- Analytics

- Technical Analysis

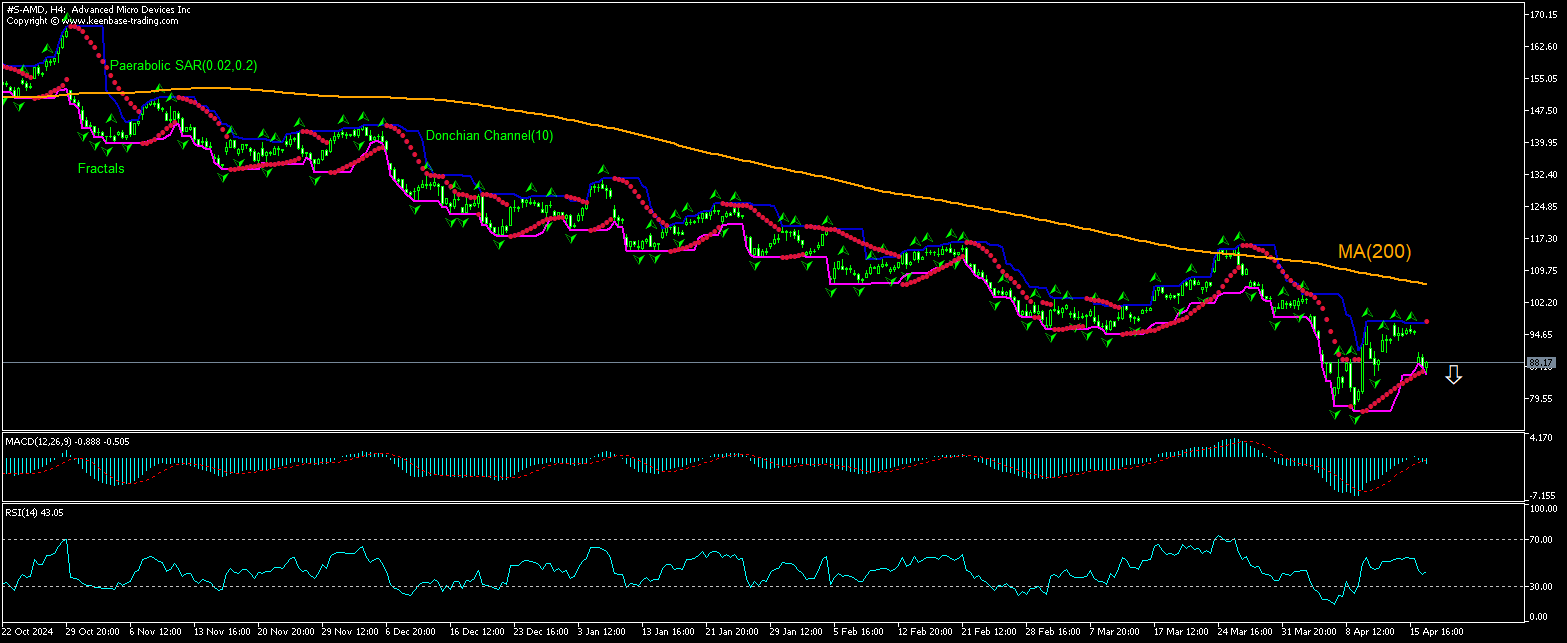

Advanced Micro Devices Inc. Technical Analysis - Advanced Micro Devices Inc. Trading: 2025-04-17

Advanced Micro Devices Technical Analysis Summary

Below 85.21

Sell Stop

Above 94.81

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Advanced Micro Devices Chart Analysis

Advanced Micro Devices Technical Analysis

The technical analysis of the AMD stock price chart on 4-hour timeframe shows #S-AMD,H4 is declining under the 200-period moving average MA(200) after rebound following a drop to 26-month low nine days ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 85.21. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 94.81. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (94.81) without reaching the order (85.21), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Advanced Micro Devices

AMD stock plunged after news chip exporters to China will have to obtain White House license for their exports to China. Will the AMD stock price reverse retreating?

Advanced Micro Devices, Inc. revealed yesterday that it expected to take an $800 million write-down as the company will likely not be able to sell its MI308X processor to China after White House announced new licensing requirements for chip exports to China. AMD claims that its MI300 series is “uniquely well-suited to power even the most demanding AI and HPC workloads.” The new US license requirement applying to exports of certain semiconductor products includes also inventory, purchase commitments, and related reserves. The chip maker said that it expects to apply for licenses to export, “but there is no assurance that licenses will be granted.” Considerable loss of revenue due to new chip exports licensing requirements is bearish for AMD stock price.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.