- Analítica

- Análise Técnica

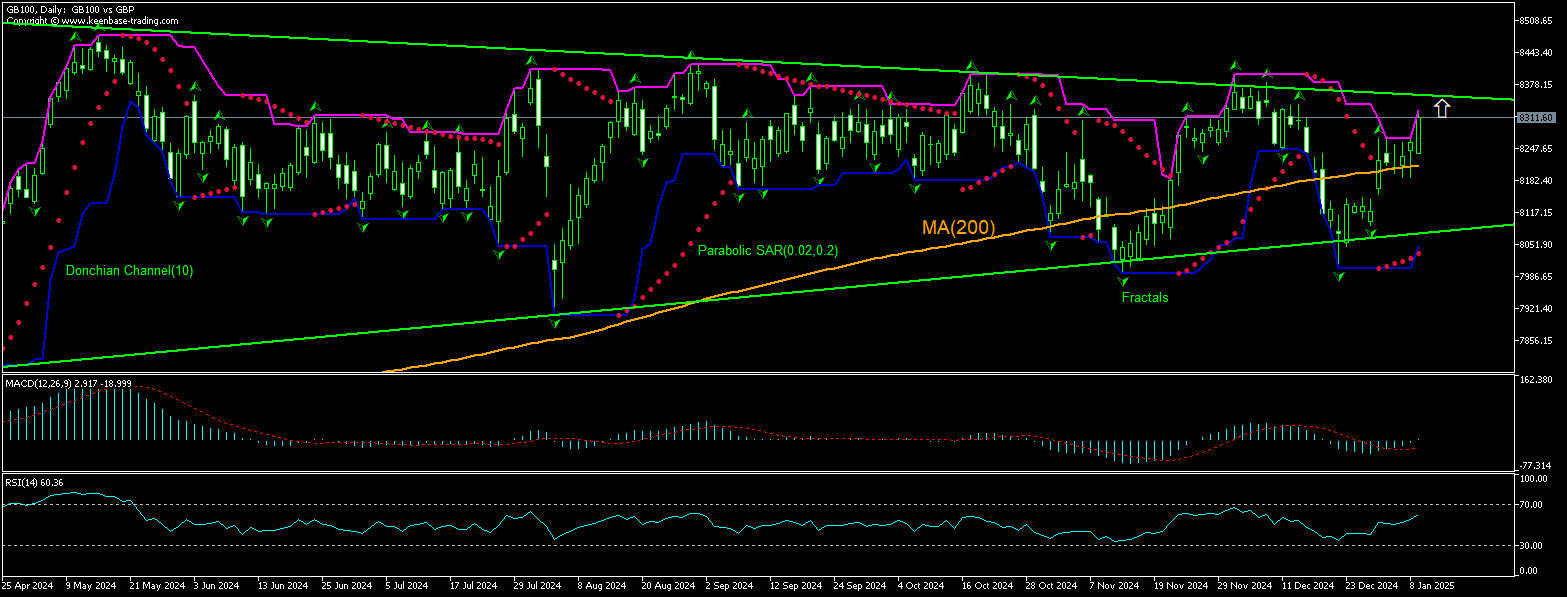

Indice GB 100 Análise técnica - Indice GB 100 Negociação: 2025-01-10

Índice de ações do Reino Unido Resumo da Análise Técnica

acima de 8325.35

Buy Stop

abaixo de 8155.53

Stop Loss

| Indicador | Sinal |

| RSI | Neutro |

| MACD | Comprar |

| Donchian Channel | Comprar |

| MA(200) | Comprar |

| Fractals | Comprar |

| Parabolic SAR | Comprar |

Índice de ações do Reino Unido Análise gráfica

Índice de ações do Reino Unido Análise Técnica

The GB100 technical analysis of the price chart on daily timeframe shows GB100, D1 is rising after returning above the 200-day moving average MA(200) which is rising itself. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 8325.35. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 8155.53. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (8155.53) without reaching the order (8325.35), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

Análise Fundamental de Índices - Índice de ações do Reino Unido

UK economic reports were weak in the second week of January. Will the GB100 price rebound continue?

UK economic data in the recent week were negative. UK construction sector activities expansion slowed while retail prices continued declining. The S&P Global reported earlier in the week that UK Construction PMI fell from 55.2 in November to 53.3 in December 2024, the lowest in six months. Readings above 50.0 indicate sector expansion, below indicate contraction. While commercial and civil engineering constructions continued growing, the residential construction recorded its third consecutive monthly decline, contracting at the fastest rate since June 2024. Slowing construction activity indicates slowing growth of gross domestic product(GDP) which is bearish for Pound and GBPUSD pair. A few days later UK’s British Retail Consortium (BRC) reported the decline of the index of prices of goods purchased at BRC-member retail stores accelerated in December: the BRC Shop Price Index dropped 1.0% over year after 0.6% fall in November, when a 0.4% decline was forecast. BRC accredited price drops to Black Friday discounts. Continuing decline in BRC Shop Price Index points to weakening demand for consumer goods at BRC shops which may indicate weakening of UK retail sales. Indications of weakening of UK retail sales are also bearish for Pound and GBPUSD pair price. However, the current setup is bullish for the GBPUSD pair.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.