- Analytics

- Technical Analysis

COPPER Technical Analysis - COPPER Trading: 2017-11-09

No change in copper price trend yet

Lower import and exports in October signal slowing of China’s economy. Will copper price continue to decline?

Economic data on Tuesday showed China’s import and export growth slowed in October. Chinese imports rose 17.2% in October from a year earlier after 18.7% growth in September, and export growth was at 6.9% after 9% gain. This signals slowing of China’s growth. Authorities are concerned about accumulating debt in Chinese companies and China’s central bank governor recently warned about rising risks to China’s financial system. A focus on lowering companies’ financial leverage will result in lower financing for Chinese enterprises, further slowing growth. Slower growth is bearish for copper prices.

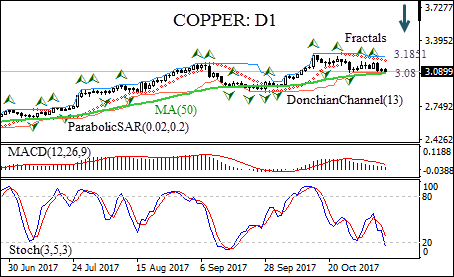

COPPER:D1 is correcting downward in daily timeframe after hitting 51-month high in mid-October. The price is close to testing the 50-day moving average MA(50).

- The Parabolic indicator has formed a sell signal.

- The Donchian channel indicates no certain trend: no slope has developed yet.

- The MACD indicator gives a bearish signal.

- The stochastic oscillator has breached into the oversold zone, this is a bullish signal.

We believe the bearish momentum will continue after the price closes below the lower Donchian bound at 3.08. A price below that level can be used as an entry point for a pending order to sell. The stop loss can be placed above the last fractal high at 3.1851. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop loss level (3.1851) without reaching the order(3.08), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

| Position | Sell |

| Sell stop | Below 3.08 |

| Stop loss | Above 3.1851 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.