- Analytics

- Technical Analysis

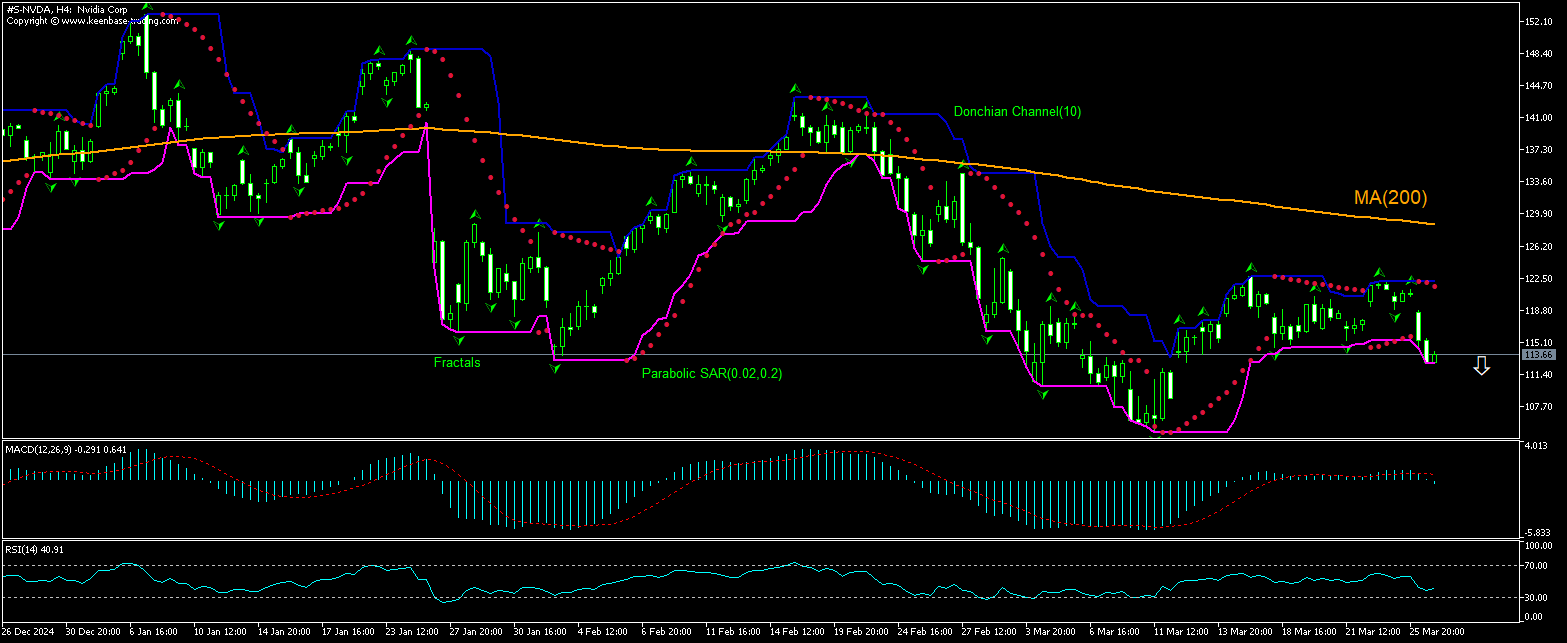

Nvidia Technical Analysis - Nvidia Trading: 2025-03-27

Nvidia Technical Analysis Summary

Below 112.63

Sell Stop

Above 121.59

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(100) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Nvidia Chart Analysis

Nvidia Technical Analysis

The technical analysis of the Nvidia stock price chart on 4-hour timeframe shows #S-NVDA,H4 is retracing down under the 200-period moving average MA(200) which is declining itself. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 112.63. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 121.59. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (121.59) without reaching the order (112.63), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Nvidia

Moody's upgraded Nvidia credit rating yesterday. Will the Nvidia stock price continue retracting lower?

Moody's Ratings announced an upgrade to Nvidia Corporation's senior unsecured rating, elevating it to Aa2 from Aa3. Alongside this upgrade, Moody's affirmed Nvidia's Prime-1 short term commercial paper rating and sustained the positive outlook on the company's ratings. The upgrade was attributed to NVIDIA's leading position in the artificial intelligence (AI) infrastructure sector, its strong prospects for long-term growth, and an impressive financial profile. With $43.2 billion in cash and investments and a relatively low debt level of $8.5 billion, NVIDIA's financial health appears robust. The rating agency notes that geopolitical risks and company’s reliance on a few large cloud service providers are downside risks for Nvidia’s stock price. US export controls have affected NVIDIA's revenue growth in China, while Nvidia’s revenue is subject to volatility due to its reliance on a few large cloud service providers which historically account for nearly half of its Data Center end market revenues. Company’s rating upgrade is bullish for the company’s stock price. However, the current setup is bearish for Nvidia stock.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.