- Education

- Forex Technical Analysis

- Technical Indicators

- Trend Indicators

- Price Rate of Change Indicator

Price Rate of Change Indicator: Definition, Formula and How to Use

In the world of technical analysis, the Price Rate of Change (ROC) indicator is a valuable tool that helps traders assess the speed and magnitude of price changes in financial markets.

The following key headings will be discussed:

- What is ROC Indicator: We will start by understanding the concept of the ROC indicator. The ROC measures the percentage change in price over a specific time period, indicating the rate at which prices are changing. By analyzing the ROC, traders can gain insights into the momentum and strength of price movements.

- How to Use ROC Indicator: This section will focus on practical applications of the ROC indicator. We will discuss various ways to utilize the indicator in trading, including identifying trend reversals, assessing overbought and oversold conditions, and generating trading signals. By mastering the usage of the ROC, you can enhance your decision-making process and improve trading outcomes.

- ROC Indicator Formula: We will delve into the formula for calculating the ROC. The formula compares the current price to a previous price over a specific time period, expressing the change as a percentage. Understanding the formula will enable you to perform the calculation and interpret the resulting ROC values accurately.

- ROC Calculation: In this section, we will walk you through the step-by-step process of calculating the ROC. This involves selecting the time period, determining the current and previous prices, and applying the formula. By following the calculation steps, you can compute the ROC values for the chosen assets or instruments.

By reading this article, you will gain a comprehensive understanding of the ROC indicator and its practical applications. You will learn how to interpret ROC values, identify potential trading opportunities, and make informed decisions based on price momentum. So, let's dive into the Price Rate of Change indicator and explore its formula, calculation, and effective usage in the dynamic world of financial markets.

What is ROC Indicator

The ROC indicator calculates the percentage change between the current price and a previous price, expressed as a ratio or percentage. It allows traders to analyze the rate at which prices are changing and understand the strength of the price trend.

By comparing the ROC values across different time periods, traders can identify patterns and trends. An increasing ROC indicates accelerating price momentum, suggesting a potential uptrend. Conversely, a decreasing ROC suggests a slowdown in price momentum, indicating a potential downtrend. The ROC indicator can be applied to various financial instruments, including stocks, commodities, and currencies.

It is commonly used in conjunction with other technical indicators to confirm signals and make more informed trading decisions.

Traders utilize the ROC indicator in different ways, such as identifying potential trend reversals, assessing overbought or oversold conditions, or generating trading signals based on ROC crossovers or divergences.

It's important to remember that the ROC is a lagging indicator, meaning it reacts to price movements that have already occurred. Traders should consider using the ROC alongside other analysis techniques to get a comprehensive view of the market.

Overall, the ROC indicator provides valuable insights into price momentum and helps traders assess the speed and magnitude of price changes. By analyzing ROC values, traders can make informed decisions and potentially capitalize on emerging trends and market opportunities.

How to Use ROC Indicator

Using the ROC (Rate of Change) indicator effectively involves understanding its interpretation and applying it to your trading strategy. Here are steps on how to use the ROC indicator:

- Interpretation of ROC Values

- Identify Overbought and Oversold Conditions

- Spot Divergences

- Confirmation with Other Indicators

- Adjust the Time Period

- Practice and Backtest

1. Interpretation of ROC Values

The ROC indicator measures the percentage change in price over a specific time period. Positive ROC values indicate price appreciation, while negative values suggest price depreciation. Higher ROC values indicate stronger momentum, while lower values indicate weaker momentum.

The ROC indicator can be interpreted in a number of ways. One way is to look for overbought and oversold conditions. The ROC is typically considered to be overbought when it crosses above 70 and oversold when it crosses below -70. However, these thresholds can be adjusted depending on the asset and the time frame being used.

For example, the following chart shows the ROC indicator for the price of Bitcoin over a period of 100 days. The ROC is shown in blue and the signal line is shown in red.

As you can see, the ROC has crossed above 70 on several occasions. This is a sign that the asset is overbought and could be due for a correction.

2. Identify Overbought and Oversold Conditions

ROC values can help identify overbought and oversold conditions. When the ROC reaches high positive values, it suggests that the price has risen significantly and may be overbought. Conversely, when the ROC reaches low negative values, it indicates that the price has declined significantly and may be oversold. These extremes can be potential reversal points or opportunities for trade entry or exit.

As mentioned above, the ROC indicator can be used to identify overbought and oversold conditions. The ROC is typically considered to be overbought when it crosses above 70 and oversold when it crosses below -70. However, these thresholds can be adjusted depending on the asset and the time frame being used.

For example, the following chart shows the ROC indicator for the price of Apple stock over a period of 200 days. The ROC is shown in blue and the signal line is shown in red.

As you can see, the ROC has crossed above 70 on several occasions. This is a sign that the asset is overbought and could be due for a correction.

