- Analyses

- Analyse technique

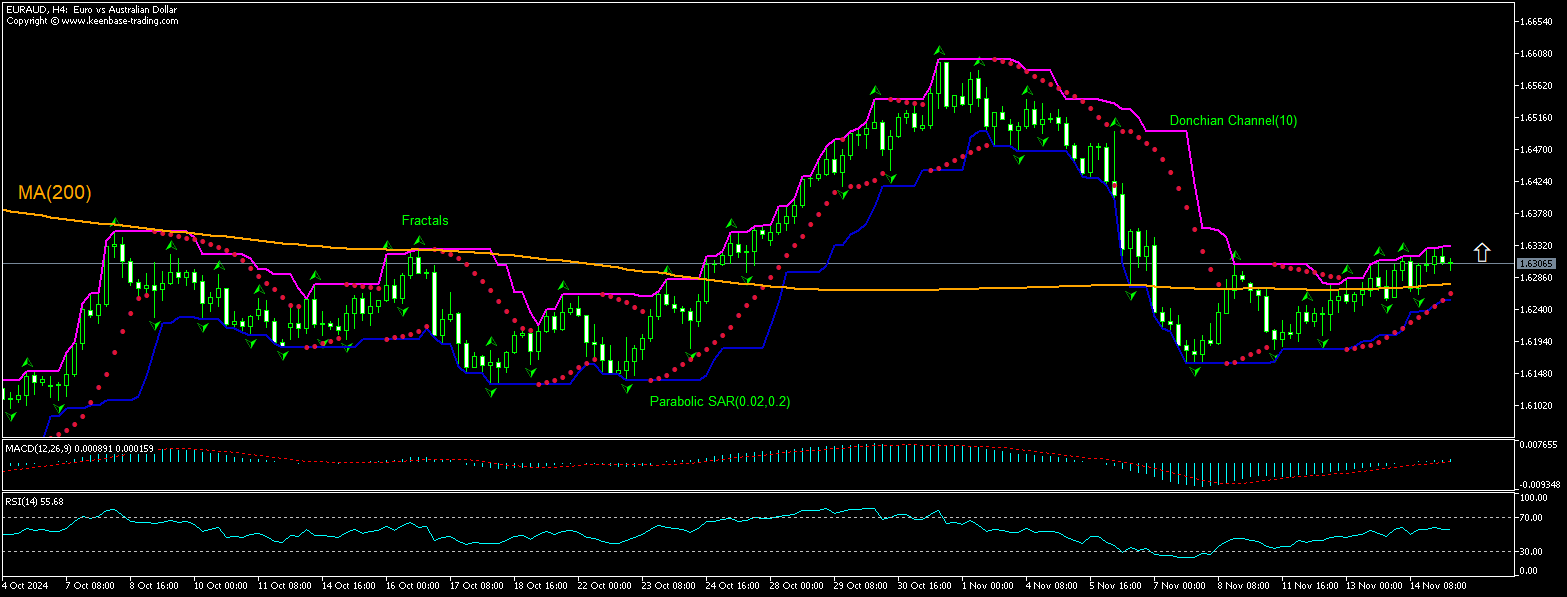

EUR/AUD Analyse technique - EUR/AUD Trading: 2024-11-15

EUR/AUD Résumé de l'Analyse Technique

Supérieur de 1.63307

Buy Stop

Inférieur à 1.62534

Stop Loss

| indicateur | Signal |

| RSI | Neutre |

| MACD | Acheter |

| Donchian Channel | Neutre |

| MA(200) | Acheter |

| Fractals | Acheter |

| Parabolic SAR | Acheter |

EUR/AUD Analyse graphique

EUR/AUD Analyse technique

The technical analysis of the EURAUD price chart on 4-hour timeframe shows EURAUD,H4 is on the rise after returning above the 200-period moving average MA(200) which is tilted up itself. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 1.63307. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 1.62534. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analyse Fondamentale de Forex - EUR/AUD

Latest data indicate euro area industrial production declined while Australia’s labor market report painted a mixed picture. Will the EURAUD price rebounding continue?

Latest data indicate euro area industrial production declined: Eurostat, the statistical office of the European Union, reported industrial production decreased by 2.0% in September compared with August in both the euro area and the EU. Industrial production had grown by 1.5% in the euro area and by 1.2% in the EU in August. The contraction in industrial output was led by drop in capital goods and energy output which offset increases in durable and non-durable consumer goods. On the other hand, Australia’s unemployment rate remained steady while the number of employed people rose less than expected: the Australian Bureau of Statistics reported the unemployment rate remained steady at 4.1% in October, while the number of employed people during the previous month rose by 15.9 thousand after increasing by 61.3 thousand in September when an increase by 25.2 thousand was expected. Declining euro area industrial output is bearish for EURAUD currency pair. However, the current setup is bullish for the pair.

NB:

Cet aperçu a un caractère instructif et didactique, publié gratuitement. Toutes les données, comprises dans l'aperçu, sont reçues de sources publiques, reconnues comme plus ou moins fiables. En outre, rien ne garantit que les informations indiquées sont complètes et précises. Les aperçus ne sont pas mis à jour. L'ensemble de l'information contenue dans chaque aperçu, y compris l'opinion, les indicateurs, les graphiques et tout le reste, est fourni uniquement à des fins de familiarisation et n'est pas un conseil financier ou une recommandation. Tout le texte entier et sa partie, ainsi que les graphiques ne peuvent pas être considérés comme une offre de faire une transaction sur chaque actif. IFC Markets et ses employés, dans n'importe quelle circonstance, ne sont pas responsables de toute action prise par quelqu'un d'autre pendant ou après la lecture de l’aperçu.