- Analyses

- Analyse technique

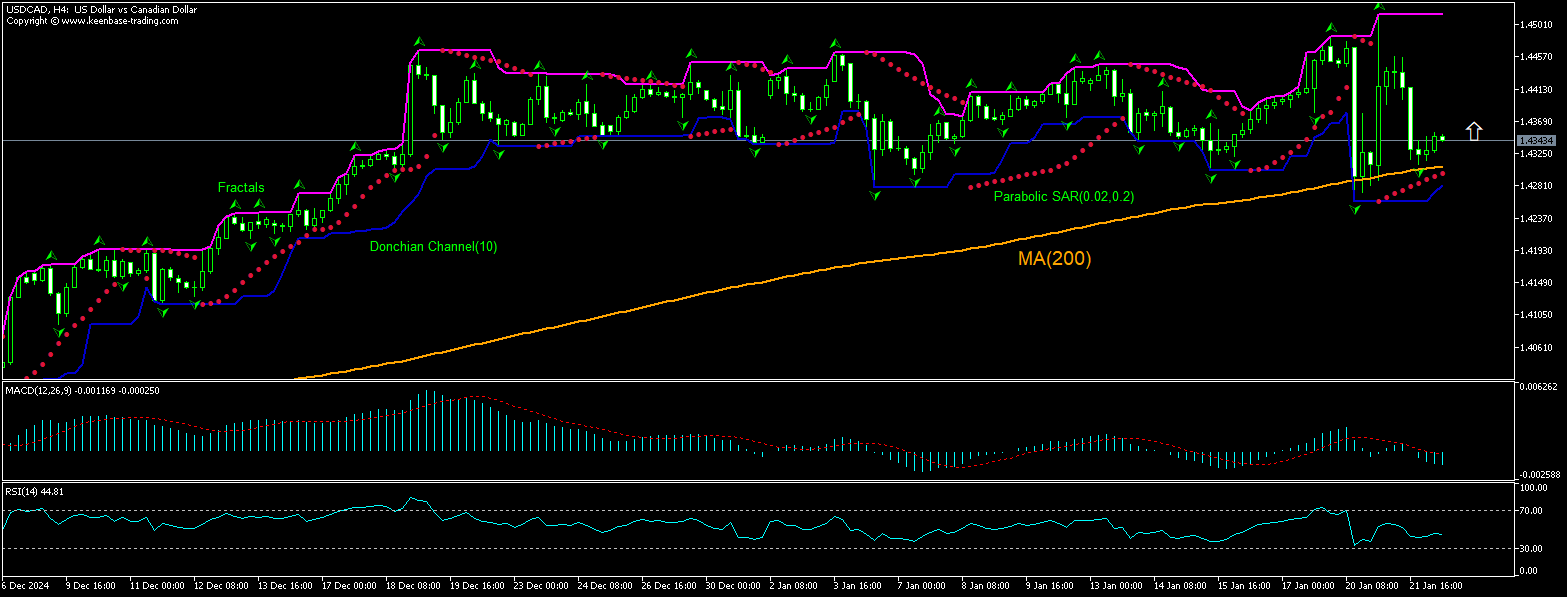

USD/CAD Analyse technique - USD/CAD Trading: 2025-01-22

USD/CAD Résumé de l'Analyse Technique

Supérieur de 1.43908

Buy Stop

Inférieur à 1.42982

Stop Loss

| indicateur | Signal |

| RSI | Neutre |

| MACD | Vendre |

| Donchian Channel | Acheter |

| MA(200) | Acheter |

| Fractals | Acheter |

| Parabolic SAR | Acheter |

USD/CAD Analyse graphique

USD/CAD Analyse technique

The USDCAD technical analysis of the price chart on 4-hour timeframe shows USDCAD,H4 is rebounding after testing the 200-period moving average MA(200) which is rising itself. We believe the bullish movement will continue after the price rises above 1.43908. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 1.42982. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analyse Fondamentale de Forex - USD/CAD

Canadian Consumer Price Index declined in December. Will the USDCAD price rebounding persist?

Canada’s statistics agency Statistics Canada reported that Canada’s consumer price inflation (CPI) Consumer Price Index (CPI) decline 0.4% on monthly basis in December, after no change in November when 0.7% drop was expected. The annual inflation rate remained steady at 2.0% when a tick down to 1.9% was forecast. Bank of Canada two main measures both dipped— the median consumer prices index went down two ticks to 2.4% from 2.6% in November, and the trimmed consumer prices index came down to 2.5% over year from 2.6%. However, the Statistics Canada states that inflation measures declined mainly due to sales-tax related cuts and expect they will reverse over the next two months, and they anticipate the Bank of Canada will cut interest rates next week. Expectations of interest rate cut are bearish for Canadian dollar and bullish for USDCAD pair.

Explorez nos

conditions de trading

- Spreads à partir de 0.0 pip

- Plus de 30,000 instruments de trading

- Stop Out Level - Only 10%

Prêt à trader?

Ouvrir un compte NB:

Cet aperçu a un caractère instructif et didactique, publié gratuitement. Toutes les données, comprises dans l'aperçu, sont reçues de sources publiques, reconnues comme plus ou moins fiables. En outre, rien ne garantit que les informations indiquées sont complètes et précises. Les aperçus ne sont pas mis à jour. L'ensemble de l'information contenue dans chaque aperçu, y compris l'opinion, les indicateurs, les graphiques et tout le reste, est fourni uniquement à des fins de familiarisation et n'est pas un conseil financier ou une recommandation. Tout le texte entier et sa partie, ainsi que les graphiques ne peuvent pas être considérés comme une offre de faire une transaction sur chaque actif. IFC Markets et ses employés, dans n'importe quelle circonstance, ne sont pas responsables de toute action prise par quelqu'un d'autre pendant ou après la lecture de l’aperçu.