- Education

- Trading CFDs

- CFDs on Gold

CFDs on Gold

Let’s discover a golden opportunity in the world of trading!

Welcome to the exciting world of CFDs on Gold. In this dynamic market, where the value of gold constantly fluctuates, CFDs offer a thrilling way to participate in the price movements of this precious metal without owning the physical asset. Gold trading online has revolutionized the way investors and traders engage with this precious metal, opening up new avenues for profit potential and market participation.

Whether you're a seasoned trader seeking diversification or a newcomer looking to explore the world of trading, CFDs on Gold provide an accessible and flexible avenue for potential profit. Join us as we delve into the captivating world of CFDs on Gold and unlock the potential of this shining investment opportunity.

KEY TAKEAWAYS

- CFDs on gold are like virtual bets on the price of gold. You don't actually buy physical gold, but you speculate on whether the price will go up or down.

- Gold stocks are shares of companies that are in the business of mining, producing, or financing gold.

- CFDs on Gold provide an accessible and flexible avenue for potential profit.

- But remember, just like with any investment, it's crucial to do your research, understand the risks involved, and develop a well-thought-out strategy.

CFDs on Gold

CFDs on gold are like virtual bets on the price of gold. You don't actually buy physical gold, but you speculate on whether the price will go up or down.

Here's how it works:

Online Trading Platform

You use an online trading platform provided by a broker to trade CFDs on gold.

Long and Short Bets

You can make two types of bets: "long" if you think the price will go up, or "short" if you think it will go down.

Trading with Leverage

You can trade with more money than you actually have. Let's say you have $100, but with leverage, you can control, for example, $1,000 worth of gold. This means you can make bigger profits (or losses) than your initial investment.

Trade Details

There are specific details for each trade, like the size of the trade, how much the price needs to move to make a profit, and how much money you need to put down as a deposit.

Profits and Losses

If the price moves in your favor, you can close the trade and make a profit. If it goes against you, you can lose money.

Overnight Financing Fees

If you keep a trade open overnight, you might have to pay a fee for borrowing the money to keep the trade going.

Risk Management with Stop-Loss and Take-Profit Orders

To manage risks, you can set limits on how much you're willing to lose (stop-loss orders) or when you want to take your profits (take-profit orders).

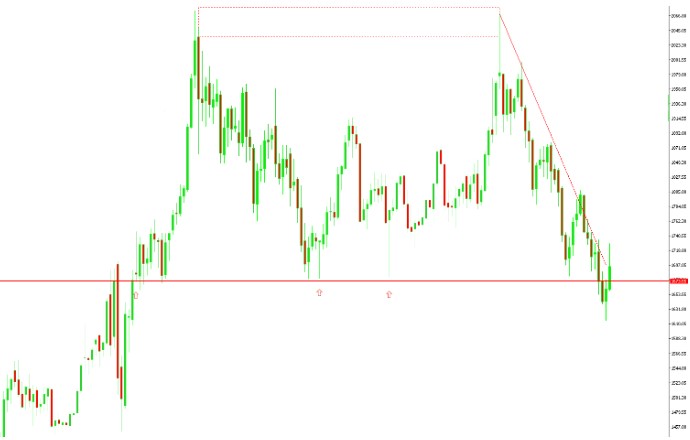

Here is another example of a bearish candlestick pattern that could be used to trade CFDs on gold:

Identify a chart pattern

In this case, we can see a bearish harami cross pattern forming on the daily chart. A bearish harami cross pattern is formed when a small white candle is sandwiched between two large red candles. This pattern indicates that the buying sentiment in the market is waning and that the price of gold is likely to fall.

Place a sell order

Once we have identified the bearish harami cross pattern, we can place a sell order for CFDs on gold. We should place our order at the open of the next candle, which is likely to continue the downward trend.

Monitor the trade

Once our order is placed, we need to monitor the trade closely. If the price of gold continues to fall, we can hold onto our position and wait for it to reach our target profit. However, if the price of gold starts to rise, we should close our position to avoid losses.

It is important to note that candlestick patterns are not always reliable and should be used in conjunction with other technical analysis tools and your own judgment when making trading decisions.

In conclusion, the trading price of gold (XAUUSD price) and trading Gold CFDs are vital aspects of the global financial markets. As one of the most sought-after commodities, gold trading price is influenced by various factors such as economic indicators, geopolitical events, and investor sentiment.

