- 분석

- 기술적 분석

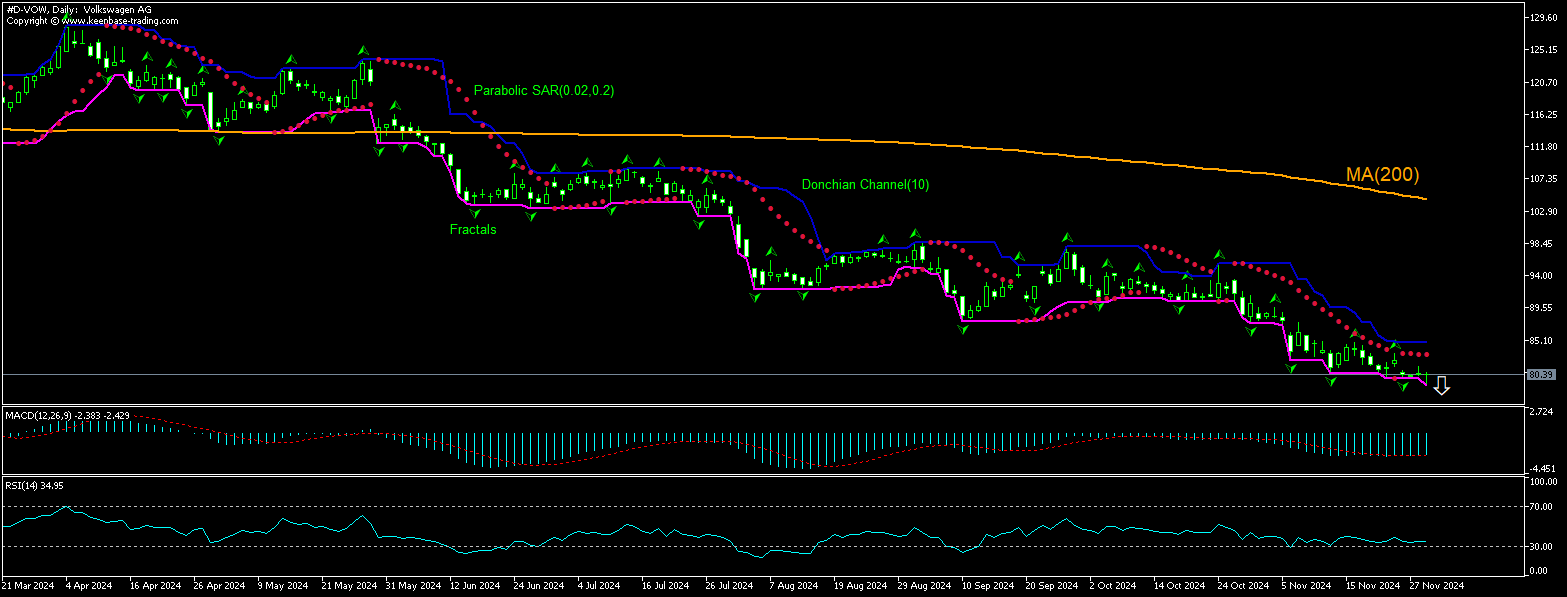

Volkswagen 기술적 분석 - Volkswagen 거래: 2024-12-02

Volkswagen AG 기술적 분석 요약

위에 78.77

Buy Stop

아래에 83.05

Stop Loss

| 인디케이터 | 신호 |

| MACD | 구매 |

| Donchian Channel | 판매 |

| MA(200) | 판매 |

| Fractals | 판매 |

| Parabolic SAR | 판매 |

Volkswagen AG 차트 분석

Volkswagen AG 기술적 분석

The technical analysis of the Volkswagen stock price chart on daily timeframe shows #D-VOW,Daily is retreating under the 200-day moving average MA(200) which is declining itself. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 78.77. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 83.05. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (83.05) without reaching the order (78.77), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

지수 - Volkswagen AG 기본 분석

Volkswagen workers at nine plants strike today. Will the Volkswagen stock price persist retreating?

IG Metall union announced workers at nine Volkswagen car and component plants across Germany will strike for several hours today. Last week the union proposed measures it said would save 1.5 billion euros ($1.6 billion), including forgoing bonuses for 2025 and 2026. Volkswagen dismissed the proposal insisting on a demand for 10% wage cut, arguing it needs to slash costs and boost profit to defend market share. Europe's top carmaker is also threatening to close plants in Germany, a first in its 87-year history. The labor union called on employees of the plants housed under subsidiary Volkswagen Sachsen GmbH, which include VW's EV-only plant Zwickau, to strike on both Monday and Tuesday. The company said yesterday it had taken steps to ensure a basic level of supplies to customers and minimize the strike's impact. A strike is bearish for Volkswagen's price as it will decrease output at a time when the carmaker is already facing declining deliveries and plunging profit.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.