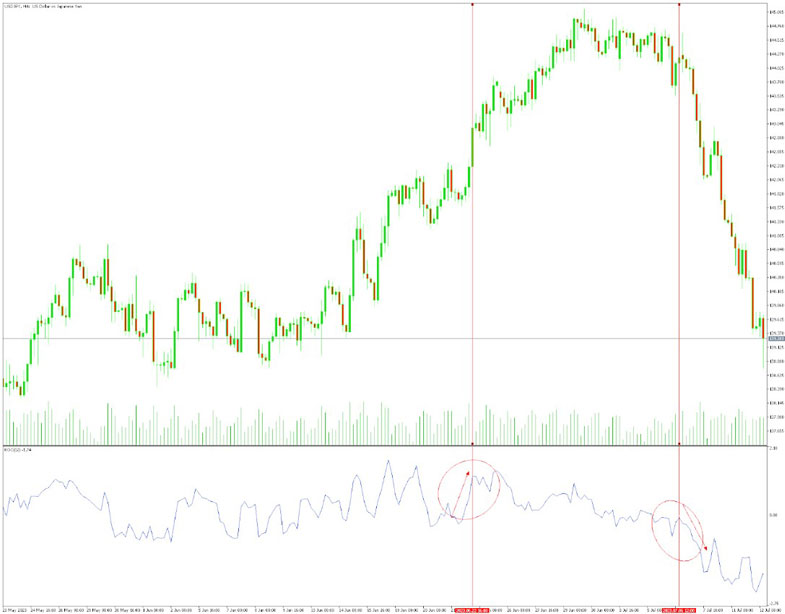

3. Spot Divergences

Divergences occur when the price and the ROC indicator move in opposite directions. Bullish divergence occurs when the price makes lower lows while the ROC indicator makes higher lows. This suggests potential upward momentum and a possible trend reversal. Bearish divergence occurs when the price makes higher highs while the ROC indicator makes lower highs. This indicates potential downward momentum and a possible trend reversal.

Another way to interpret the ROC indicator is to look for divergences. A divergence occurs when the ROC indicator moves in a different direction than the price of the asset. A bullish divergence occurs when the ROC indicator makes a lower high while the price of the asset makes a higher high. This is a sign that the trend is likely to reverse and the asset is likely to start a new uptrend.

A bearish divergence occurs when the ROC indicator makes a higher high while the price of the asset makes a lower high. This is a sign that the trend is likely to reverse and the asset is likely to start a new downtrend.

4. Confirmation with Other Indicators

To strengthen your analysis, consider using the ROC indicator in conjunction with other technical indicators. For example, you can confirm the ROC signals with trend lines, support and resistance levels, or other momentum indicators. Multiple indicators working together can provide more robust trading signals.

The ROC indicator can also be used in conjunction with other technical analysis tools to confirm signals.

The ROC indicator can also be used to confirm trend reversals. If the ROC indicator is crossing from above zero to below zero, this is a bearish signal. Conversely, if the ROC indicator is crossing from below zero to above zero, this is a bullish signal.

5. Adjust the Time Period

Experiment with different time periods to match your trading style and the timeframe you are analyzing. Shorter time periods, such as 5 or 10 periods, offer more responsiveness to recent price changes and suit short-term trading. Longer time periods, such as 20 or 50 periods, provide a broader view and suit longer-term trading.

The time period used for the ROC indicator can also be adjusted to suit the trader's preferences. A shorter time period will make the ROC indicator more sensitive to changes in price, while a longer time period will make the ROC indicator less sensitive to changes in price.

For example, a trader who is looking to trade short-term trends may use a 10-day ROC indicator. Conversely, a trader who is looking to trade long-term trends may use a 200-day ROC indicator.

6. Practice and Backtest

It is crucial to practice using the ROC indicator on historical data or through paper trading. Backtesting your strategy using past market data can help you understand how the indicator performs in different market conditions and refine your trading approach.

ROC Indicator Formula and Calculation

The formula for calculating the Price Rate of Change (ROC) indicator involves comparing the current price to a previous price and expressing the change as a percentage.

Here's the formula for calculating the ROC:

ROC = ((Current Price - Previous Price) / Previous Price) * 100Let's break down the components of the formula:

Current Price: This refers to the most recent price of the asset or instrument being analyzed. It represents the price at the current time period.

Previous Price: This denotes the price of the asset in the previous time period, which is typically one period before the current price.

Difference between Current Price and Previous Price: Subtract the value of the previous price from the current price to determine the numerical difference between the two prices.

Divide by Previous Price: Divide the difference obtained in the previous step by the value of the previous price.

Multiply by 100: Finally, multiply the result from the previous step by 100 to convert it into a percentage.

By applying this formula, the ROC indicator calculates the percentage change between the current price and the previous price, representing the rate of change in price over the specified time period.

It's important to note that the time period used for the calculation can vary depending on the trader's preference and the characteristics of the asset being analyzed. Additionally, different trading platforms or charting tools may offer variations in the ROC calculation, such as using different time periods or additional smoothing techniques.

