- Analytics

- Technical Analysis

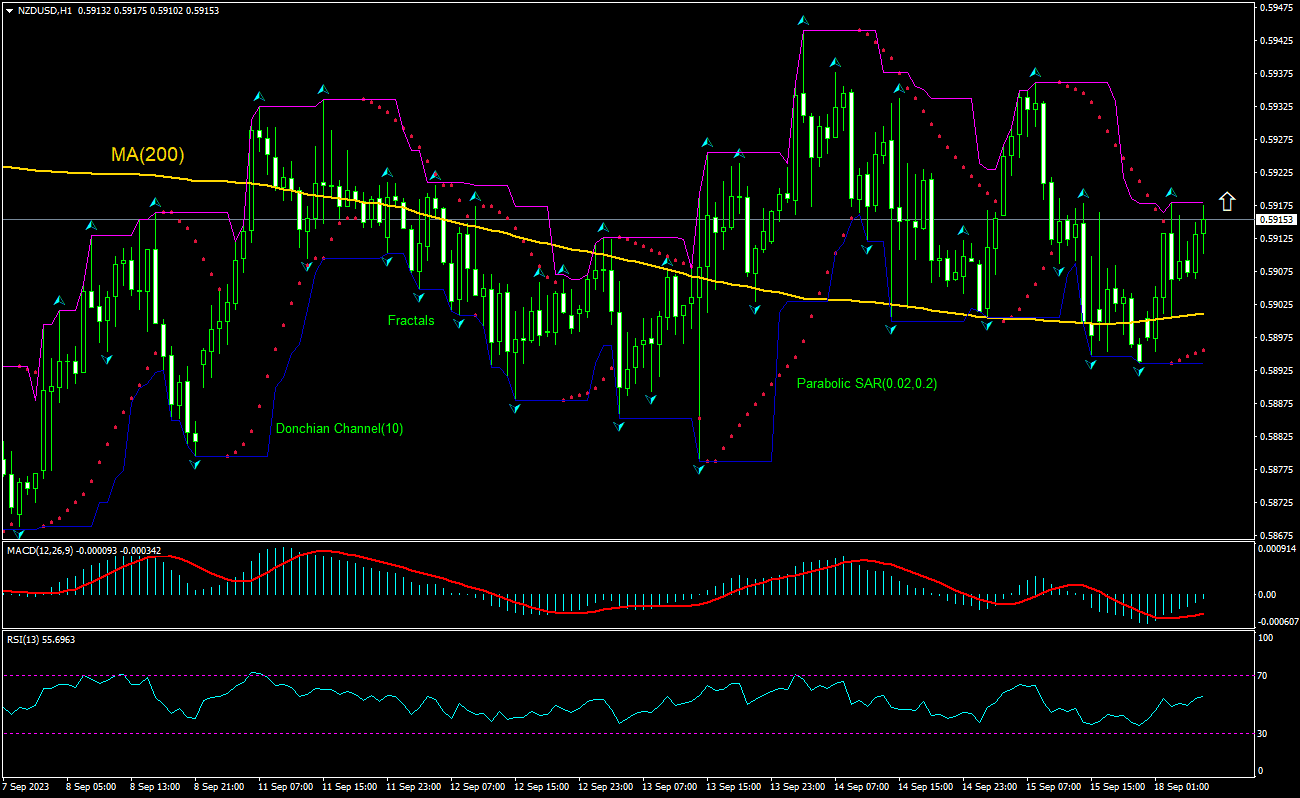

NZD USD Technical Analysis - NZD USD Trading: 2023-09-18

NZD/USD Technical Analysis Summary

Above 0.5918

Buy Stop

Below 0.5894

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Neutral |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Buy |

NZD/USD Chart Analysis

NZD/USD Technical Analysis

The technical analysis of the NZDUSD price chart on 1-hour timeframe shows NZDUSD,H1 is rebounding above the 200-period moving average MA(200) after hitting four-day low last session. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 0.5918. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 0.5894. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Forex - NZD/USD

New Zealand services sector contraction continued in August. Will the NZDUSD price rebounding reverse?

New Zealand services sector contraction continued in August. BusinessNZ reported its Services Index declined to 47.1 in August from 48.0 in July. Readings above 50.0 indicate expansion, below indicate contraction. New Zealand’s services sector experienced its third consecutive drop in activity levels, according to BusinessNZ Services Index, with activity falling almost to the level seen back in January 2022 and well below the long-term average of 53.5 for the survey. Falling New Zealand services sector activity is bearish for New Zealand dollar and the NZDUSD pair. However, the current setup is bullish for NZDUSD.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.