Trading Gold CFDs provides an alternative means for investors to gain exposure to the gold market without physically owning the metal, allowing for greater flexibility and leverage. Understanding the dynamics of the gold market and effectively trading Gold CFDs can offer opportunities for investors to capitalize on price movements and diversify their portfolios.

How to Start Gold Trading

First of all, let's learn what are the steps in theory that you will need to go through, and then we will show you on example how it should be done.

Here are the steps to start gold trading explained in a more casual and easy-to-understand language:

1. Learn about Gold

Get a basic understanding of how gold trading works, including what affects its price and what's happening in the market right now. This will help you make smarter trading decisions.

2. Pick a Trading Platform

Find a reliable online platform where you can trade gold. Look for one that's easy to use, safe, and has helpful tools and support.

3. Open an Account

Sign up and create an account on your chosen platform. They'll ask for some personal info and may need to verify your identity.

4. Put Money In

Deposit some money into your trading account. The amount required varies, so make sure you have enough to get started.

5. Research and Analyze

Use the tools and resources on the platform to research and analyze the gold market. Look at price charts, read news updates, and learn about different strategies that can help you find good trading opportunities.

6. Make a Trading Plan

Decide on a plan for your trades. Figure out how much risk you're comfortable with, the best times to trade, and when you'll enter or exit trades. Having a plan makes it easier to stick to your strategy.

7. Practice with a Demo Account

If the platform offers a demo account, use it to practice trading without using real money. This lets you get the hang of things and see how your strategy works without risking anything.

8. Start Making Trades

Once you feel confident, start trading for real. You can decide whether to buy gold (going "long") or sell gold (going "short") based on your analysis of the market.

9. Keep an Eye on Your Trades

Watch how your trades are doing. If the price of gold moves in your favor, you can close the trade and make a profit. If it goes against you, you might end up losing money.

10. Learn and Improve

Regularly review your trades to see what worked and what didn't. Learn from your experiences and make adjustments to your strategy and risk management techniques as needed.

To begin trading, you can start by downloading MetaTrader 4, a popular trading platform. MetaTrader 4 provides a user-friendly interface and a range of tools for analyzing the markets and executing trades. Once you have completed the MetaTrader 4 download, you can set up your account, deposit funds, and begin exploring the opportunities in the financial markets.

Here are the steps on how to start gold trading on IFC Markets:

- Open an account. You can open an account with IFC Markets through their website. You will need to provide some personal information, such as your name, address, and email address. You will also need to choose a trading account type and deposit funds.

- Choose a trading platform. IFC Markets offers two trading platforms: NetTradeX and MetaTrader 4 (MT4). NetTradeX is their proprietary platform, while MT4 is a popular third-party platform. You can choose the platform that best suits your needs.

- Learn about gold trading. Before you start trading gold, it is important to learn about the market. You should understand the factors that affect the price of gold, such as economic conditions, interest rates, and political events. You should also learn about different trading strategies and how to manage risk.

- Start trading. Once you have learned about gold trading and you are comfortable with the risks involved, you can start trading. You can place trades through the IFC Markets trading platform.

Here is an example of how you could start trading gold on IFC Markets:

- You open an account with IFC Markets and deposit $1,000.

- You choose the NetTradeX trading platform.

- You learn about gold trading and develop a trading strategy.

- You place a buy order for 1 lot of gold CFDs.

- The price of gold goes up and you close your trade for a profit of $50.

Here is an example of a chart patterns trading strategy using a 1000$ deposit and a buy order for 1 lot of gold CFDs. The chart is for the daily price of gold.

Setup: The price of gold is trading in a downtrend. On the daily chart, we can see a series of bearish candlesticks, with the most recent candle closing below the previous day's low.

Signal: A bullish engulfing pattern forms. This is a reversal pattern that occurs when a large green candle engulfs a large red candle. The engulfing candle indicates that the bulls are gaining control of the market and that the downtrend may be coming to an end.

Entry: We enter a long CFD trade at the open of the next candle. In the chart you can see how the price started the uptrend.

Stop-loss: We place our stop-loss order below the low of the bearish engulfing candle.

Target: Our target is to reach the previous day's high.

The total amount of money that we are risking on this trade is equal to the stop-loss order, which is $50. If the price of gold goes below the stop-loss order, we will lose $50.

The potential profit on this trade is equal to the difference between the entry price and the target price, which is $300. If the price of gold reaches the target price, we will make a profit of $300.

The risk-to-reward ratio for this trade is 6:1. This means that for every $1 that we risk, we have the potential to make $6.

