- 분석

- 기술적 분석

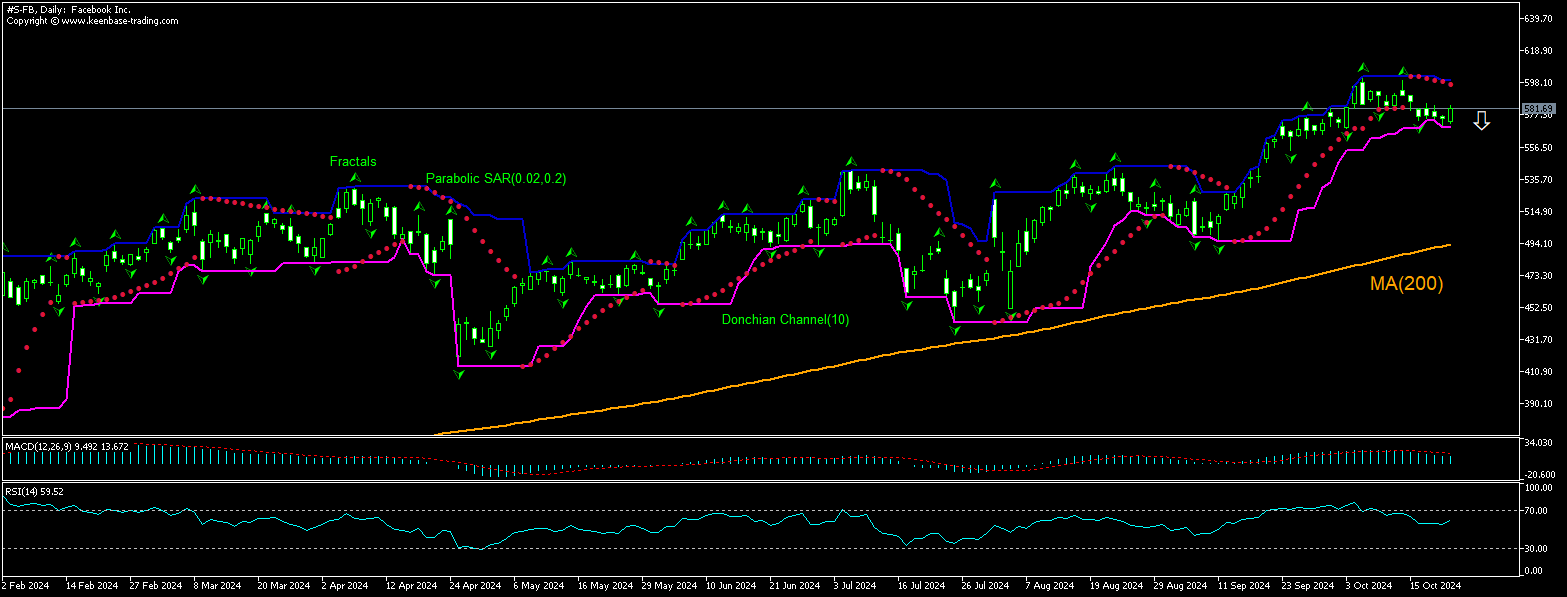

Facebook 기술적 분석 - Facebook 거래: 2024-10-23

Facebook 기술적 분석 요약

아래에 569.05

Sell Stop

위에 597.09

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 중립적 |

| Donchian Channel | 중립적 |

| MA(200) | 구매 |

| Fractals | 판매 |

| Parabolic SAR | 판매 |

Facebook 차트 분석

Facebook 기술적 분석

The technical analysis of the Facebook stock price chart on daily timeframe shows #S-FB,Daily is retracing down toward the 200-day moving average MA(200) after hitting all-time high two weeks ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 569.05. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 597.09. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (597.09) without reaching the order (569.05), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

지수 - Facebook 기본 분석

Facebook’s stock closed up yesterday after US court dismissed a lawsuit against Meta Platforms and Chief Executive Mark Zuckerberg claiming they misled shareholders in Meta's proxy statement about their ability to ensure the safety of children who use Facebook and Instagram. Will the Facebook stock price continue advancing?

Stock of Meta Platforms, Inc., the Facebook parent, ended higher on Tuesday after U.S. District Judge Charles Breyer in San Francisco dismissed the lawsuit saying the plaintiff Matt Eisner failed to show that shareholders suffered economic losses from Meta's alleged inadequate disclosures. The judge also said federal securities law did not require Meta to detail the severity of sexually explicit content and sexual exploitation of children on its platforms, or all the child protection strategies it decided not to adopt. The dismissal was with prejudice, meaning Eisner cannot sue Meta and Zuckerberg again. Dismissal of a lawsuit against a company is bullish for the company stock price. However, Meta still faces lawsuits by dozens of state attorneys general accusing the company of addicting children to its apps while downplaying the risks.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.