- Analytics

- Technical Analysis

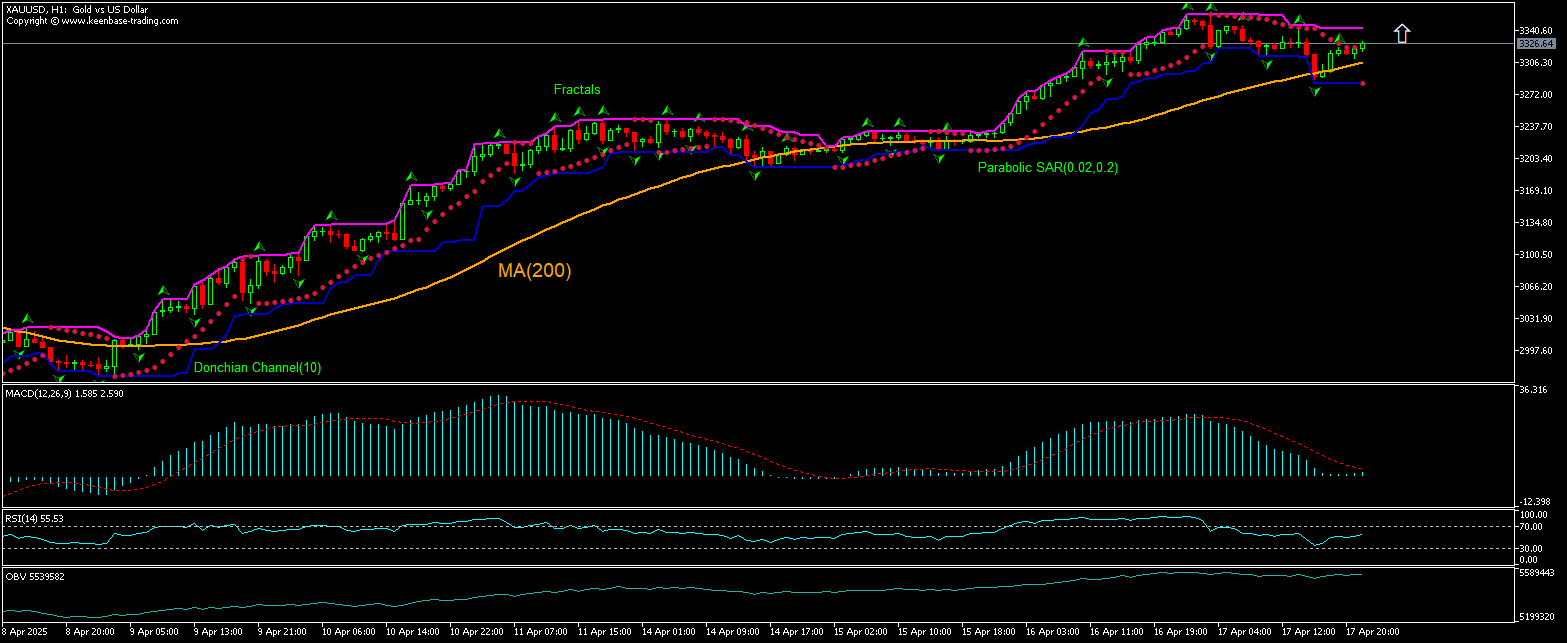

XAUUSD Technical Analysis - XAUUSD Trading: 2025-04-18

Gold Technical Analysis Summary

Above 3342.15

Buy Stop

Below 3283.72

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Neutral |

| MA(50) | Buy |

| MA(200) | Neutral |

| Parabolic SAR | Buy |

| On Balance Volume | Neutral |

Gold Chart Analysis

Gold Technical Analysis

The technical analysis of XAUUSD price on the 4-hour timeframe shows XAUUSD,H4 is rebounding above the 50-period moving average MA(50) after testing the MA(50) yesterday. We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 3342.15. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 3283.72. After placing the pending order the stop loss is to be moved every day to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (3283.72) without reaching the order (3342.15) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Fundamental Analysis of Precious Metals - Gold

US official data showed that foreign holdings of Treasuries rose in February despites speculation China or Japan was dumping them after start of tariff war. Will the XAUUSD rebound?

US Treasury Department reported that foreign holdings of Treasuries actually rose 3.4% in February: data showed Japan increased its holdings by 4% to $1.1259 trillion while China raised its holdings by 3% to $784.3 billion. China remained the second-largest foreign holder of Treasuries while Japan remained the largest holder with overall foreign holdings of US Treasuries standing at $8.8172 trillion at the end of February. After President Trump announced larger than expected reciprocal tariffs in April, there were rumors that China or Japan was dumping treasuries. Decrease in foreign holdings of US Treasuries results in falling demand for Treasuries which is bearish for US dollar and therefor bullish for XAUUSD price. So data showing increase in foreign holdings of Treasuries is bearish for gold. However, the current setup is bullish for XAUUSD>

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.