- Trading

- Instrument Specifications

- Synthetic Instruments Library

- Brent Crude Oil vs Euro Investing

Brent Crude Oil vs Euro - Brent Euro Trading

Brent Crude Oil vs Euro Investing

Type:

PCIInstrument : &BRENT/EUR

Brent EUR Description

The personal composite trading instrument «&BRENT/EUR» reflects the price dynamics of Oil against Euro. The base part of this instrument is composed of 1 barrel of crude oil of the Brent grade, and the quoted part – 1 euro. The oil is represented by #C-BRENT - a continuous CFD on Brent oil futures.

The asset percentage content of the instrument is estimated on the basis of asset prices on the instrument creation date.

The trading instrument &BRENT/EUR is used for the analysis and trade of oil quoted against the main European currency.

Structure

Parameters

Trading hours

Application field

Structure

| &BRENT/EUR | № | Asset | Volume / 1 PCI | Percentage | Volume (USD) / 1 PCI | Unit of measurеment |

|---|---|---|---|---|---|---|

| Base part | 1 | #C-BRENT | 1.0000 | 9.240 | 92.4400 | barrels |

| Quoted part | 1 | EUR | 1.000 | 0.1300 | 1.2600 | EUR |

Parameters

| Standard | Beginner | Demo | |

|---|---|---|---|

| Fixed spread, pip | |||

| Floating Spread, pip | |||

| Order distance, pip | |||

| Swap (long/short) in pips on Vol | |||

|

Available volumes | |||

| The value of 1 pip in USD for the Vol |

Trading hours

| Week day | Trading hours (CET) | Local trading hours |

| Monday | 01:00 — 23:00 | 01:00 — 23:00 |

| Tuesday | 01:00 — 23:00 | 01:00 — 23:00 |

| Wednesday | 01:00 — 23:00 | 01:00 — 23:00 |

| Thursday | 01:00 — 23:00 | 01:00 — 23:00 |

| Friday | 01:00 — 21:00 | 01:00 — 21:00 |

| Saturday | — | — |

| Sunday | — | — |

Application field

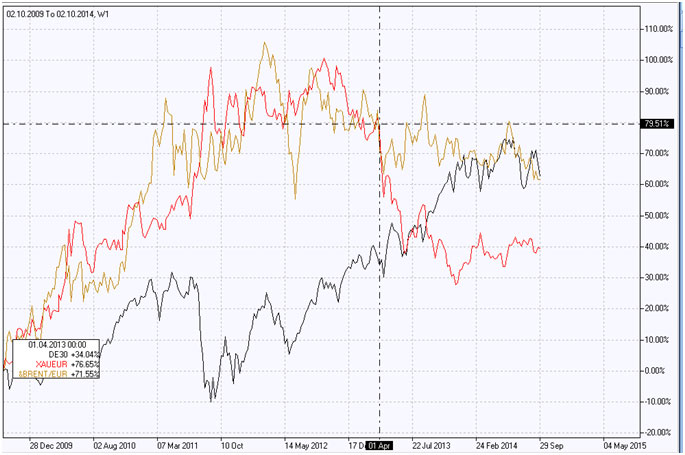

The personal composite trading instrument &BRENT/EUR is used for trade and dynamics analysis of Brent Oil vs Euro, as well as multi-year comparative analysis of various popular investment assets quoted against euro. For example, by building a percentage chart in the NetTradeX terminal for three instruments &BRENT/EUR, XAUEUR и DE30 (German stock index in eurо ) (Рict. 1), it is evident that two periods stand out in the last five years: from October 2009 to April 2013 the investments in gold and oil yielded approximately equal returns (up to 80-100%); but from the summer of 2013 to the autumn of 2014 the investments in stock market and oil provided equal returns (about 70%), while investments in gold yielded considerably lower return of 40%.

Traders, whose main assets and investments are denominated in euro, will be comfortable trading this PCI.

To trade PCI instruments offered exclusively by IFC Markets, you need to open a free account and download the NetTradeX platform.

- Clients Also Trade These Instruments