Novo Nordisk FDA Appeal: The Potential Impact on Drug Sales

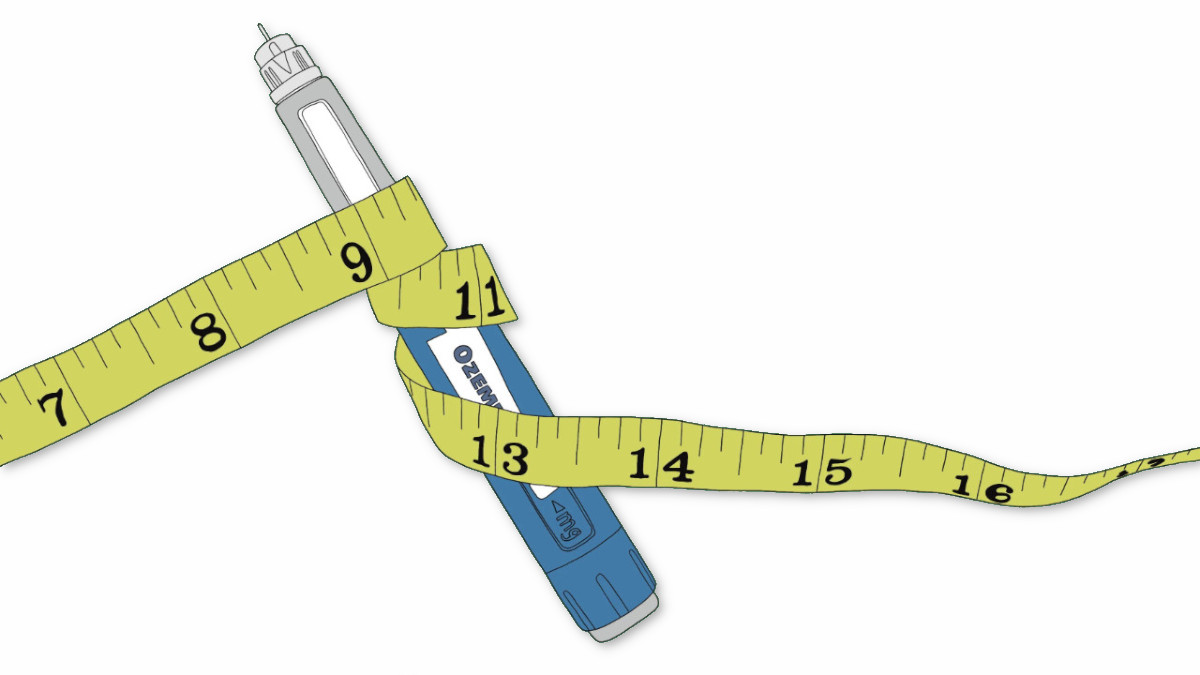

Novo Nordisk's recent appeal to FDA to stop the production of compounded versions of its popular drugs, Wegovy and Ozempic, has spotlighted a significant debate.

These drugs have become widely popular for weight loss and diabetes treatment, and are at the center of a dispute over safety and affordability. Novo Nordisk’s move could reshape the market for weight-loss medications and affect both brand and compounded drug sales.

What Led to This Appeal?

The Danish pharmaceutical company filed a formal request on Tuesday, urging the FDA to ban compounding pharmacies from producing and distributing cheaper versions of its weight-loss and diabetes drugs, citing safety concerns.

Novo Nordisk emphasized that the complexity of these medications, which rely on the active ingredient semaglutide, makes them challenging to replicate safely.

Note: Compounded versions, typically produced at lower costs without FDA approval.

This is especially critical as Novo Nordisk has been actively addressing supply chain issues to meet surging U.S. demand for semaglutide products.

Novo Nordisk’s actions are not isolated. The company has filed 50 lawsuits against various entities involved in the unapproved manufacturing of semaglutide-based products, intensifying its campaign to protect both its brand reputation and consumer safety.

Eli Lilly and Co., another pharmaceutical leader in the weight-loss sector, has recently joined in the push against compounded alternatives. In October, Eli Lilly escalated its legal campaign against compounding companies producing copycat versions of its own weight-loss drugs (Mounjaro), underscoring the pharmaceutical industry's unified effort to curtail these practices.

The Demand-Supply Equation

Demand for Wegovy and Ozempic has grown exponentially, fueled by interest in effective weight-loss solutions (which is dangerous). The market for weight-loss drugs has expanded so rapidly that intermittent shortages of these branded drugs have driven consumers toward compounded alternatives.

At an average monthly cost of $1,000, the branded drugs remain out of reach for many without substantial insurance support or rebates. This cost factor has positioned compounded versions as a financially viable choice, despite their lack of regulatory approval and safety guarantees.

However, as Novo Nordisk and Eli Lilly increase production to alleviate supply shortages, compounded products may face reduced demand due to competitive pricing and broader insurance coverage for branded options. The joint efforts of Novo Nordisk and Eli Lilly to restrict compounded semaglutide-based products reveal a strategic approach to controlling the market and ensuring patient safety by limiting unauthorized versions.

The Broader Market Impact

If the FDA responds favorably to Novo Nordisk’s appeal, compounding pharmacies would face new barriers to producing semaglutide-based products. This move could lead to an increase in demand for Novo Nordisk’s branded drugs, especially as the company ramps up production to meet demand. With compounded alternatives off the market, more patients might turn to official versions despite their higher cost, potentially encouraging insurers to reconsider coverage options.

However, the ban could also push patients and health care providers to explore other alternatives, such as Hims & Hers Health, which has entered the anti-obesity market with a focus on affordability. If Novo Nordisk and Eli Lilly successfully restrict compounded semaglutide, it could leave a void for competitors offering less expensive FDA-approved drugs, thus intensifying competition among pharmaceutical companies.

Regulatory Precedents and Future Considerations

Novo Nordisk’s appeal aligns with similar actions taken internationally. In May, Australia’s ban on compounded versions of weight-loss drugs highlighted rising safety concerns surrounding these alternatives. If the FDA issues a comparable ban in the U.S., it would establish a regulatory precedent that could discourage compounding pharmacies from producing off-label versions of complex medications.

The outcome of Novo Nordisk’s appeal could impact the trajectory of the compounding pharmacy industry, particularly those targeting high-cost, high-demand drugs. If a ban is enforced, it could prompt regulatory bodies worldwide to reassess the risks and benefits of compounded alternatives for specialized medications, reshaping how these drugs are marketed and consumed globally.

Conclusion

Novo Nordisk’s FDA appeal represents a pivotal moment in the pharmaceutical industry’s response to compounding practices. While this decision could help ensure safer consumption of Wegovy and Ozempic, it also raises questions about drug accessibility and affordability for patients reliant on compounded alternatives.

With Eli Lilly joining Novo Nordisk in its legal push against compounded versions, the FDA’s ruling will not only impact their revenue streams but could also influence insurance coverage and market dynamics in the weight-loss and diabetes treatment sectors for years to come.