 60-day notices to thousands of workers next month including many in its commercial aviation division, meaning those staff will leave the company in mid-January. A second phase of notices, if needed, could be issued in December. Layoff news followed company's surprise after-hours job cut announcement on Friday, which also included a new delay to the 777X jetliner and the ending of civil 767 freighter production. The one-year delay in 777X deliveries to 2026 was widely expected, but spurred concerns that the company would have to find fresh funding to overcome the financial distress. Emirates Airline President Tim Clark commented that the company faced a risk of an imminent investment downgrade with Chapter 11 looming on the horizon "unless the company is able to raise funds through a rights issue.” Ratings agency S&P has warned Boeing risks losing its prized investment-grade credit rating. Most analysts expect Boeing to raise up to $15 billion through a share issue. Forced layoffs as Boeing faces further plane delivery delays is bearish for stock price.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。