- Analítica

- Análise Técnica

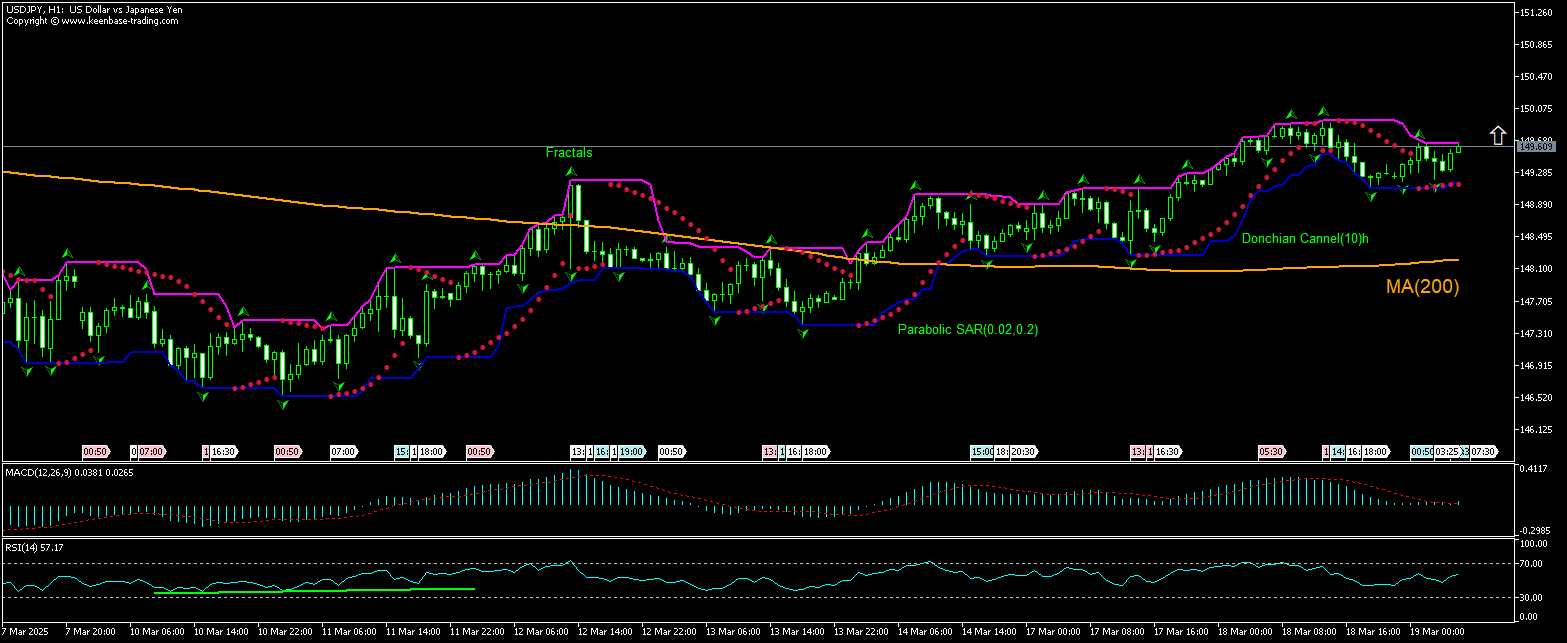

USD/JPY Análise técnica - USD/JPY Negociação: 2025-03-19

USD/JPY Resumo da Análise Técnica

acima de 149.73

Buy Stop

abaixo de 149.14

Stop Loss

| Indicador | Sinal |

| RSI | Neutro |

| MACD | Comprar |

| Donchian Channel | Neutro |

| MA(200) | Comprar |

| Fractals | Comprar |

| Parabolic SAR | Comprar |

USD/JPY Análise gráfica

USD/JPY Análise Técnica

The USDJPY technical analysis of the price chart on 1-hour timeframe shows USDJPY: H1 is rebounding above the 200-period moving average MA(200) after retracing lower following a climb to two-week high yesterday. We believe the bullish movement will continue after the price breaches above the upper bound of the Donchian channel at 149.73. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 149.14. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Análise Fundamental de Forex - USD/JPY

Japan’s machinery orders decline deepened in January. Will the USDJPY price advancing continue?

Japan’s machinery orders decline accelerated in January: the Cabinet Office of Japan reported private-sector machinery orders, excluding volatile ones for ships and those from electric power companies, fell by 3.5% over month in January after 1.2% decrease in December when an 0.1% decline was forecast. It is the steepest decline since late 2023. Orders from the manufacturing sector fell 1.3%, while non-manufacturing orders slumped 7.4%. Machinery orders are important indicator for capital spending, which is essential for economic growth. Indication of lower capital spending is bearish for yen and bullish for USDJPY. At the same time, while Japan’s trade deficit shifted into surplus, it fell short of expectations: the trade balance recorded a surplus of ¥584.5 billion in February from a deficit of ¥415.43 billion in the same month a year earlier, below expectations for a ¥722.8 billion surplus. Slower than expected increase in trade surplus is also bearish for yen and bullish for USDJPY.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.