- Analyses

- Analyse technique

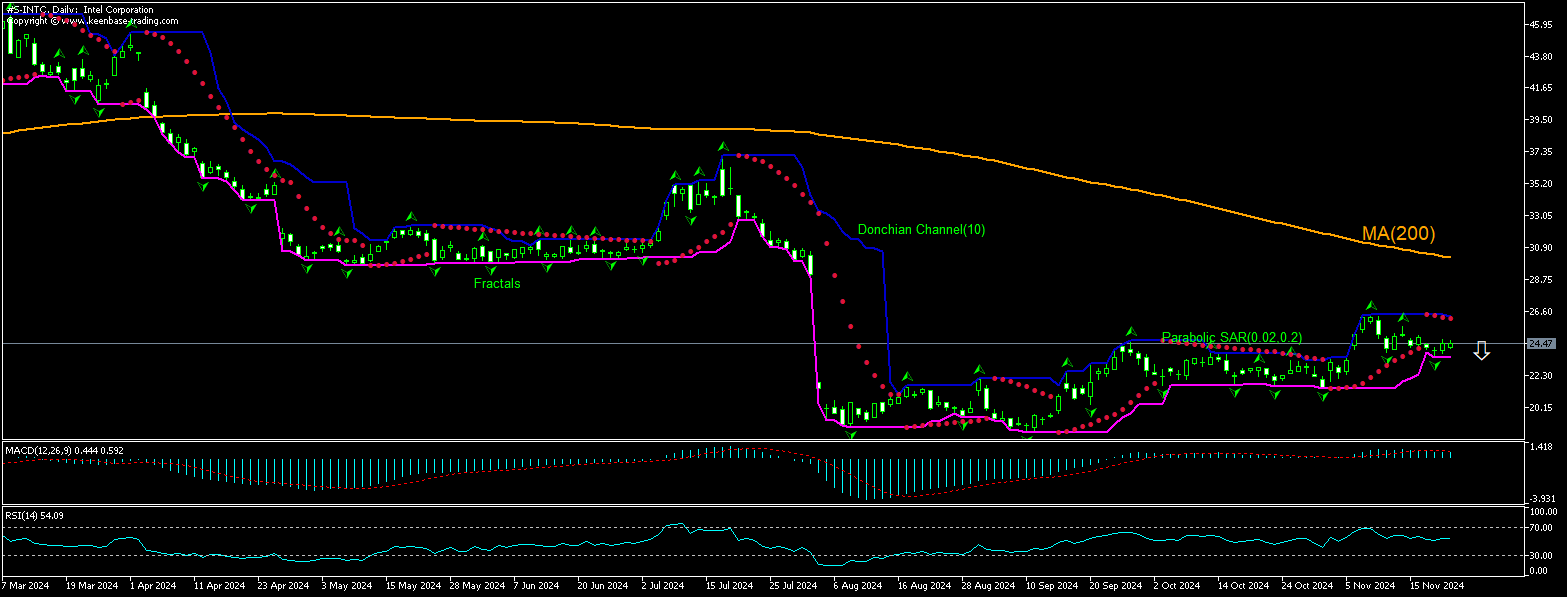

Intel Analyse technique - Intel Trading: 2024-11-25

Intel Résumé de l'Analyse Technique

Inférieur à 23.53

Sell Stop

Supérieur de 25.57

Stop Loss

| indicateur | Signal |

| RSI | Neutre |

| MACD | Vendre |

| Donchian Channel | Vendre |

| MA(200) | Vendre |

| Fractals | Vendre |

| Parabolic SAR | Vendre |

Intel Analyse graphique

Intel Analyse technique

The technical analysis of the Intel stock price chart on daily timeframe shows #S-INTC,D1 is retracing down under the 200-day moving average MA(200) after rebounding to four-month high following a retreat to 14-year low ten weeks ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 23.53. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the fractal high at 25.57. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (25.57) without reaching the order (23.53), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analyse Fondamentale de ACTIONS - Intel

Intel stock is retracing after rebounding following a retreat to 14- year low. Will the Intel stock price continue declining?

The US government plans to reduce Intel Corp's preliminary $8.5 billion federal chips grant to less than $8 billion, according to reports published this weekend. The US administration had announced a preliminary agreement for $8.5 billion in grants and up to $11 billion in loans for Intel in Arizona this spring. Some of the funding is being allocated for building two new factories and modernizing an existing one. The revision takes into account a $3 billion contract Intel had been offered to make chips for the Pentagon. Lower funding news is bearish for a company stock price. Last week a class action was filed against the chip giant in a US court alleging that the Core 13 and Core 14 central processing units sold by the firm, which are used to power desktop computers, are defective. The defect causes the processors to overheat and damages them permanently. Intel has been struggling financially and recently announced it would cut 15,000 jobs to cut costs.

NB:

Cet aperçu a un caractère instructif et didactique, publié gratuitement. Toutes les données, comprises dans l'aperçu, sont reçues de sources publiques, reconnues comme plus ou moins fiables. En outre, rien ne garantit que les informations indiquées sont complètes et précises. Les aperçus ne sont pas mis à jour. L'ensemble de l'information contenue dans chaque aperçu, y compris l'opinion, les indicateurs, les graphiques et tout le reste, est fourni uniquement à des fins de familiarisation et n'est pas un conseil financier ou une recommandation. Tout le texte entier et sa partie, ainsi que les graphiques ne peuvent pas être considérés comme une offre de faire une transaction sur chaque actif. IFC Markets et ses employés, dans n'importe quelle circonstance, ne sont pas responsables de toute action prise par quelqu'un d'autre pendant ou après la lecture de l’aperçu.