- 분석

- 기술적 분석

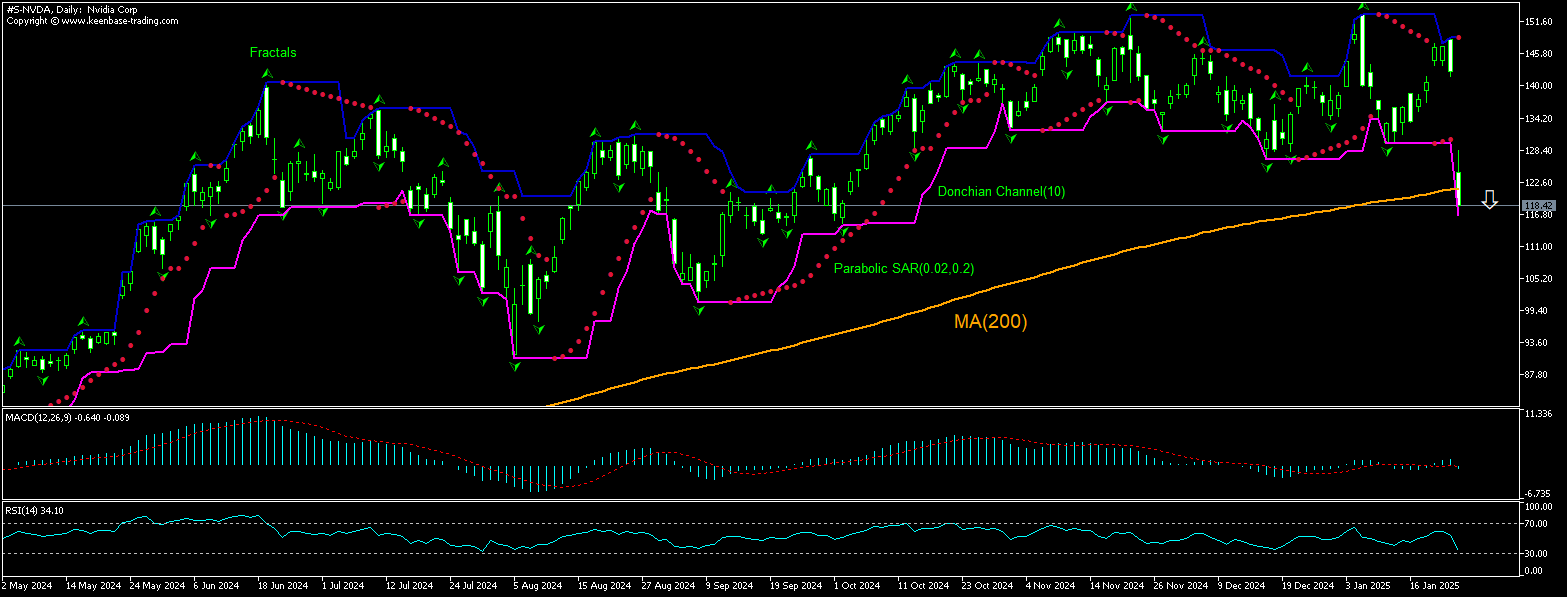

NVDA 기술적 분석 - NVDA 거래: 2025-01-28

Nvidia 기술적 분석 요약

아래에 116.61

Sell Stop

위에 136.56

Stop Loss

| 인디케이터 | 신호 |

| MACD | 판매 |

| RSI | 중립적 |

| Donchian Channel | 판매 |

| MA(200) | 구매 |

| Fractals | 판매 |

| Parabolic SAR | 판매 |

Nvidia 차트 분석

Nvidia 기술적 분석

The technical analysis of the Nvidia stock price chart on daily timeframe shows #S-NVDA,D1 has breached below the 200-day moving average MA(200) which is rising still. We believe the bearish momentum will resume after the price breaches below the lower boundary of Donchian channel at 116.61. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 136.56. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (136.56) without reaching the order (116.61), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

지수 - Nvidia 기본 분석

Nvidia stock price closed sharply lower after the release of China’s DeepSeek artificial intelligence model. Will the Nvidia stock price continue retreating?

Chinese startup DeepSeek launched a free AI assistant last week. By Monday, the assistant had overtaken U.S. rival ChatGPT in downloads from Apple's app store. OpenAI CEO Altman said yesterday that the DeepSeek R1 artificial intelligence model was impressive for what it could deliver at its current cost. At the same time Altman said that OpenAI planned to deliver better models. DeepSeek-R1 is 20 to 50 times cheaper to use than OpenAI's o1 model, depending on the task, according to a post on DeepSeek's official WeChat account. Analysts point that it could mean “less demand for chips, less need for a massive build-out of power production to fuel the models and less need for large-scale data centers” against the backdrop of announcement by president Trump last Wednesday about a private-sector plan for a $500 billion investment in AI infrastructure through a joint venture known as Stargate. Shares that are exposed to the artificial intelligence technology fell sharply after the release of China’s DeepSeek artificial intelligence model. Global investors dumped tech stocks yesterday as they worried that the emergence of a low-cost Chinese artificial intelligence model poses a threat to the dominance of AI leaders like Nvidia. Nvidia dropped 16.97% yesterday, losing $593 billion in market value, a record one-day loss for any company on Wall Street. Expectations of a lower demand for Nvidia’s AI chips after release of lower-cost Chinese AI alternatives is bearish for Nvidia stock.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.