ROC Indicator Settings

The settings for the Price Rate of Change (ROC) indicator typically involve two main components: the time period and the type of price used. Let's discuss these settings:

- Time Period: The time period determines the number of periods over which the ROC calculation is performed. It defines the duration for comparing the current price to the previous price. Traders can choose the time period based on their trading style and the timeframe they are analyzing. Commonly used time periods for the ROC indicator range from 5 to 20 periods, but it can vary depending on individual preferences and the asset being analyzed.

- Type of Price: The ROC indicator can be calculated using different types of prices, such as closing prices, high prices, or low prices. The choice of price type depends on the specific trading strategy and the aspect of price behavior that the trader wants to focus on. The most commonly used option is the closing price, as it represents the final price at the end of each period.

Traders can adjust these settings in their charting software or trading platforms to customize the ROC indicator according to their needs. It's essential to consider the timeframe, asset volatility, and trading objectives when selecting the time period and price type.

It's worth noting that different variations of the ROC indicator may exist, including smoothed ROC or ROC of ROC (Rate of Change of the ROC). These variations may incorporate additional smoothing techniques or use ROC values in the calculation.

Traders should experiment with different settings and test the effectiveness of the ROC indicator in combination with other analysis tools to find the optimal configuration for their trading strategy.

The ROC indicator offers several adjustable settings to cater to individual trading styles. These settings include:

- N-periods: This parameter determines the number of periods used in calculating the ROC. The default is 10 periods, but it can be customized to any desired number.

- Signal line: The signal line represents a moving average of the ROC values. The default is a 9-period moving average, but traders have the flexibility to choose their preferred number of periods.

- Overbought/oversold levels: These levels help identify extreme conditions in the ROC. The default settings are 70 and -70, respectively, but traders can set their own preferred levels.

It is important to experiment with different settings as there is no universally optimal configuration for the ROC indicator. Each trader's preference and trading style play a role in determining the most suitable settings.

Here are some general guidelines when adjusting the ROC indicator settings:

- N-periods: Short-term traders may opt for shorter N-periods like 5 or 10, while long-term traders may prefer longer N-periods such as 20 or 50.

- Signal line: The signal line acts as confirmation for ROC signals. Bullish signals occur when the ROC crosses above the signal line, while bearish signals happen when the ROC crosses below it.

- Overbought/oversold levels: These levels help identify potential entry and exit points. A ROC value above the overbought level indicates an asset may be overbought and due for a correction, while a ROC value below the oversold level suggests an asset may be oversold and due for a rally.

It's important to note that the ROC indicator is not infallible and should be used alongside other technical analysis tools to gain a comprehensive understanding of the market.

Bottom line on Price Rate of Change Indicator

I would like to finish this article by summarizing ROC indicator’s advantages and disadvantages.

Here we go.The ROC indicator offers several benefits and considerations to keep in mind:

Pros

- Versatility: The ROC indicator can be applied to various market conditions, making it useful for identifying overbought and oversold conditions, support and resistance levels, and potential trend reversals.

- Ease of Use: The ROC indicator is relatively straightforward to understand and use, making it accessible to traders of different experience levels.

- Availability: The ROC indicator is widely available on most charting platforms, making it easily accessible for technical analysis.

Cons

- Sensitivity to Noise: The ROC indicator can be sensitive to market noise, which may result in false signals or unnecessary trade entries if not properly filtered or confirmed by other indicators.

- Lagging Indicator: The ROC indicator may have a delayed reaction to changes in the market, as it relies on past price data. It is important to consider this lag and use it in conjunction with other indicators or tools for timely analysis.

- Supplementary Tools Required: The ROC indicator should not be solely relied upon for trading decisions. It is recommended to use it alongside other technical analysis tools to enhance accuracy and confirm signals.

- Combine with Other Indicators: Utilize the ROC indicator in conjunction with other technical analysis tools, such as trend lines, moving averages, or volume indicators, to validate signals and gain a comprehensive view of the market.

- Customize Settings: Adjust the settings of the ROC indicator, such as the time period or smoothing factors, to align with your trading style and the specific asset or market you are analyzing.

- Exercise Patience and Discernment: Avoid trading every signal generated by the ROC indicator. Exercise patience and consider the overall market context, fundamental analysis, and additional confirmations before making trading decisions.

While the ROC indicator can be a valuable tool for momentum analysis, it is important to recognize its limitations and incorporate it into a comprehensive trading strategy that considers multiple factors and indicators.

Forex Indicators FAQ

What is a Forex Indicator?

Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting.

What are the Best Technical Indicators?

Technical analysis, which is often included in various trading strategies, cannot be considered separately from technical indicators. Some indicators are rarely used, while others are almost irreplaceable for many traders. We highlighted 5 the most popular technical analysis indicators: Moving average (MA), Exponential moving average (EMA), Stochastic oscillator, Bollinger bands, Moving average convergence divergence (MACD).

How to Use Technical Indicators?

Trading strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators.

Do Indicators Work in Forex?

There are 2 types of indicators: lagging and leading. Lagging indicators base on past movements and market reversals, and are more effective when markets are trending strongly. Leading indicators try to predict the price moves and reversals in the future, they are used commonly in range trading, and since they produce many false signals, they are not suitable for trend trading.