If the trade goes our way, we will close the trade at the target price and make a profit of $300. However, if the trade goes against us, we will close the trade at the stop-loss order and lose $50. But as you can see the trade went our way and we earned some good money.

Gold Stocks

Gold stocks are shares of companies that are in the business of mining, producing, or financing gold. These companies can include mining companies, streaming companies, and royalty companies. By investing in gold stocks, you can benefit from the price of gold without needing to own physical gold yourself. It's a way to participate in the gold market and potentially protect against inflation.

Advantages and disadvantages of investing in gold stocks:

Advantages

- Potential for Profits: When you invest in gold stocks, you have a chance to make money if the price of gold goes up. If gold prices rise, the companies that mine or sell gold can become more profitable, which can lead to higher stock prices and potential returns for investors.

- Diversification: Adding gold stocks to your investment portfolio can help spread out the risk. Gold stocks often have different performance patterns compared to other types of stocks, so they can act as a hedge against market volatility. This means that even if other parts of your portfolio are not doing well, gold stocks may still hold value.

- Growth Potential: The demand for gold tends to increase during uncertain economic times or geopolitical tensions. This can lead to higher profits for gold companies and potentially benefit investors who own gold stocks.

Disadvantages

- Volatility and Risk: Gold stocks can be quite unpredictable and their prices can change a lot. Factors like changes in the price of gold, production costs, regulations, and company-specific issues can affect how well gold stocks perform. It's important to be prepared for the potential risks that come with investing in individual gold companies.

- Company-Specific Risks: Investing in gold stocks means taking on risks that are specific to each company. Things like problems with mining operations, decisions made by management, or financial troubles can hurt the profitability and stock prices of individual gold companies.

- Dependence on the Market: Gold stocks are influenced by overall market conditions and investor sentiment, not just the price of gold. This means that during market downturns or uncertain times, gold stocks may not provide the reliable protection or returns you expect.

- Limited Dividends: Some gold companies may choose to reinvest profits into further exploration and development instead of paying dividends to shareholders. This means that if you're looking for regular income from your investments, gold stocks may not be the best choice.

It's important to carefully consider your investment goals, how much risk you're comfortable with, and do thorough research before investing in gold stocks.

Keep an eye on individual companies, stay informed about market trends, and diversify your investments across different sectors. Talking to a financial advisor or doing your own research can help you make smart investment decisions.

Gold ETFs

A gold ETF (exchange-traded fund) is a type of investment fund that tracks the price of gold. It's like buying shares in a fund that represents a certain amount of gold. You can trade these ETFs on the stock exchange, just like stocks, without needing to physically own gold.

The ETFs are backed by actual gold, which is stored in a vault by the company that manages the ETF. When you buy shares of a gold ETF, you essentially own a portion of that gold. If the price of gold goes up, the value of the ETF also goes up.

Gold ETFs have some advantages.

- They are easy to buy and sell quickly,

- They usually have low fees,

- They can help diversify your investment portfolio and reduce risk.

However, there are also some downsides to consider.

- The price of gold can be unpredictable, so you could lose money if the price goes down.

- The ETF may not perfectly track the price of gold, leading to some differences in returns.

- The tax treatment of gold ETFs can be different from other investments.

Here are some of the most popular gold ETFs you can start trading

- SPDR Gold Shares (GLD),

- iShares Gold Trust (IAU),

- VanEck Gold Miners ETF (GDX),

- VanEck Junior Gold Miners ETF (GDXJ),

- and GraniteShares Gold Trust (BAR).

Before investing in gold ETFs, it's important to understand the risks involved and consider your investment goals and tax implications.

Gold Trading Hours

Gold trading hours refer to the specific time periods during which the gold market is open for trading. The gold market operates globally, allowing investors to trade gold across different time zones. Here are the general gold trading hours:

- New York Market: The gold market opens at 8:20 AM (Eastern Time) when the New York Mercantile Exchange (COMEX) starts trading gold futures contracts. The market closes at 1:30 PM (Eastern Time). However, electronic trading platforms may offer extended trading hours beyond these times.

- London Market: The London Bullion Market Association (LBMA) is a major hub for gold trading. The market officially opens at 10:30 AM (London time) with the morning gold price fixing, also known as the LBMA Gold Price. The afternoon gold price fixing takes place at 3:00 PM (London time) to establish the daily benchmark gold price. The LBMA gold market closes at 5:00 PM (London time).

