- Analytics

- Technical Analysis

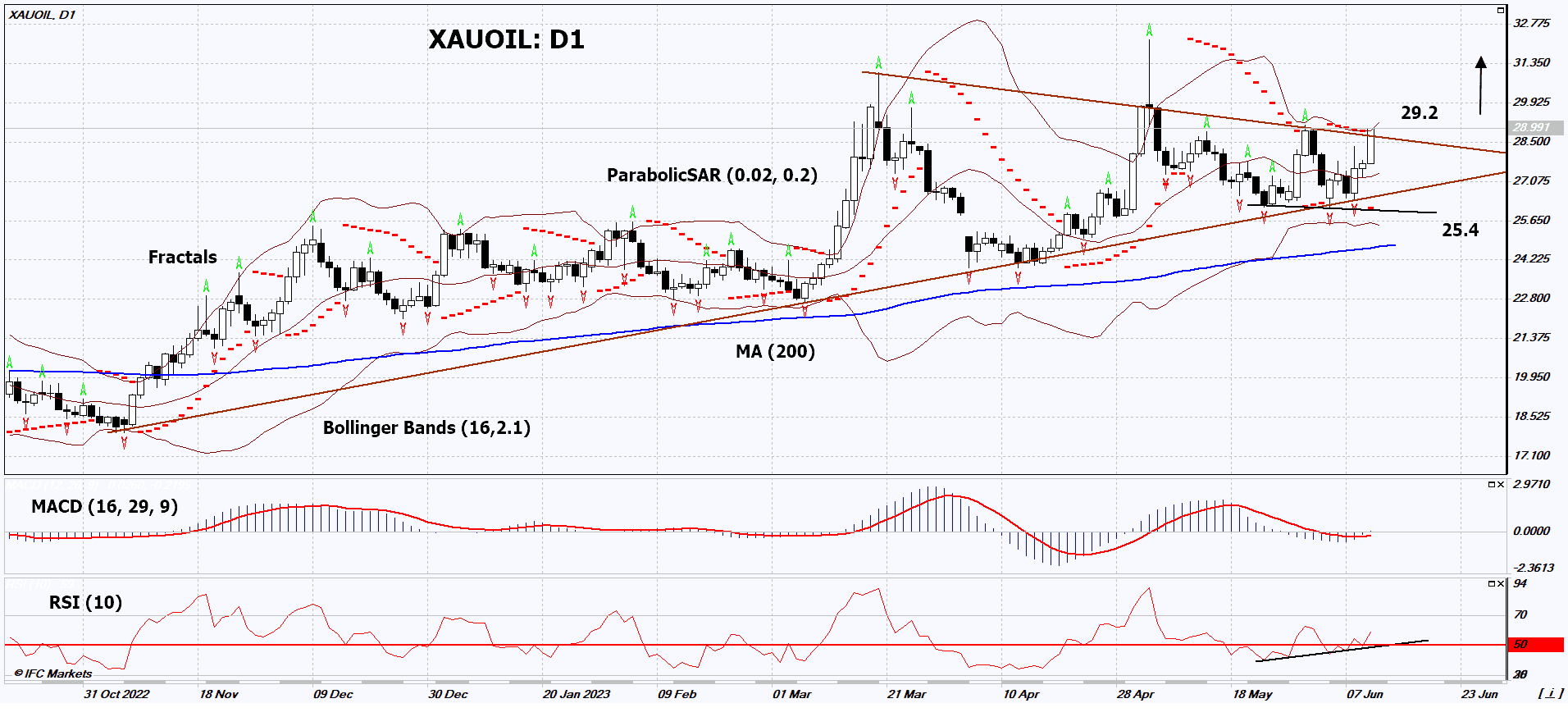

Gold vs Oil Technical Analysis - Gold vs Oil Trading: 2023-06-13

Gold vs Oil Technical Analysis Summary

Above 29.2

Buy Stop

Below 25.4

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

Gold vs Oil Chart Analysis

Gold vs Oil Technical Analysis

On the daily timeframe, XAUOIL: D1 is currently within a triangle pattern. It is expected to break out of the triangle to the upside before opening a position. Several technical analysis indicators have generated signals for further upward movement. We do not exclude a bullish movement if XAUOIL: D1 rises above the last fractal high and the upper Bollinger Band line at 29.2. This level can be used as an entry point. The initial risk limit could be set below the Parabolic signal, the lower Bollinger Band line, and the last fractal low at 25.4. After opening a pending order, the stop loss should be moved along with the Bollinger Band and Parabolic signals to the next fractal low. This way, we adjust the potential profit/loss ratio in our favor. More cautious traders, after executing the trade, can switch to the four-hour chart and set a trailing stop loss in the direction of the movement. If the price surpasses the stop level (25.4) without activating the order (29.2), it is recommended to cancel the order as there are internal changes happening in the market that were not accounted for.

Fundamental Analysis of Gold Instruments - Gold vs Oil

In the US, inflation data will be released. Will the increase in XAUOIL quotes continue?

This particular instrument represents Gold vs Light Sweet Oil (WTI). An upward movement indicates that gold is experiencing higher demand compared to oil. The United States Consumer Price Index (CPI) for May will be published on June 13th. A decrease in inflation to +4.1% YoY is expected, compared to +4.9% YoY in April. If the actual figure aligns with the forecasts, it will be the lowest since March 2021. The decline in inflation could contribute to the conclusion of the Federal Reserve's monetary policy tightening. Theoretically, this is a positive factor for precious metals. It's worth noting that the next Federal Reserve meeting will take place on June 14th. No rate hike to +5.25% is expected. On the other hand, oil prices are declining due to expectations of increased Iranian exports in the event of a positive outcome of the negotiations on the nuclear deal with Western countries. According to various estimates, Iran could supply up to 1.5 million barrels of oil per day to the global market.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.