- Analytics

- Technical Analysis

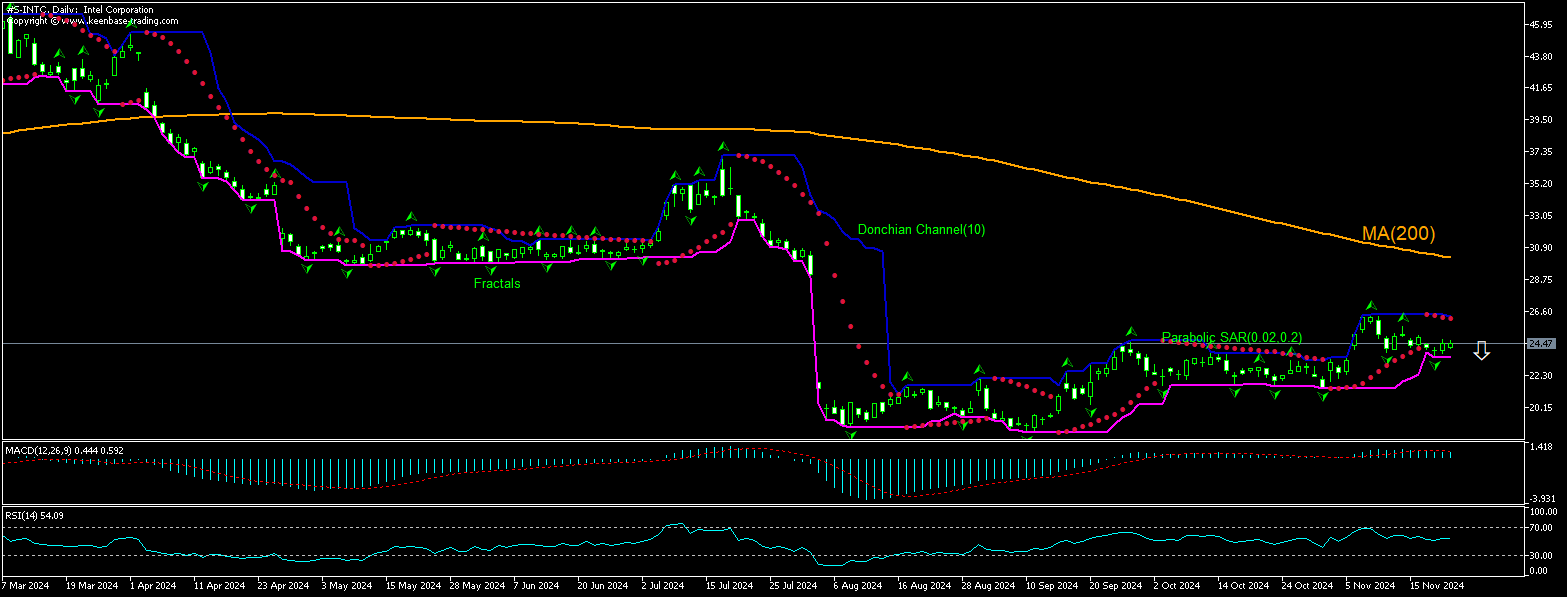

INTC Technical Analysis - INTC Trading: 2024-11-25

Intel Technical Analysis Summary

Below 23.53

Sell Stop

Above 25.57

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Intel Chart Analysis

Intel Technical Analysis

The technical analysis of the Intel stock price chart on daily timeframe shows #S-INTC,D1 is retracing down under the 200-day moving average MA(200) after rebounding to four-month high following a retreat to 14-year low ten weeks ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 23.53. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the fractal high at 25.57. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (25.57) without reaching the order (23.53), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Intel

Intel stock is retracing after rebounding following a retreat to 14- year low. Will the Intel stock price continue declining?

The US government plans to reduce Intel Corp's preliminary $8.5 billion federal chips grant to less than $8 billion, according to reports published this weekend. The US administration had announced a preliminary agreement for $8.5 billion in grants and up to $11 billion in loans for Intel in Arizona this spring. Some of the funding is being allocated for building two new factories and modernizing an existing one. The revision takes into account a $3 billion contract Intel had been offered to make chips for the Pentagon. Lower funding news is bearish for a company stock price. Last week a class action was filed against the chip giant in a US court alleging that the Core 13 and Core 14 central processing units sold by the firm, which are used to power desktop computers, are defective. The defect causes the processors to overheat and damages them permanently. Intel has been struggling financially and recently announced it would cut 15,000 jobs to cut costs.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.