- 분석

- 기술적 분석

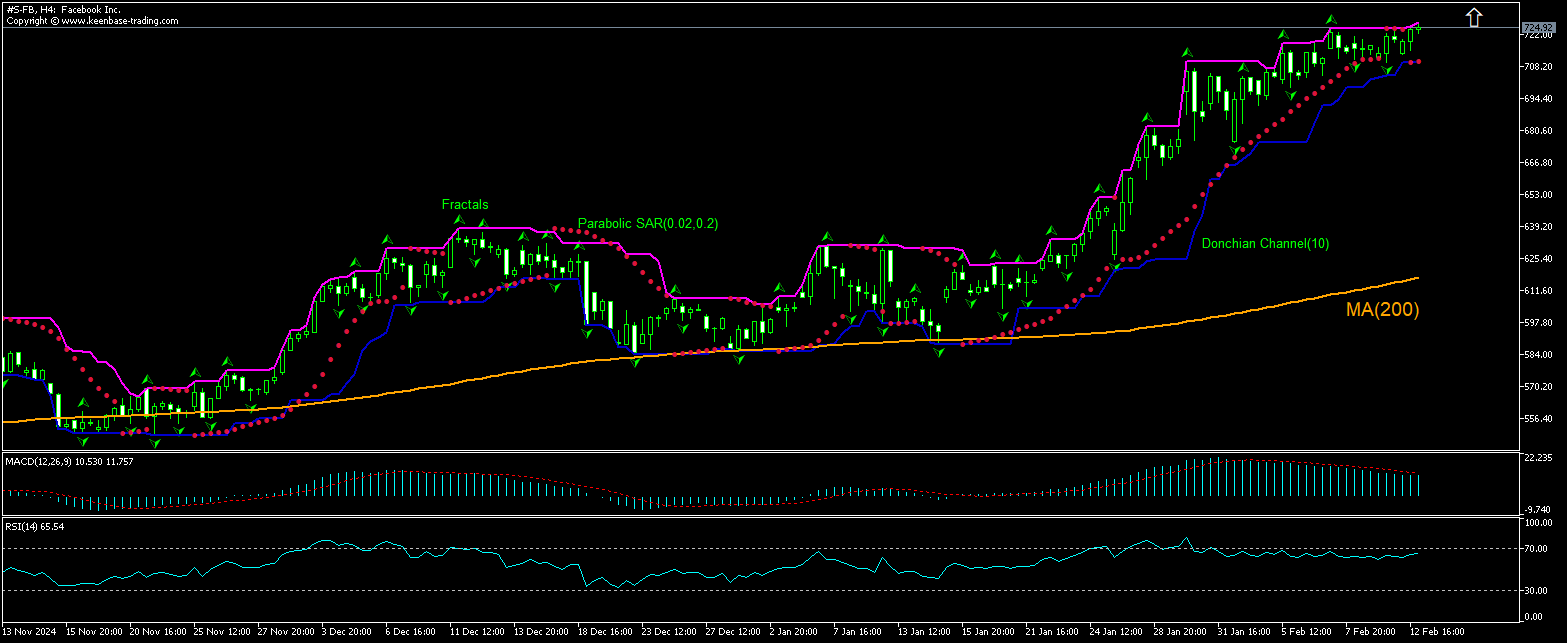

Facebook 기술적 분석 - Facebook 거래: 2025-02-13

Facebook 기술적 분석 요약

위에 726.79

Buy Stop

아래에 709.87

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 판매 |

| Donchian Channel | 구매 |

| MA(200) | 구매 |

| Fractals | 중립적 |

| Parabolic SAR | 구매 |

Facebook 차트 분석

Facebook 기술적 분석

The technical analysis of the Facebook stock price chart on 4-hour timeframe shows #S-FB,H4 closed at all-time high last session above 200-period moving average MA(200) which is rising itself. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 726.79. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 709.87. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (709.87) without reaching the order (726.79), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

지수 - Facebook 기본 분석

Facebook’s stock closed up yesterday before news Tigress Financial raised its Meta Platforms price target. Will the Facebook stock price continue advancing?

Stock of Meta Platforms, Inc., the Facebook parent, ended 0.78% higher on Wednesday before reports Tigress Financial raised the firm’s price target on Meta Platforms to $935 from $645 and kept a “Strong Buy” rating on the shares. The company wrote that the raised 12-month target of $935 amounts to a potential return with dividends of over 30% from current levels. It views Meta as having “tremendous AI-driven opportunities” for personalized AI-driven functionality across its platform of apps, and sees “significant upside,” driven by the ongoing potential to monetize many of its critical applications and technologies, including Instagram, Messenger, and WhatsApp. A company share price target upgrade is bullish for the stock price. Before the price target upgrade news Meta began notifying staff of job cuts on February 10. The layoffs will be affecting almost 4,000 Meta workers across the United States, Europe, and Asia. Chief Executive Officer Mark Zuckerberg told employees that Meta would cut 5% of its workforce, particularly those who “aren’t meeting expectations” while telling managers that the cuts would help make space for the company to hire the “strongest talent.”

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.