- 분석

- 시장 심리

Dollar bearish bets decline continued despite lackluster January jobs report

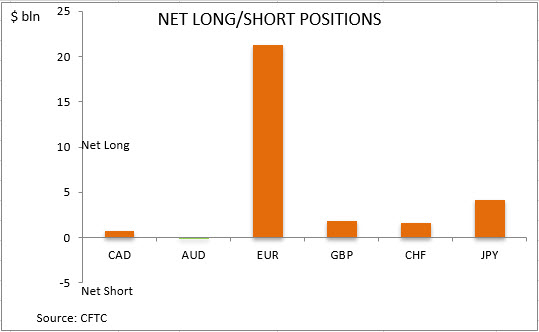

US dollar short bets inched down to $29.54 billion from $29.95 billion against the major currencies during the one week period, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to February 9 and released on February 12. The dollar sentiment improvement continued despite Bureau of Labor Statistics report US economy added only 49,000 jobs in January after losing 227 thousand in December, while the unemployment rate declined to 6.3% from 6.7% the previous month.. The drop in dollar bearish bets was recorded despite Fed chair Powell’s highlighting of headwinds to the economic recovery - saying ‘we have not won this yet’, signaling that monetary policy will remain ultra-easy as Fed kept interest rates and bond purchases unchanged. However, US Labor Department reported 847 thousand Americans sought unemployment benefits over the last week, down from 914 thousand the previous week.

CFTC Sentiment vs Exchange Rate

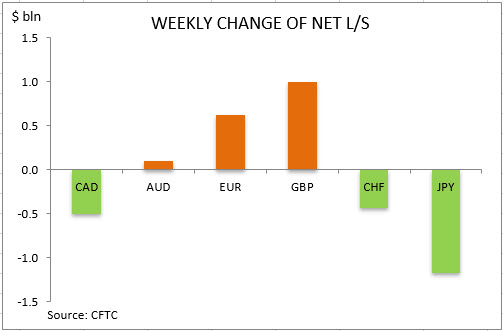

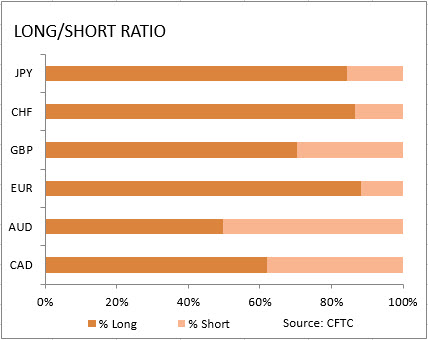

| February 09 2021 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bullish | positive | 750 | -509 |

| AUD | bearish | positive | -17 | 95 |

| EUR | bullish | positive | 21242 | 618 |

| GBP | bullish | positive | 1823 | 1002 |

| CHF | bullish | positive | 1598 | -441 |

| JPY | bullish | negative | 4139 | -1175 |

| Total | 29535 |

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.

Last Sentiments

- 183월2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 103월2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 43월2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...