- Asian Markets: Several Asian markets contribute to gold trading. In Tokyo, the Tokyo Commodity Exchange (TOCOM) opens at 9:00 AM (Tokyo time) and closes at 3:00 PM (Tokyo time). The Shanghai Gold Exchange (SGE) in China opens at 9:00 AM (Beijing time) and closes at 3:30 PM (Beijing time).

It's important to note that these are general trading hours, and specific gold trading hours may vary depending on holidays, daylight saving time adjustments, or other factors. Additionally, over-the-counter (OTC) trading may occur outside of regular exchange hours.

Traders and investors should check with their broker or the respective exchanges for the most up-to-date and accurate information on gold trading hours to ensure they are aware of when the market is open for trading.

What are the best hours to trade Gold

The best hours to trade gold can vary depending on your trading strategy, time zone, and market conditions. However, there are certain periods when the gold market tends to have higher trading volumes and increased price volatility, which can present potential opportunities for traders.

Here are some key timeframes to consider:

Overlapping Sessions

When the trading hours of major gold markets overlap, there is typically increased activity and liquidity. The overlap between the London and New York sessions, which occurs from approximately 8:00 AM to 11:00 AM (Eastern Time), is often considered a favorable time for trading gold. During this period, there can be increased price movements and trading opportunities.

Market Openings

The opening hours of major gold markets, such as the London and New York markets, can also offer potential trading opportunities. The London market opens at 3:00 AM (Eastern Time), while the New York market opens at 8:20 AM (Eastern Time). During these opening hours, there can be initial bursts of trading activity and price volatility.

Economic News Releases

Pay attention to the release of economic news and data that can impact gold prices. Important economic reports, such as non-farm payroll data, central bank announcements, or geopolitical events, can cause significant price movements. Traders often look for trading opportunities immediately before or after these news releases.

For example:

News Release

The US Bureau of Labor Statistics releases the monthly employment report. The report shows that the unemployment rate fell to 3.6%, which is below the market expectation of 3.7%.

Gold Trading Chart

The gold price initially rises on the news, but then falls back down. This is because the lower unemployment rate is seen as a sign that the US economy is doing well, which could lead to higher interest rates. Higher interest rates are usually seen as a negative for gold, as they make it more attractive to hold other assets, such as bonds.

This example shows how economic news releases can have a significant impact on gold trading charts. Traders should be aware of upcoming news releases and how they could affect the price of gold.

Here are some other economic news releases that can affect gold trading charts:

- Interest rate decisions: When central banks announce interest rate decisions, it can have a big impact on the price of gold. Higher interest rates are usually seen as a negative for gold, while lower interest rates are usually seen as a positive.

- Economic growth data: Economic growth data can also affect the price of gold. If economic growth is strong, it could lead to higher interest rates, which would be negative for gold. However, if economic growth is weak, it could lead to lower interest rates, which would be positive for gold.

- Inflation data: Inflation data can also affect the price of gold. If inflation is high, it could lead to higher interest rates, which would be negative for gold. However, if inflation is low, it could lead to lower interest rates, which would be positive for gold.

Traders should be aware of these economic news releases and how they could affect the price of gold. By understanding the factors that affect the price of gold, traders can make better trading decisions.

Asian Sessions

The Asian trading sessions, particularly when the Tokyo and Shanghai markets are open, can influence gold prices. During these sessions, traders in Asia react to global market events and news, which can result in price movements that may continue into the London and New York sessions.

It's important to note that while these timeframes may offer increased trading opportunities, they also come with higher volatility and risks.

Additionally, individual trading preferences and strategies may lead traders to different optimal trading hours. It is recommended to conduct thorough analysis, monitor market conditions, and consider factors such as liquidity, volatility, and personal availability when determining the best hours for your gold trading activities.

Bottom Line on CFDs on Gold

So, there you have it, the golden ticket to financial possibilities - CFDs on gold!

With the power to trade gold without the hassle of physical ownership, you can tap into the glimmering world of precious metals right from your trading platform. Whether you're a seasoned trader or just starting out, CFDs offer a thrilling way to speculate on the price of gold and potentially profit from its fluctuations.

But remember, just like with any investment, it's crucial to do your research, understand the risks involved, and develop a well-thought-out strategy. Stay informed about the latest market trends, leverage the tools at your disposal, and always trade responsibly.

So, are you ready to seize the opportunity and let your trading dreams shine bright? Start exploring CFDs on gold today and see where this dazzling adventure takes you. Happy trading!